Gold

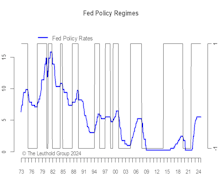

Anatomy Of An Easing Cycle

The economy normally fades heading into a series of rate cuts, with higher unemployment and lessening CPI inflation. Risky assets (stocks and credit) do well, and bond yields move lower. Real assets also benefit (gold in particular). On the whole, an easing cycle is favorable for most assets.

Golden Intrigues

Chinese investors have flocked to gold as traditional investments have massively disappointed. Global central banks are also buying gold amid heightened geopolitical tension. Both trends help explain why gold has defied the gravitational pull of a stronger dollar and higher real yields.

Gold: Not As Shiny

In mid-July, we sold our tactical portfolios’ small (2%-ish) position in physical gold ETFs. That holding had been built up from 2018 to 2020 to around 5.5% of the portfolio, then pared in early 2022 when Russia invaded Ukraine. That doesn’t mean we’re gold bears.

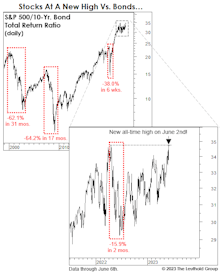

Stocks Versus “Safe Havens”

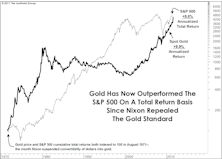

While we aren’t clamoring to add long-term Treasuries in tactical accounts, we believe that the past 18-months’ action has left them more attractive versus stocks than during most of the last 15 years. However, compared to gold, the S&P 500 still trails on a total return basis measured back to Y2K.

Three Themes To Watch—An Update

The Value/Growth dynamic seemed to indicate a return to the “lower rates are good for Growth stocks” regime. China reopening is still alive and well, despite a recent pause. The GSCI Industrial Metals/Gold ratio has broken below its recent range, which bodes ill for inflation expectations going forward.

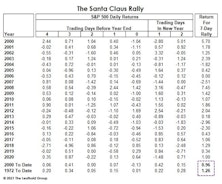

Can Santa Cap-Off A Stellar Year?

The S&P 500 is flirting with new all-time highs, and the news gets even better for followers of seasonal patterns: The Santa Claus rally has yet to officially begin!

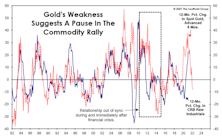

Gold: Still A Useful Dollar Hedge

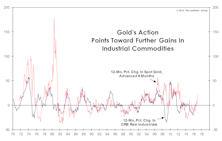

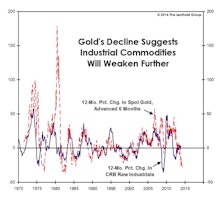

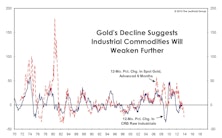

A stronger U.S. dollar is “supposed” to be bearish for commodities, but it’s been a banner year for most commodities with gold among the few that are down on the year. However, keep in mind that gold tends to be a harbinger of major moves in industrial commodities, with a lead time of about six months—and its year-over-year change is now negative.

Golden Milestone

Fifty years ago this month, Richard Nixon formally suspended the convertibility of U.S. dollars into gold. Editorials commemorating this have tended to have a celebratory tone, and why not? Abandoning the gold standard greatly expanded the arsenals and imaginations of policymakers, both of which have been on historic display over the last 18 months.

How To Value Gold

July’s surge drove the yellow metal to the brink of its overvaluation threshold, where only 150 ounces of gold are required to buy the median-priced existing home (currently about $299,000). Impressively, gold made all but the last month of this move without attracting mainstream attention.

Commodity Comeback?

Many analysts thought the last cycle would end with a bit of “fire” in the form of higher commodity and consumer prices, and they might well argue they would have been right if not for the eruption of COVID-19.

How Much For Your “Free Lunch?”

