Bull Market Peak

The Bull Is Dead, But The Leaders Live On

The bull market of 2009-2020 is no longer. But its spirit—its leadership—has somehow lingered, right through the worst of the decline and during the eleven-day, +19% S&P 500 bounce that followed.

Valuation “Reset?”

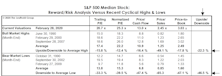

The massive performance dispersion of the past two years makes it difficult (if not hazardous) to draw a simple conclusion about U.S. stock market valuations. But it’s safe to say that cap-weighted indexes like the S&P 500 and S&P Industrial Index remained significantly overvalued at the low point of the February correction.

Out Of The Blue?

There have been long-time divergences between blue chips and other market segments signaling that all is not “in gear” beneath the surface—but this cautionary activity never foretells the “timing.” Recently, Small Caps, the Value Line Arithmetic Composite, and Dow Transports staged pathetic bounces off the January 31st “Coronavirus 1.0” low, while the blue chips had strong momentum into mid-February. Normally, such divergences typically last for at least 3-4 months before they become meaningful.

Back Breaker?

With the wavering state of consumer and business confidence, even a modest stock market correction of 8-10% might deliver the fatal blow to confidence—and therefore to the U.S. economic expansion.

Milestones, Mayhem, and Miley

If it can recover from its February setbacks, the bull market will turn 11-years-old some time in March, and our Golden Retriever will turn 13 at the end of the month.