Capex

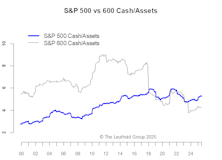

Not All Cash Is Equal—A Tale Of Two Sizes

An examination of how large- and small-cap companies allocate cash across three main uses: investment (Capex and R&D), shareholder returns (dividends and buybacks), and M&A. We further evaluate how, over time, the market rewards or penalizes each.

Rolling In Cash & Spending It In Style

We take a look at how the market rewards different uses for cash and what drives management decisions about the use of cash over time. The focus here is on the three main cash applications: investment (Capex and R&D), return of cash (via buybacks and dividends), and M&A spending.

Capex Beneficiaries “Delivered,” But Only On Price Action

With optimistic views on capex in late 2017, we built a thematic group of companies that appeared to be potential beneficiaries of higher spending going forward. This group has outperformed the market; but, the capex trend is disappointing and quite concerning.

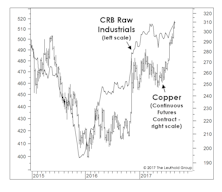

Commodities: How Strong Is Too Strong?

While the bond market doesn’t believe it, the past couple of months leave no doubt that the U.S. industrial economy has recovered from the energy-related slump of 2015-2016.

Stock Picking In A Season Of Animal Spirits

We examine past capex spending patterns and identify industries with sales growth rates that have historically been the most responsive to capex cycles.

Does Returning Cash Crowd Out Capex?

Companies are returning cash to investors at a level never before seen. Does the historically high level of cash being returned to shareholders crowd out the use of cash elsewhere? One wide-spread concern is that by shelling out cash through dividends and share buybacks, companies are spending less on capital expenditures. Is that a real concern?

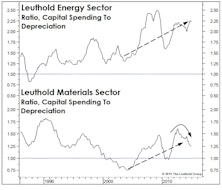

Time For Materials?

The Leuthold Materials sector jumped five spots to #3 in the June Group Selection (GS) rankings, its highest ranking in eight years and the first reading outside of the bottom four in almost four years.

Capex, Capacity And The Dollar

We’ve been highlighting the overinvestment (or malinvestment) risks in commodity-oriented equity sectors for the past three years, but we certainly did not foresee those risks exploding the way they have in the oil market over the last seven months.

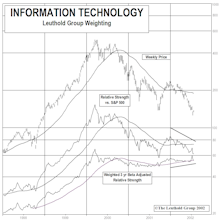

Technology’s Prospects For Long Term Leadership Looking Good

Nine Technology groups are in the top quintile of our group model, and the sector has strengthened on a relative basis after twice “testing” a trendline that dates back to the early 2000’s tech wreck. There’s reason to believe the new uptrend has longer-term legs.

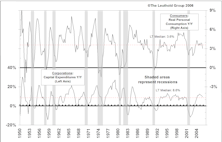

How Investors Are Rewarding Management Decisions: A Global Perspective

There are four key decisions a company’s management has to make: Dividend Policy, External Financing, Capital Expenditure (Capex), and Research & Development (R&D). We studied how the market rewards each of these management decisions.

Corporate Share Repurchases Now At Record Levels...Five Reasons Why They Are Expected To Slow

Share repurchases have been a major driver in the extension of the bull market, but this month’s “Of Special Interest” outlines several factors which are likely to contribute to a deceleration in corporate repurchase activity over the next several quarters.

CAPEX Is Slowing: Which industries still stand to benefit—and which ones are in trouble?

We dig deeper into the capital spending data to determine which industries still could benefit from recent CAPEX trends and which ones are likely to get hurt.

Capex Beneficiaries: Where Is The Big Spending….And Which Industries Stand To Gain?

Capex spending on the rise. Eric Bjorgen segments the spending areas and theorizes about which groups will be the most significant beneficiaries of spending. Great idea generator for those looking for ways to play the rising capex spending.

Tech Watch Revisited – Examining The Bullish Case For Info Tech

Technology continues to be a hot topic. This month’s “Inside The Stock Market” takes an objective look at the Tech sector.

Update On The Economy….Q4 Just A Bump In The Road...Or Something More?

Real GDP in Q4 was not too robust, but the numbers will likely be revised upward.

The Latest On Capex...Growth Appears Likely To Continue

Real growth in capital spending remained at an above-median rate in Q2, and it now looks like it might hold at or near these levels if an inventory rebuilding scenario plays out during the rest of the year.

Market Mood Swings

Bull market still intact, but investor appetite for risk remains subdued. April’s preference was for defensive and conservative strategies. Old axiom “Sell in May and go away” doesn’t seem to apply during the 130 days leading up to election day.

Capex And Consumer Spending Back In Sync

Another confirmation of the strength of the recovery.

Tech Watch

Still overweight Info Tech, but stock selection likely to get tougher in coming months.

Tech Watch—Pockets of Strength Beginning to Emerge

Stock selection and small cap focus have provided the only hopes of surviving this decimated sector.