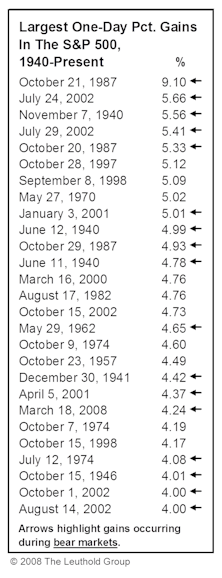

The 41% S&P 500 rally would be half as large if measured in terms of gold, and a “unit” of the S&P 500 now buys 70% fewer ounces of gold than it did in early 2000. Meanwhile, when denominated in either silver or Bitcoin, the stock market rally has been almost nonexistent.

Keep An Eye On What Your Stocks Will Buy

News that the Bureau of Labor Statistics may have undercounted the May unemployment rate by six percentage points should remind investors of the danger of taking government economic reports too seriously. Regardless of the figure, though, unemployment is no doubt near its peak for the downturn.

The Commodity Bull That Equity Investors Missed...

While the bottom-line impact may ultimately be the same, there’s one thing we find more demoralizing than getting the direction of an asset wrong: getting the direction right and not getting paid for it.

Commodities: More To Come?

Commodities have enjoyed a strong year thus far, and the GS Scores on the Materials sector have followed suit (albeit with a slight lag), as highlighted in June’s “Of Special Interest” section.

Avoiding Gold

The vast majority of recent gold commentary centers on its extremely oversold technical condition and the related washout in all sorts of sentiment indicators, ranging from trader surveys to futures and options positioning. Maybe these conditions will produce a short-term bounce, but we’re going to stand with the message of our bearish longer-term work.

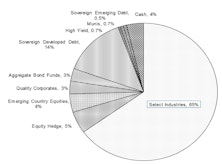

Core & Global Portfolios Equity Exposure Maintained In December

The Major Trend Index remains positive and net exposure in both portfolios is 64%. For all of 2013, our average net equity exposure was 60% in each portfolio.

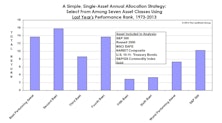

Buy The Bridesmaid, Not The One Looking To Rebound

The investment leadership of a given year has historically had better-than-even odds of outperforming in the following year at both the asset class and equity sector levels.

Commodities In 2014: Supply Remains A Concern

While gold garnered most of the headlines last year (down 27%), commodities performed badly across the board in 2013. We expect more of the same in 2014.

No “Pop,” Just A “Hiss”…

In the 1970s, a cassette tape manufacturer asked listeners, “Is it live, or is it Memorex?” Forty years later, watchers of the stock market “tape” find themselves asking, “Is it real, or is it QE?”

A New Leg In The Commodity Decline?

For more than two years we’ve discussed the supply-side risks to commodity producers stemming from capacity built during the manic “Third Act” of last decade’s Three Act Play in commodities. Commodity-oriented equities have indeed underperformed since 2011, but to date, most pundits have laid blame squarely on the demand side.

Gold’s Implications For Other Commodities

Gold’s recent weakness may be more ominous for industrial commodity investors.

Gold, After The Deluge

Gold broke sharply lower in April, possibly sounding the death knell for the 12-year bull market in gold (and silver). We sold one-third of our holdings in the Core and Global funds in late February at around $1595/oz., cutting each fund’s position to 4% of total assets from 6% previously. Following the big bounce in late April, we sold another chunk at $1470/oz., leaving both Core and Global funds each with a small position of 2.5% of total assets that we’ll likely continue to hold, simply in the interest of diversification.

Gold: Twelve Years And Going Strong

A textbook, commodity-like top in gold would be a panicky, spiky event that would take the metal well above $2000.

The Changing Role of Gold In An Investment Portfolio

As global capital markets are yet again dominated by extreme macro-economic uncertainty, gold appears to be behaving as a hedge against extreme equity market movements, a store of value and an alternative to fiat currencies.

Predictions for 2012…

From the stock market to politics to football, Doug Ramsey offers up ten predictions and thoughts for the New Year…. Even though we’ve already had a one month “peek” at 2012.

