Fund Flow Trends

Previous Inflow Records Shattered

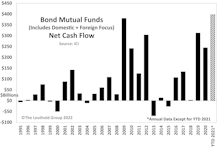

Bond mutual funds had a stellar 2021. With data available through November, this subset has already amassed YTD net-cash inflow trumping 2009’s all-time record.

Bond Mutual Funds: Record Cash Inflows

The mutual-fund category for bonds, in general, continues to rake in record amounts of cash. It has registered the highest inflow ever for the first five months of a year. January, February, and April each captured enough to rank among the top-ten-highest monthly inflows back to 1984.

Fresh In/Outflow Records For Fund Categories Continue In 2021

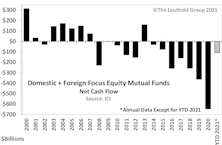

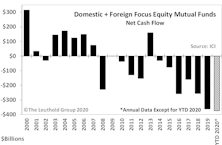

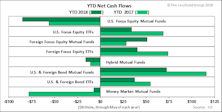

Massive net-cash outflow from equity mutual funds (MFs) shows no sign of slowing, even as equity markets notch new record highs. Combined MF net outflow that focuses on domestic and foreign equities tallied a remarkable $646 billion in 2020—practically doubling the previous outflow record set in 2019.

New Records In 2020

Despite fresh all-time highs in the stock market, heavy net outflow from equity focused mutual funds shows no sign of abating. With 2020 data through November, fund flows for MFs that focus on domestic or foreign equities saw an incredible $569 billion head for the exits.

2020 Record Fund Inflow AND Outflow Levels Persist

Outflow from equity-focused mutual fund categories remains relentless despite the recovering stock market, while bond ETFs continue to blow-out record inflows.

Net Inflow AND Outflow Records Set This Year

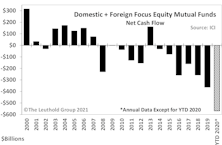

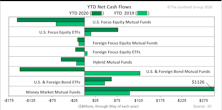

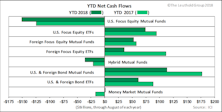

As of May 2020, domestic equity mutual funds and bond mutual funds have seen record outflow, while money market mutual funds have received record net inflow. Domestic equity and bond ETFs are also experiencing record net inflow YTD.

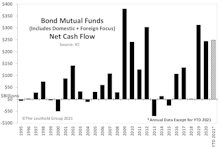

Cash Flows Accelerate Out Of Stock Funds Into Bond And Money Market

Bond and money-market fund subsets are seeing strong net cash inflows year-to-date, having captured $581 billion thus far (versus $176 billion at this time last year).

Cash Flows Decisively From Stock Funds, To Bond And Money Market Funds

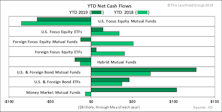

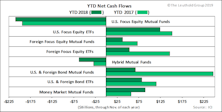

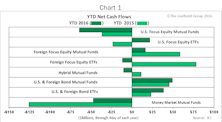

Through May 2019, total net cash flow into equity and hybrid mutual funds and ETFs have turned negative.

Flows Muted For Most Equity Categories

As of the end of February, net cash flow into equity fund categories was subdued compared to that logged for the first two months of 2018.

Flows Subdued Y/Y Across Categories

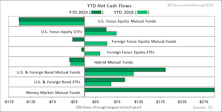

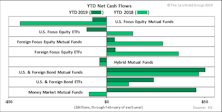

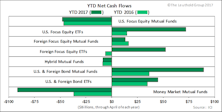

As of November 2018, net cash flows into mutual funds and ETFs are positive but significantly muted compared to those logged at this time in 2017.

Flows Subdued Across Categories

Through August 2018, total net cash flows into mutual funds and ETFs are positive but remain muted compared to those logged at this time in 2017.

2018 Flows Muted Across Categories

In 2017, equity and bond funds captured a staggering net $400+ billion. In 2018, uneasy investors are still buying funds, but at subdued levels compared to the same period last year.

2018 Fund Flows Off To A Slow Start

Volatile markets in 2018 have lent to relatively subdued mutual fund (MF) and ETF inflows.

Fund Flow Trends - January 2018

Cumulatively, mutual funds (MFs) and ETFs (ex-money market funds) captured more money in 2017 YTD than any other year over the same period (data through November).

YTD Fund Inflow Highest On Record

On a cumulative basis, YTD through August, equity and bond funds (ex. money market) have captured more money than ever before over the same period.

YTD Fund Inflow Remains Highest Since 2013

Excluding money market, all equity and bond fund categories have captured cumulative net cash inflow that is more than five times the level seen at this time last year. ETF inflow this year has accounted for nearly 80% of all flows.

YTD Fund Inflow Highest Since 2013

YTD Fund Inflow Highest Since 2013

Fund Inflow Subdued In 2016

Net cash inflow for 2016 (through November) was muted relative to that of the same period in 2015.

Fund Inflows Subdued In 2016

Bond mutual funds, bond ETFs, and domestic-focused equity ETFs are the only categories registering material positive cash flows YTD.

Stock/Bond Market Fund Flow Trends

Bond funds (including ETFs), foreign-focused equity mutual funds and domestic-focused ETFs are the only categories capturing positive cash flows YTD.