Sector Allocation Strategy

Bridesmaid Strategy For Equity Managers

Our work on the annual “momentum effect” dates back 15 years, and was originally based on equity sectors rather than asset classes. The hypothetical approach is to entirely dispense macroeconomic trends, sector fundamentals, and valuations, and base the allocation decision exclusively on momentum.

For Value Investors Only!

With the possible diminution of “alpha” in price momentum strategies, we recommend that sector allocators consider approaches that are more countertrend or contrarian in nature.

Bridesmaid Strategy For Equity Managers

Our work on the Bridesmaid momentum effect dates back to 2006, and was originally based on equity sectors rather than asset classes. Again, the hypothetical approach is to ignore macroeconomic trends, sector fundamentals, valuations, and the like, and to base sector selection solely on the prior year’s sector total return rankings.

Bridesmaid Strategy - Sectors

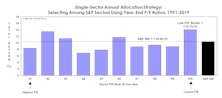

Our analysis of the Bridesmaid effect originated in 2006, but was based on S&P 500 sectors rather than asset classes.

Cheapest Sector Strategy

We recognize that—regardless of their empirical appeal—momentum-oriented approaches aren’t suitable for every investor. For those investors, we’ve identified an alternative sector allocation strategy that’s delivered long-term results almost identical to those of the Bridesmaid approach, but which is based on a single, simple selection criterion that should appeal to the most hard-wired contrarian: The Low P/E.

New Sector Initiated: “Buy The Numbers”

The Leuthold Group has unveiled a new sector strategy to be employed this month in the Model Equity Portfolio. This is a quantitative approach to the stock selection process involving both fundamental and technical factors.