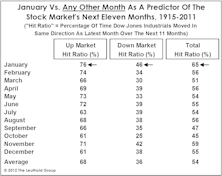

Up Market In January = Up Year??

As January goes, so goes the year. 2012 looks like it could well be an up year for stocks based on the January barometer. Market cycle chart from 1958 also says 2012 will be the “time to buy.”

Golden Milestone

The yellow metal itself celebrated 40 years of “independence” by pulling ahead of the S&P 500 on a cumulative, total return basis since the gold window was closed.

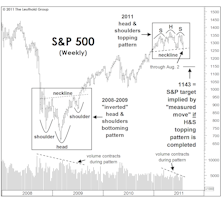

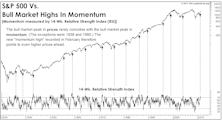

The Bull Market’s Technical “Book Ends”

The 30-point collapse in the S&P 500 on Tuesday, August 2nd completed a bearish H&S pattern that has been several months in the making.

Two Down… One To Go?

Doug Ramsey highlights the “point of recognition” in this month’s “Inside The Stock Market” section. This is the point of maximum market upthrust, the point at which even hardened pessimists become convinced that the economic recovery and bull market are for real.

2010: Better Than It Felt

2010 was better than it felt for the equity markets, but while 2011 may be better for the economy, it might not be as strong for the equity markets. Could the bull market be running out of milestones?

Perspectives On Gold: Relationships That Help Us Understand Gold Price Movements

All our asset allocation portfolios have commitment to gold and silver. This month’s “Of Special Interest” focuses on the yellow metal. Valuation matrixes are of little use, but we do present a variety of relationships that may help at least understand the price movements of gold.

Warming Up To Gold

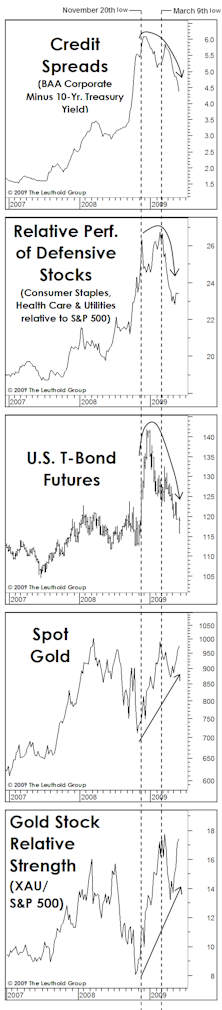

One might have expected gold and gold stocks to stumble as investors abandoned their defensive postures. However, spot gold and gold stocks (on a relative basis) are threatening to break out to new highs.

Portraits Of Declining Inflation

Jim Floyd and Steve Leuthold believe that U.S. consumer price inflation has peaked and is headed for the +3% level by mid-2009. With current headline inflation running at +5.4%, that implies there is plenty of disinflation in the pipeline.

We're Bullish (And Hoping For “Small” Gains)

Improving cyclical leadership could be signaling that the bear market is in its final stages. In 10 of the 12 past bear markets, cyclical stocks turned up prior to the conclusion of the bear.

View From The North Country

Not only is October ‘National Pork Month’ in the U.S., it is the “Year of the Pig” in China. This brings to mind the old stock market homily “A Bull can make money and a Bear can make money, but Pigs are losers.”

View From The North Country

2007 half time report. Revisiting our original 2007 projections with some current modifications. Outlook for stock market, interest rates, inflation, profits, economy, the deficits, the U.S. dollar and gold.

View From The North Country

A recap of the year so far, and our outlook for the second half of 2005.

View From The North Country

Steve’s assessment of the current bullish and bearish factors. Also, Leuthold’s recent discussion of secular bear markets, sparked some debate among readers.

View From The North Country

Steve's Half Time Report: A recap of the year so far, and our outlook for the second half of 2004.

.jpg?fit=fillmax&w=222&bg=FFFFFF)