Value

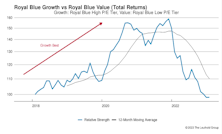

Flight From Growth

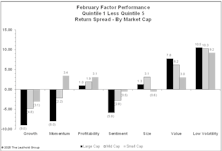

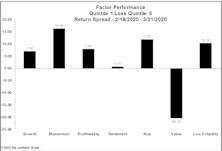

While the momentum factor often sees sizeable performance swings, in February, growth was the outlier with a -9% spread—the worst since September 2008. Growth has become very correlated with beta, making it more susceptible to underperformance during a flight to safety.

The Current State Of Value—An Update

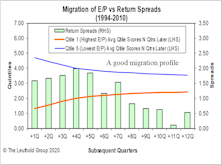

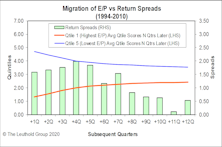

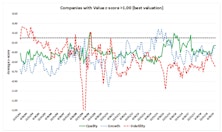

Value’s migration behavior was the key to its failure between 2010-2020—its pattern got progressively worse, culminating in a Value trap during 2017-2020. We believe macro tailwinds and positive surprises are both needed, and, while the setup on the macro front, post-2020, has become quite favorable, in order to breathe more life into Value we need to see the upswing in earnings surprises continue.

Value Functioning Better Than Advertised

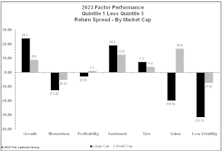

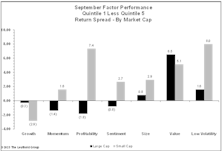

Value has worked much better within small caps compared to large caps for three of the last four years. This is nothing new, though, as value is historically a much better factor within the less efficient smaller-cap universe.

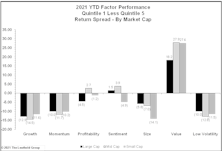

Factor Behavior Differs By Market Cap

Growth has performed much better among large caps than small caps, resulting in higher relative valuations for large caps. Based on factor valuations, we think value provides a more attractive large-cap entry point, while growth looks more attractive within small caps.

Growth vs. Value vs. Cyclicals

Both Growth and Value Small-Cap style boxes gained 10% in January’s rally. However, SC Growth remains well in the rearview mirror since its relative strength peak in September 2020: Small Cap Growth +8% versus Small Cap Value +60%.

Is Value Still A Value?

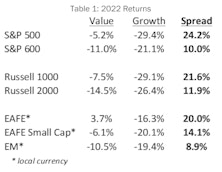

Deflating valuations in the Technology and Innovation space produced ghastly results for growth investors in 2022, with the S&P 500 Growth index experiencing an agonizing 29.4% loss. Meanwhile, last year’s bear market was no more than a mild irritation for value investors as the S&P 500 Value index lost just 5.2%. The collapse in exuberantly priced growth stocks produced a 24.2% return spread between the value and growth styles, which goes into the record books as the second biggest annual win for value since 1975.

Research Preview: An Epic Comeback

Style rotation powered S&P 500 Value to a 24.2% advantage vs. Growth, while DM large-cap Value earned a 20% return spread against Growth. Small-cap spreads favoring Value were also in the double-digits, but narrower because small-cap Growth wasn’t exposed to the collapse of mega-cap Tech.

Factor Returns And A Basket Of EGGs

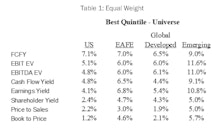

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

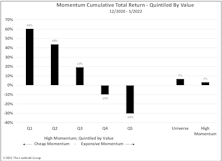

Reversal Of Fortune For ValMo Investors

From the end of 2020 through May, stocks in the top quintile of both value and momentum have returned 60% versus 7% for the overall universe. That compares to the brutal stretch from 2016-2020 when the only way momentum investing worked was to not only disregard valuations, but to actively buy the most expensive momentum stocks.

Research Preview: A Playground Scuffle Between Value And Growth

It is a scene easy to imagine: Two children on the playground arguing about who’s the top dog. This schoolyard scuffle played out in 2021 between the Value and Growth styles, with each claiming bragging rights from their own perspective.

A Good Year For Cheapskates

For our more fundamentally-oriented readers who are repulsed by all this talk of momentum, we have an alternative. Just forget about performance and focus solely on value!

