Dollar

U.S. Dollar—Buy The Dip

The U.S. dollar has seen some interesting dynamics this year, so we’ve updated our U.S. Dollar Monitor. Currently, the model implies a higher likelihood of dollar strength, or at least a decent rebound over the next few months.

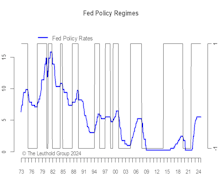

Anatomy Of An Easing Cycle

The economy normally fades heading into a series of rate cuts, with higher unemployment and lessening CPI inflation. Risky assets (stocks and credit) do well, and bond yields move lower. Real assets also benefit (gold in particular). On the whole, an easing cycle is favorable for most assets.

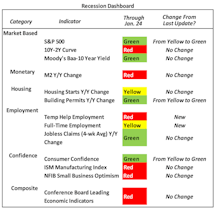

Three Key Themes To Watch—Recession, Inflation & The Dollar

The probability of a soft landing has materially increased, while stronger than expected growth is likely to put a floor on inflation, which challenges the consensus disinflation view. A refresh of our Dollar Monitor suggests a weaker dollar going forward.

Tactical Tools For A Stronger Dollar

The 2022 bear market has been driven by collapsing valuation multiples, particularly for expensive growth stocks and unprofitable companies. Coming into the year, U.S. stocks stood as one of the most egregiously valued equity markets around the world, motivating investors to look elsewhere for more reasonably priced alternatives. Fortunately, international stock markets offered much better valuations that could serve as havens from the coming U.S. valuation collapse. Unfortunately, the strategy of seeking refuge in moderately priced foreign markets was foiled by an unusually strong U.S. dollar, leading us to take a closer look at how moves in the USD affect investment outcomes for domestic investors.

Research Preview: Returns In A Year Of Dollar Strength

The U.S. Dollar Index (DXY) has gained 16.2% YTD, its best performance in almost 40 years. However, a strong dollar is bad for those with international investments, as returns are slashed when translated back into dollars.

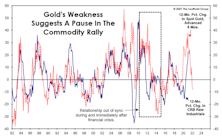

Gold: Still A Useful Dollar Hedge

A stronger U.S. dollar is “supposed” to be bearish for commodities, but it’s been a banner year for most commodities with gold among the few that are down on the year. However, keep in mind that gold tends to be a harbinger of major moves in industrial commodities, with a lead time of about six months—and its year-over-year change is now negative.

The Stock Market IS A “Fundamental”

The impact of U.S. stock-market “hegemony” extends far beyond currency markets. We believe the mania has progressed to the point where the stock market itself will shape the intermediate-term and even long-term fortunes of the U.S. economy more than it ever has before.

Triggered!?

In recent months, we’ve highlighted some reasons to buy or add to Emerging Market equities, and at year-end received a formal endorsement from our monthly Emerging Market Allocation Model. The signal triggered after a 30-month period in which the model recommended the relative “safety” of the S&P 500—in retrospect, a good call.

Textual Analysis Of Fed Statements—Always Artificial, Sometimes Intelligent

We geek it up a notch and use some of the popular text-processing techniques to quantify the hawkish/dovish sentiment of the latest Fed statement. Some human “coaching” is needed in every step of the process (hence the “artificial” part). But when these tools are used properly for carefully chosen tasks, they can be quite intelligent.

How Much For Your “Free Lunch?”

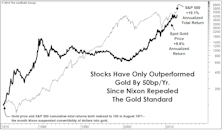

The 41% S&P 500 rally would be half as large if measured in terms of gold, and a “unit” of the S&P 500 now buys 70% fewer ounces of gold than it did in early 2000. Meanwhile, when denominated in either silver or Bitcoin, the stock market rally has been almost nonexistent.

Keep An Eye On What Your Stocks Will Buy

News that the Bureau of Labor Statistics may have undercounted the May unemployment rate by six percentage points should remind investors of the danger of taking government economic reports too seriously. Regardless of the figure, though, unemployment is no doubt near its peak for the downturn.

The Decade Of U.S. Exceptionalism & The Year Ahead

Two words sum up the past decade pretty nicely: U.S. Exceptionalism. The superiority of U.S. assets really comes down to the unique combination of growth (U.S. stocks), yield (U.S. bonds), and relative safety (both U.S. stocks and bonds).

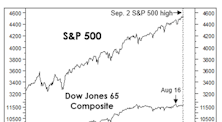

1987 Parallels (Part 2)

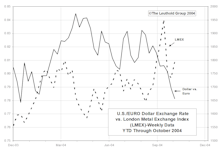

At the risk of yelling “fire” in a crowded theater, we present a few parallels between recent action and the year leading up to the October 1987 crash.

A Crude Catalyst?

The great mystery behind the trade-weighted dollar’s nearly-10% YTD decline is that it’s failed to fuel further gains (or any gains) in commodity prices in 2017.

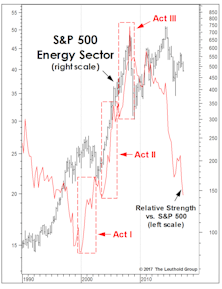

Energy: Too Early To Bottom Fish

The gap between crude oil prices and Energy sector RS is now much wider than seen even at that historic 2014 juncture. The “divergent” weakness in Energy stocks suggests that crude will likely trade lower.

