MZM

What Should Quants Count?

On May 25th, Fed Chair Jerome Powell promised to pull back emergency support “very gradually over time and with great transparency.”

“Very gradually?” No one doubts that. But “with great transparency?” Not a chance...

Cash Is King… The Regime Of Buying Power Is Alive And Well

One might begin to think that if the reports of money supply growth rolling over are true, that the stock market could be facing its own liquidity crisis in short order. While these reports sound pretty bleak for future stock market liquidity, we advise taking these headline “scare” stories with a grain of salt.

Tracking Cash...Who Has It, And Who Doesn’t

Still a mountain of cash available (MZM data), which could find its way into the stock market. Don’t confuse scarcity of buyers with scarcity of liquidity.

Think There's No Fuel For A Rally??.....Better Think Again

Using the ratio of MZM relative to total stock market capitalization as a gauge of market liquidity, shows there is a lot of fuel that can be put to work to drive a stock market rally.

Swimming In Liquidity...Fuel For A Thirsty Bull

Another bullish sign is huge buildup of cash now sitting on the sidelines earning 0.7% in interest. As investors put this money to work, stocks should move higher.

Understanding MZM…It May Not Represent What You Think It Does

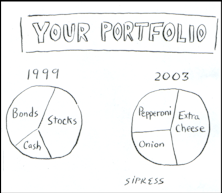

Much of the movement in MZM levels is not directly related to Fed policy. Stock market performance may be the primary driver, as investors and institutions move assets between the stock market and cash market.

View From The North Country

Contrary to Wall Street wisdom, rising MZM is not necessarily indicative of Fed easing. Nor does contracting MZM mean a tightening Fed. Also, unlocking the mystery of the low U.S. savings rate.