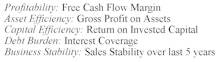

Q'Val: A Factor Powerhouse

Quant researchers widely agree that Value offers a return premium over time (although not recently) and that High Quality also offers excess returns. The Quality angle seems contrary to intuition, in that investors generally prefer Quality companies and are willing to pay up for them, yet Quality regularly outperforms. Value and Quality are both well-respected investment factors, and we were curious to explore the interaction of these two smart beta stalwarts. Is Value enhanced by adding a layer of Quality, thereby avoiding value traps, or are Value investors better off buying junky, unattractive companies that have the most room to rebound from depressed prices?

Value Turns Discerning

The weakness in Value* over the last few months has gotten a lot of attention (Chart 1). While we are still on board with the “Value trade” in general, a subtle but distinct change within the theme has emerged. There is a clear bid for Quality, which had not happened in the massive post-Covid junk rally until recently.

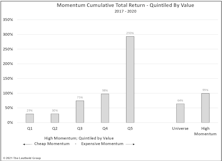

Val-Mo (Finally) Explodes Higher

After years of underperformance, investors who pay attention to both Momentum and Value are finally being rewarded. The turnaround has been substantial, but the relative valuation of expensive Momentum vs. cheap Momentum stocks is still extremely elevated by historical standards.

Active Vs. Passive Return Drivers March 2021 Update

Our ongoing research into the relative performance of active vs. passive styles reveals that market conditions play a significant role in the active/passive return cycle. We identified a set of metrics that describe the market conditions we believe influence which management style is more likely to outperform. This note updates our data through March 2021.

Rotation Into Value Continues

While Value outperformance continued throughout the first quarter, March saw higher-quality Value names take the lead. Prior to March, it was mostly the unprofitable companies that had driven the rotation.

Kindred Spirits: Financials And The Value Style

Investors looking for the long-awaited rebound in the Value style point to the potential for rising interest rates as a possible driver of style rotation. Higher rates would benefit many Financial companies, a sector closely linked to the Value style. In fact, many commentators believe that the Value style cannot experience a major run without the participation of Financials. We launched a research effort to examine the link between Financials and Value, seeking to understand whether there is truth in this old saw, or whether this connection is more properly classified as market folklore.

Research Preview: Are Financials And Value “Best Friends Forever?”

Investors looking for the long-awaited rebound in the Value style point to the potential for rising interest rates as a possible driver of style rotation. Higher rates would benefit many Financial companies—a sector closely linked to the Value style. In fact, numerous commentators believe that Value cannot experience a major run without the participation of Financials.

For Value Investors Only!

With the Bridesmaid approach we’re attempting to capture “stealthy momentum,” rather than pure momentum. Fundamentalists—and especially value investors—might find that to be a distinction without a difference.

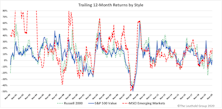

Style Rotation: Anything But Growth

Driven by massive government stimulus, an imminent vaccine rollout, and the expectation of record earnings in 2021, investors seem to be on the verge of embracing a move away from Large Cap Growth stocks in earnest. The leading candidates offered as broad-based alternatives to Large Growth (LG) include Value, Small Caps, and Emerging Markets.

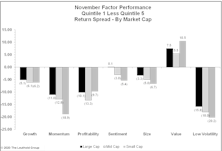

Factor Chaos

The November 9th Pfizer vaccine news compressed an entire Momentum reversal into one historic day. Factor performance easily broke records looking back over our entire history of data. While great news for the general public, it was awful news for Momentum indicators.

Research Preview: Rotating Away From Growth

This study examines Value, Small Cap, and Emerging Markets to see if they do, in fact, behave in a correlated manner when viewed as alternatives to Large Growth. The goal is to determine whether this trio of rotational favorites can be considered as broadly-equivalent replacements for LG.

Momentum’s Terrible, Horrible, No Good, Very Bad Day!

If Momentum and Growth investors thought they were escaping 2020 unscathed, they learned otherwise on Monday. Pfizer’s promising news about a COVID-19 vaccine was met with universal excitement and investors rearranging portfolios—taking gains in long-term winners and plowing into beaten-down cyclical stocks.

VLT’s Struggles Are Telling Us Something

Our Very Long Term (VLT) Momentum algorithm has been a very good “confirmatory” market tool over the years, especially at the onset of a new cyclical bull market. But VLT has proven to be of little to no value in navigating this year’s gyrations. VLT’s latest flip-flops reinforce our view that the market leaderboard is set to be rearranged.

Election—Another Chance For Value

As we Chinese watch the elegant display of the western democratic process this election season, we can’t help but think there are indeed people less fortunate than us “commies.” Worse yet, some of these people are Value investors.