Grappling With A Strong U.S. Dollar Outlook

Profitable investing overseas requires not one, but two, successful decisions: 1) select an outperforming asset class; and, 2) be in a currency that provides a favorable foreign exchange impact.

Trump Trade—Pause Before More Gain

The market seemed hesitant to push the Trump trade any farther as new policies have focused on trade renegotiation and immigration, the less positive part of the policy package.

Can The Dollar Save Small Caps?

The dollar’s moonshot in recent months has resuscitated a stock market leadership argument we haven’t heard for a long time.

The Dollar And Foreign Equities

Xenophobia continues to be a handsomely rewarded trait for U.S.-based equity investors, with the MSCI World Ex USA Index down 3.8% YTD through December 3rd—and now (incredibly) unchanged from its May 2011 high. Comparable period gains for the S&P 500 are +12.2% YTD and +50% from spring 2011 highs.

U.S. Versus Foreign Stocks: More Of The Same

Long before the U.S. dollar began to rebound, the current bull market in global stocks had already favored “provincial” portfolio managers focusing solely on U.S. stocks.

Inflation & The Dollar

Are U.S. markets for labor and capital actually getting tight?

Stocks Vs. The Dollar—More Complicated Than You Think

The recent strength in the dollar coincided with a spike in volatility and weakness in risky assets, but the relationship over the last couple years has been tenuous at best.

Five Reasons Inflation Is Still Missing

Overall demand slack, stubbornly low velocity of money, an overall stronger dollar, painfully low labor cost inflation and weakness in commodity prices are strong disinflationary forces.

Gold: Twelve Years And Going Strong

A textbook, commodity-like top in gold would be a panicky, spiky event that would take the metal well above $2000.

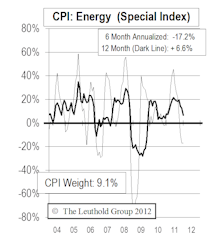

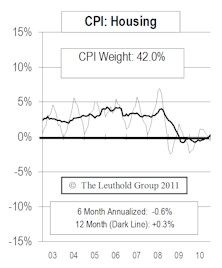

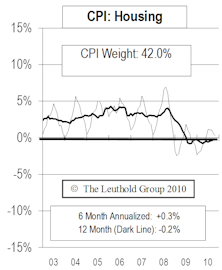

Reported Inflation Should Be Muted In 2012

For 2012, the reported CPI is expected to slip down to the +2% area (although items like lunches, transportation, parking and food may continue rising at close to a 10% rate).

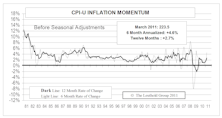

Inflation Pressures Continuing To Heat Up...Boosted Year End Projections

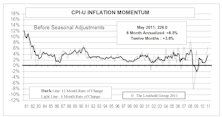

CPI rose 0.5% in May (before seasonal adjustments), down from April’s +0.6% monthly increase.

Despite Falling Commodity Prices, Inflation Still Expected To Accelerate In 2011

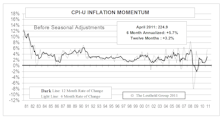

Latest PPI month/month increase was +1.2%, however the latest report is a measure of inflation from mid March through mid April and does not include the impact of the plunge in commodity prices.

Inflation Pressures Becoming More Evident

All three PPI measures have their six month rates of change well above the 12 month rates, so the trend points toward even higher inflation ahead.

Look Out For Rising Inflation This Year

Given global economic recovery, and Fed action meant to stimulate the U.S. economy, we expect that inflation fires will heat up significantly in 2011.

Inflation Acceleration In 2011

By keeping interest rates at extreme lows and printing money, the Fed is trying to reflate, convincing consumers to spend, not save and investors to buy riskier assets.

Inflation Acceleration In 2011

Commodities are on fire, and it’s not just because of the weaker dollar. Commodity prices are signaling significant pass-through inflation pressures building.

View From The North Country

Steve presents the transcript of his April 3rd interview with Barron's Senior Editor, Sandra Ward.

Inflation Watch

We continue to be more optimistic about the dollar than most, and believe the post election U.S. dollar weakness was overdone.

Inflation Watch: 2005 Outlook

For now the economic expansion remains healthy, but could fade some in the second half of the year.

2005 Outlook: High Energy Prices Will Show Up In Next CPI & PPI Reports

We estimate +3.3% real GDP growth in 2005, after weakening in the second half of the year.

Inflation Watch: 2005 Outlook

CPI and PPI declined more than expected in December due to impact of lower energy prices.

Looking Ahead To 2005

Continued U.S. dollar weakness could certainly be an inflation negative, but we are getting more optimistic about the dollar.

Recent Surge In CPI/PPI Inflation Temporary, Not Sustainable

Higher oil prices and higher food prices pushed recent CPI and PPI higher. Next month’s readings will likely show less inflation with oil prices coming down some recently.

Industrial Metals Stocks: October Brings A Wild Ride For Metals Investors

Physical metals experienced a deep sell-off on Wednesday Oct. 13th. It was one of the largest single day drops ever in the base metals markets, prompting London metals traders to dub the day “Black Wednesday.”

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.png?fit=fillmax&w=222&bg=FFFFFF)