Growth

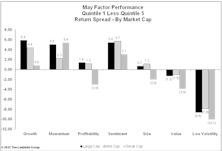

Growth Performance Roars Back

Growth quickly U-turned and led the market higher over the last two months, while low volatility stocks have been discarded. Momentum has weathered the volatility well so far—especially within small caps.

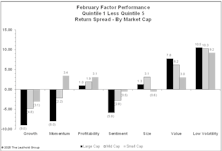

Flight From Growth

While the momentum factor often sees sizeable performance swings, in February, growth was the outlier with a -9% spread—the worst since September 2008. Growth has become very correlated with beta, making it more susceptible to underperformance during a flight to safety.

Low Correlations Haven’t Helped

With the Mag 7 driving S&P 500 returns on a daily basis, the other 593 stocks have become less correlated with the S&P 500’s day-to-day changes. Although dropping correlations are typically a good thing for active managers, we think this time is different.

Herd Instinct

Growth and Tech have been the flagrant winners YTD, yet the SVB crisis triggered further bifurcation: Since SVB failed, it’s been important to own only “big” Growth and “big” Technology, amplifying the multiples of monster stocks, like MSFT and AAPL. Can a major market low occur when investors are herded in a handful of the most richly-priced public companies in history?

Growth vs. Value vs. Cyclicals

Both Growth and Value Small-Cap style boxes gained 10% in January’s rally. However, SC Growth remains well in the rearview mirror since its relative strength peak in September 2020: Small Cap Growth +8% versus Small Cap Value +60%.

Speculative Growth Selloff: Near The End?

The group is back to where it was before the pandemonium began, both on a price and valuation basis. While the move is likely to overshoot below median and historical lows, we think we’re closer to the final chapter than the midpoint.

Style Rotation: Anything But Growth

Driven by massive government stimulus, an imminent vaccine rollout, and the expectation of record earnings in 2021, investors seem to be on the verge of embracing a move away from Large Cap Growth stocks in earnest. The leading candidates offered as broad-based alternatives to Large Growth (LG) include Value, Small Caps, and Emerging Markets.

Momentum’s Terrible, Horrible, No Good, Very Bad Day!

If Momentum and Growth investors thought they were escaping 2020 unscathed, they learned otherwise on Monday. Pfizer’s promising news about a COVID-19 vaccine was met with universal excitement and investors rearranging portfolios—taking gains in long-term winners and plowing into beaten-down cyclical stocks.

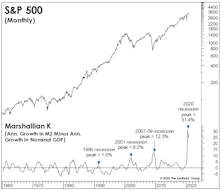

Liquidity: As Good As It Gets?

Stock market manias thrive on buzzwords, and if there’s a single one that captured the essence of the late 1990s’ boom it was “productivity.” In today’s version, our top candidate is “liquidity”—and we doubt anyone would argue.

Growth Wherever You Find It

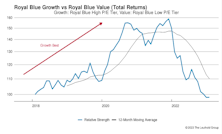

Growth investing is in the midst of a spectacular run this year, extending its decade-long dominance over the Value style. Chart 1 depicts the Growth / Value relationship over the last 25 years through July 31st, with key turning points marked by vertical lines.

Research Preview: Growth, Pure And Simple

Growth investing is in the midst of a record run this year, extending its decade-long dominance over the Value style.

The Growth Style’s Twin Peaks

The strong market rebound in the second quarter lifted the relative return of Growth vs. Value to an all-time high by the end of June. Chart 1 reveals that the cumulative S&P 500 Growth / Value return spread hit a new record last month, surpassing the previous high reached at the end of the Tech bubble in June 2000.

Growth Remains Undefeated

What can slowdown the outperformance of Growth stocks? It turns out, the answer to that persistently-unanswerable question is “Not much.” Not even a global pandemic-driven sell-off and swift rebound. From the market high in February through June 30th, Growth handily outperformed every other factor.

The Money Supply Isn’t Magic

Imagine our surprise when the bullish stock market narrative is suddenly all about money. Cynically, though, that might be because money supply and the unemployment rate are the only economic data series staging upside breakouts, and the latter doesn’t lend itself to a good narrative.

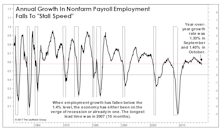

Lagging From Behind?