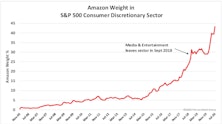

Consumer Discretionary: Neither Fish Nor Fowl

The combination of rebounding economic activity and a surging (peaking?) enchantment with mega cap growth stocks is pressing investors to make an important tactical call: whether to take profits in some highfliers and shift assets to sectors with more cyclical exposure and better valuations.

Back To The Brink

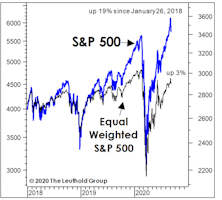

Despite equal-weighted measures’ long-time underperformance, all valuation ratios we monitor for the median S&P 500 stock have returned to their top historical deciles. Even worse, our new equally-weighted “Valuation Composite,” based on these measures, closed August at a 98th percentile reading.

Research Preview: Not Your Parents’ “Discretionary”

The combination of rebounding economic activity and a surging enchantment with mega-cap growth stocks is pressing investors to make an important tactical call: whether or not to exit some highfliers and shift assets to sectors with more cyclical exposure.

Profiting From Mighty Mites

One of the signature traits of the U.S. small cap market is the prevalence of money losing companies. A recent tally indicated that prior to Covid, 38% of small caps were reporting trailing year losses despite the widespread economic strength of 2019.

Why Value Failed—Top-Down & Bottom-Up Views

From a top-down view, since 2003, Value’s performance has been much more closely tied to various asset markets and macro drivers. From a bottom-up perspective, we believe the change in Value’s migration behavior might be the key to its failure. We believe macro tailwinds and positive surprises are both necessary for a true Value revival.

Factor Performance: Value Crushed

The selloff has served to amplify secular style-trends that were in place going into this debacle. Large Cap Growth has continued to outperform everything else, with the underperformance of Value stocks accelerating alongside market losses.

Valuation Dispersions Reach 2009 Levels

The recent market turmoil has only served to exacerbate equity style trends that have been in place for years, with Value, Small Caps, and High Beta all underperforming relative to Growth / Momentum, Large Cap, and Low Volatility, respectively.

The King Is Dead: A Global Chartbook

Last year we published a report titled Price to Book: The King is Dead (available on the Leuthold Research website) with the objective to better understand the decade-long struggle of the value style. Our findings showed that indexes based on the Price to Book ratio have indeed lagged since 2007 but that other measures of value performed significantly better until just recently.

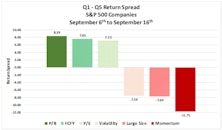

The Case Of The Flipping Factors

Equity market themes have been boringly consistent of late; growth beating value, large beating small, and domestic beating international. In the factor world, Momentum and Low Volatility have been investor favorites for most of 2019 while Value resided in last place – the same old, same old. Then, something remarkable occurred on September 9th.

Horse Trading In The Factor Zoo

Smart beta ETFs have become an immensely popular investment tool, attracting billions of dollars in AUM by providing investors with targeted exposure to factors such as Value, Momentum and Quality. Characteristics such as these have been shown to generate alpha over time, and investors understandably wish to have focused positions in these return-generating styles.

Factor Performance: Momentum Saves The Day (Year); Value Is Awful

Momentum has made a furious comeback after a rough start to the year, posting an +11% spread in both May and August. Value continues to get crushed and there has been nowhere to hide: The pain is equally distributed between cheap and expensive, and it’s happening in every sector.

Value Turns Positive

Value finally performed well during July, turning in its best month of 2018 on a spread basis. While the factor category is still deep in negative territory for the year, almost 85% of its underperformance is coming from the worst quintile outperforming the universe; meaning Value has mostly struggled because of expensive stocks outperforming, not cheap stocks lagging.

Value Style’s 100-Year Flood

Value is the philosophical cornerstone of many legendary portfolio managers and is widely recognized as one of the most robust quantitative investment factors. Yet, despite its compelling conceptual merits and long-term record of superior returns, recent years’ underperformance of Value has lasted long enough to weigh on even 10-year performance records.

Muster Drill: To The Value Lifeboats

While we’re not calling for an imminent market top, we are keeping a diligent watch from the crow’s nest for signs of a coming market correction.

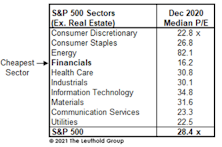

Bridesmaid Strategy: Low P/E Sector: Annual Results

Table 5 shows annual performance results for the Cheapest Sector strategy under all four rebalancing frequencies, along with the lowest P/E sector for the annual version of the strategy.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)