Equity Strategies Group-Level Analysis Of The Equity Markets

Leuthold Portfolios Update - December 2025

We sold two long-term group holdings last month: Big Communication Services and Systems Software. This continues our shift from growth into cyclical and defensive industries.

Leuthold Portfolios Update - January 2026

Markets are changing and our strategies are adjusting accordingly. Core gained from improving breadth and balanced positioning, Select Industries navigated a decisive rotation toward cyclicals and commodities, and Grizzly continued uncovering structural disruption themes beneath the surface. With mega-cap momentum fading and leadership broadening, flexibility remains our advantage.

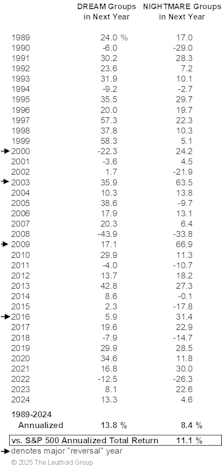

Leuthold’s Industry Group “Dreams” And “Nightmares”—Annual Update

Historically, the momentum plays of our Dreams and Nightmares have worked both ways, and 2025 was a “confirmation” year for this study. The best performing groups from 2024 beat the S&P 500 in 2025, and the worst performers of 2024 trailed both the Dreams and the S&P 500 in 2025.

Leuthold Portfolios Update - November 2025

Select Industries added a new group position in Pharmaceuticals, looking to take advantage of historically low relative valuations and recent momentum.

Leuthold Portfolios Update - October 2025

With equities trading at extreme valuations, Select Industries remains diversified among styles and themes.

Leuthold Portfolios Update - September 2025

Biotechnology has reentered the Select Industries portfolio as improving fundamentals and a sharp sentiment rebound lifted the group into Attractive territory. While policy risks remain, the backdrop of stronger earnings revisions and reasonable valuations supports a renewed allocation to the sector.

Leuthold Portfolios Update - August 2025

The bookends of our sector rankings seem to have stabilized after a very rocky start to the year. The only changes in the past few months have been in the middle of the standings, with Health Care, Industrials, Utilities, and Materials oscillating between the #5 and #8 positions.

Leuthold Portfolios Update - July 2025

The cyclical sectors of Consumer Discretionary, Industrials, and Materials have climbed from the bottom of our sector rankings, three months ago, to now occupy the fourth, fifth, and sixth positions, respectively.

Leuthold Portfolios Update - June 2025

Regional Banks were sold from the Leuthold Select Industries Portfolio as challenges in lending and commercial real estate exposure weighed on the group. The portfolio remains overweight in Communication Services and Financials, while exposure to Consumer Staples, Energy, and Real Estate is zero. Despite recent volatility, Attractive-ranked groups continue to offer a diversified mix and are outperforming year-to-date.

Leuthold Portfolios Update - May 2025

The strategy holds equity groups that participate when the market moves higher, as well as industries that are more defensive and well insulated from tariffs.

Leuthold Portfolios Update - April 2025

The Select Industries portfolio is shifting defensively in response to evolving Group Selection Scores, exiting Homebuilding and Interactive Media while adding to more stable industries like Data Processing, Education Services, and Gas Utilities. April’s volatility also drove a broader rotation across the GS framework, with cyclicals like Airlines and Internet Services making way for more resilient Health Care and Reinsurance names. While Financials still offer upside if uncertainty fades, rising tariff risks have pushed several Consumer and Tech groups into the Unattractive category.

Leuthold Portfolios Update - March 2025

The strategy sold Airlines and Apparel Retail and put the proceeds into a defensive basket consisting of Data Processing & Outsourced Services and Gas Utilities.

Leuthold Portfolios Update - February 2025

The strategy initiated new group holdings in Airlines and Education Services, while liquidating Construction & Farm Machinery & Heavy Trucks, Reinsurance, and our DOGI theme (Department of Government Inefficiency).

Leuthold Portfolios Update - January 2024

There were two new group positions this month: Internet Services & Infrastructure and Hotels & Leisure. Trading Companies & Distributors was sold.

Leuthold Portfolios Update - December 2024

After several reductions to the IT sector, Communications Equipment was purchased as a new group holding in the Select Industries equity portfolio.

Leuthold’s Industry Group “Dreams” And “Nightmares”—Annual Update

Over the entire history of this study, the momentum plays of our “Dreams” and “Nightmares” have worked both ways. Like everything else, our Dreams fell short of the Cap Weighted S&P 500 in 2024. However, the spread of Dreams over the Nightmares was fairly impressive.

Leuthold Portfolios Update - November 2024

Financials had another boost as the sector should thrive under the new administration. Among others, less regulatory oversight and weaker capital controls are apt to improve profitability. Within Info Tech, several industries that contain top AI-beneficiaries have deteriorated; both Semiconductors and Tech Hardware Storage & Peripherals are now rated Unattractive.

Leuthold Portfolios Update - October 2024

The portfolio is positioned with a slightly pro-cyclical stance, but also owns defensive and growth-oriented groups that are deemed attractive by the Group Selection (GS) Scores.

Information Technology Falls Out Of Favor

Due to a falloff in our sector rankings, exposure to IT in our equity portfolio has dropped sharply over the past year. Elevated valuations, combined with poor relative strength, overbought signals, and slowing growth are the primary impetus for the declining scores.

Leuthold Portfolios Update - September 2024

While the IT sector and its group constituents have fallen from the upper echelons of the GS Scores, the majority of the underlying industries sit in the middle range (Neutral) of the ratings. This isn’t a negative call toward the IT sector, but a shift away from the high-conviction outlook we previously held.