Credit

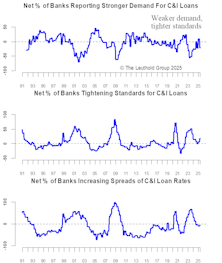

Bank Lending Slowing? Watch Credit Spreads

Despite heightened uncertainty from shifting trade policies, credit markets remain relatively stable—at least for now. While bank lending standards are tightening and loan demand is softening, market-based indicators like credit spreads and bank stock performance suggest credit risk is contained. If that holds, the broader economy may avoid serious damage, even as tariffs rise.

Crunched!

We have no special insights into the likely depth or duration of the banking crisis, but the impact on credit has already been severe. That might seal the fate of the economic expansion. It’s worth noting that in 2008, the recession seemed to have “caused” the credit crunch—not the other way around.

A Real Corona-Crash In Credit

If the U.S. economy falls into recession in the months ahead, it might be the only one in history that will be remembered as having been triggered by a “black swan.”

How Will It Be Remembered?

A way to gain perspective on the present is by trying to view it from the future. Ask yourself, “What are the signs of impending decline, now ignored by investors, that will one day be memorialized by the same investors as the most obvious in retrospect?”

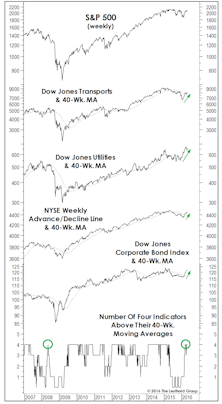

“Four On The Floor”

Leadership, breadth, and corporate credit all staged intermediate-term breakouts, rising above their respective 40-week moving averages. In this formation, historically, S&P 500 annualized return is +15%.

U.S. Interest Rates & Credits—Keep An Open Mind

The ease with which the 10-year yield broke the strong 185 bps barrier was simply too hard to ignore. This tells us interest rates will likely go lower before going higher. The current active range is 140-185.

U.S. Interest Rates And Credits—Expect The Unexpected

We expect much higher volatility in interest rates this year as the market grapples with the prospect and timing of the Fed’s first rate hike. Our base case is for the Fed to raise rates in the third quarter. There are various reasons for the Fed to be patient. Inflation will be the biggest one. The threat of oil-related risk contagion is certainly real. We are concerned that equities have not fully priced in this threat.

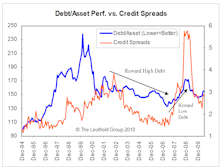

Credit Conditions Still Good But Less-Easy Than Pre-Taper

With the Taper underway and the back-up in interest rates over the last year, credit conditions have become less-easy for some consumers and small businesses.

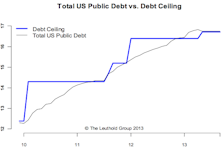

Debt Ceiling—Weakness Before But Strength After Resolution

A look at prior debt ceiling debates and patterns around resolution dates gives no surprises: markets are weaker in the two weeks before but stronger in the month after a resolution is reached.

Believe It Or Not, New Highs

Steps are falling into place for the U.S. market to climb another 15-20% into 2012.

Risk Aversion and “Episodic” Factor Returns: Investors Favoring Conservative Characteristics

We expect risk appetites to remain low and investors to continue to reward conservative stock characteristics over the next 3-6 months.

View From The North Country

Steve's commentary on the stock market's Wall of Worry, the oil patch and mining company squeeze, the abusurdity of corn to ethanol and the world's most valuable companies.