As Yogi Berra might have quipped, it’s not just the leading indicators that are lagging… the lagging ones are, too.

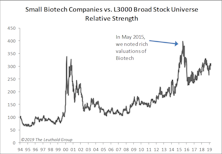

Small Cap Biotech Getting Pricey Again

In May 2015, we warned about rich valuations for small cap Biotech stocks and looked at various ways to evaluate those companies, as the majority have no approved drugs on the market, thus no revenue; therefore, valuing these companies using the conventional methodology is problematic.

If Not Large Cap Growth, Then What?

With the valuation of several high-profile Large Growth names well over 100 times earnings, we consid-er alternatives by examining the relative valuations between LG and other equity categories.

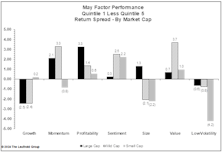

October Factor Performance

Most factor categories reversed performance along with the market in October. During the month, Value had solid results while Growth gave up all of its 2018 gains. Profitability also had a nice bounce-back month.

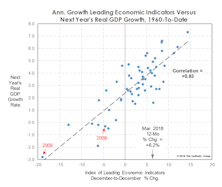

Cashing In On The LEI?

The consensus view is that the stock market will be fine as long as there’s no recession in sight.The same LEI that has displayed a fine GDP forecasting record has shown essentially no relationship with S&P 500 forward twelve-month performance. In fact the regression line shows a slight negative slope!

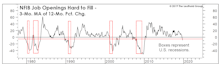

Below “Stall Speed”?

The last few months have served up some of the strongest readings observed during the U.S. economic expansion.

Glamour Growth Stocks: Better For The Long Haul

Are Glamour Growth stocks a good investment? Using data from the past 30 years, we found very different outcomes depending on the duration of investment. The best results are attained with a long-term holding period in mind.

Implications Of Low Growth, Low Inflation, Low Rates

The current environment will likely persist longer than most expect which will put further downward pressure on profit margins. As margins come under pressure, companies increase leverage to prop up ROE. However, the market wants higher duration, not higher leverage.

Growth vs Value vs Cyclicals

Small Cap Growth stocks have gotten off to a rotten start in 2016—down almost 12%. On a relative basis, the segment has also been lagging Small Cap Value—underperforming by 9% since last July.

Growth vs Value vs Cyclicals

Growth Edges Out Value As Stocks Rebound

Growth / Value / Cyclicals

Despite the down market, Large Cap Growth expanded its YTD outperformance over Value—now almost 11%.

Growth/Value/Cyclicals

Growth Showing No Mercy To Value

Growth vs Value vs Cyclicals

First Half Of 2015 All About Growth

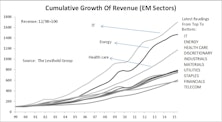

Searching For Growth In Emerging Markets

Even though the ten EM sectors are growing at a much stronger pace than corresponding U.S. sectors on the Top-Line, only a small margin exceed the U.S. in terms of EPS growth.

Growth, Value, Cyclicals

Small Cap Growth stocks were the clear outperformers in May, up almost 4%. Growth stocks are still in favor when comparing YTD figures, with the performance gap especially prevalent in the Small and Large Cap spaces.

Growth, Value, Cyclicals

Value stocks, recent underachievers, regained some lost ground in April. Large Cap Value was the month’s big winner—helped in large part by rallying energy firms. Large Cap Growth still leads YTD by more than 5%.

Growth, Value, Cyclicals

Growth Continues Run In Q1

Growth, Value, Cyclicals

Growth Stocks Dominating Value

Growth/Value/Cyclicals

Momentum Continues For Growth Stocks

Growth, Value, Cyclicals

Growth Strong In Second Half Of 2014

Growth/Value/Cyclicals

Growth Stocks Better In November

Growth vs Value vs Cyclicals

Large Cap Value Left Out Of October Surge

Growth/Value/Cyclicals

Growth Stocks Better In Rough September

Growth/Value/Cyclicals

Large Cap Growth has had an impressive advantage over Large Cap Value in six of the past seven years but that trend is reversing in 2014.

Growth/Value/Cyclicals

Growth And Value Go Down Together

Separating Earnings And Sales Growth

With the two factors decoupling, we examine if either one has been adding more value.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

_0.jpg?fit=fillmax&w=222&bg=FFFFFF)