Fed Policy

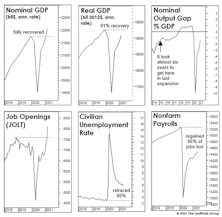

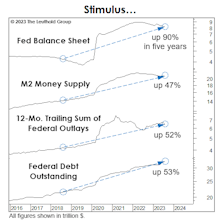

Has The Tsunami Of Stimulus Been Worth It?

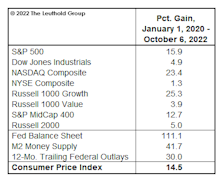

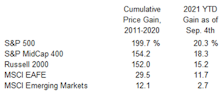

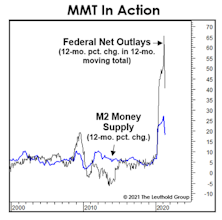

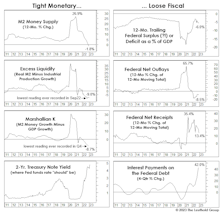

Federal outlays, federal debt, and M2 have each jumped ~50% in five years, while the Fed’s balance sheet soared by 90%. The “reward”: Real GDP cumulative growth per capita of 1.6% per year (a good chunk of which will be reversed during a recession).

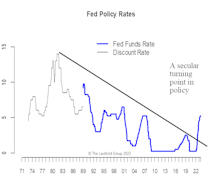

Not All Fed Pauses Are Equal

The latest pause is widely expected to be short-lived, but many things can happen to extend the pause or even completely end the tightening cycle. While some markets show little distinction between a final pause and an interim one, most behave in a way that’s consistent with the economic backdrop.

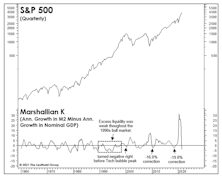

The “K” Has Been “KO’d”

Volcker stormed to the scene to extinguish a blaze lit by others, while Powell battles a conflagration of his own making. Even if Powell executed a perfect, disinflationary soft landing, there may be something else in the cards: The magnitude of M2 shrinkage has resulted in the Marshallian K’s worst ever reading.

ISM: Down, But Not Out

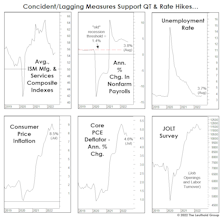

Early evidence shows the recent banking calamity knocked down already-fragile measures of confidence and activity, as exhibited by the ISM Manufacturing Composite posting a fifth-consecutive reading below 50.

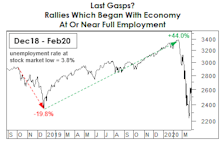

Rose-Colored Remembrances

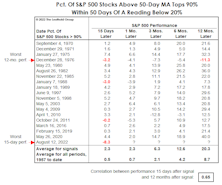

Monetary conditions have worsened, recession evidence is piling up, and some of our Large Cap valuation measures have returned to their tenth historical deciles. However, with the economy near full employment we thought it worth revisiting the past to find examples where the market might have temporarily thrived under similar circumstances.

Inadvertent Easing?

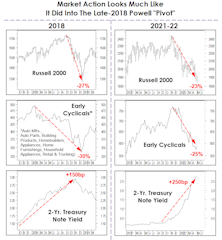

Sometimes, a sharp upside reversal in the stock market will correctly anticipate future improvement in monetary and liquidity conditions. That was the case with the powerful up-leg that sprang from the market’s 2018 Christmas Eve bottom.

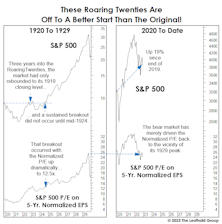

A One-Hundred-Year Market Echo

Hopes that this decade might see a repeat of the “Roaring Twenties” took a hit last year. But there’s plenty of time to recover, and bulls will be encouraged to learn that cumulative stock market performance for this decade, thus far, is better than at the same point in the Roaring 1920s.

Jay Powell, The Chartist

When Jerome Powell took the reins of the Federal Reserve in early 2018, many commentators cheered the fact that he does not possess a Ph.D. in Economics. It will be many, many years before historians are able to conclude whether that’s a good or bad thing.

Yesterday’s action, though, left us wondering whether Powell might stealthily be in the process of earning a different designation—that of Chartered Market Technician (CMT).

Past Pivots Prompted By Politics

We scrutinized the typical path of money growth during the four-year presidential election cycle, and found that it typically tends to bottom out in October of the midterm year! The cycle says a monetary pivot is imminent, and the average pattern traced out by M2 suggests an acceleration in the growth rate of about 2.5% leading up to the presidential election.

Powell Doesn’t Need To Be Volcker

The current bear has been no more than moderate based on conventional measurements. However, the loss of market wealth in relation to GDP is not too far from the levels suffered during the Great Financial Crisis.

Roaring Good Times...

Boy, were the pundits ever right about the Roaring Twenties. Less than three years into the decade, the animal they fear most has already roared two times. Actually, the first one, in the first quarter of 2020, was more like a piercing “yap,” taking the S&P 500 down almost 34% in just 23 trading days. The second roar has been a deeper, more guttural one that’s lasted nine months and is probably not done.

Labor: Snatching Defeat From The Jaws Of Victory

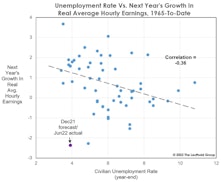

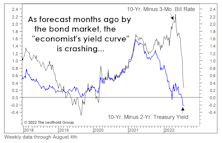

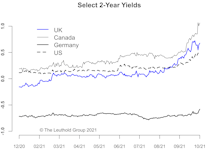

This year it’s been popular to say the Fed will hike interest rates until it “breaks something.” Has that not already happened? Pull up charts of the Japanese yen, the British pound, and the euro, among others. And stateside, the Fed has broken one of economists’ favorite toys: the Phillips Curve.

Fake-Out Or Break-Out?

“Don’t fight the Fed” was profitable advice dispensed almost daily by bulls in the 2nd half of 2020 and all of 2021. It’s been valuable advice in 2022, as well. However, when the Fed turned hostile earlier this year, the bulls deviated from their own sound advice and looked for new narratives.

Tightening Into A Slowdown: Month Seven

An economy can slow to a standstill on a “real” basis while growing rapidly in nominal terms; it happens in emerging economies all the time. But this dichotomous condition now afflicts most of the developed world.

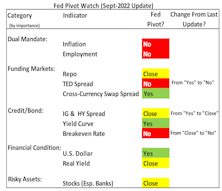

Fed-Pivot Watch—Pivot Pushed Further Out

Since our July report, market action felt like the pivot had already occurred. However, according to our latest update, numerous measures have moved away from levels that would support a pivot. In other words, the eagerly-awaited Fed pivot has been pushed further out.

The Yield Curve: Two “Perfect Records” At Stake

Yield curve action is getting harder to dismiss by the day. But which curve is the most relevant? We tried to answer that question in disciplined fashion in April. To our surprise, the “2s10s” spread that’s ubiquitous in bond-land scored near the bottom of the pack.

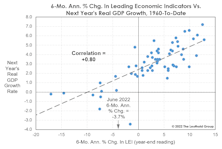

LEI On The Precipice

The LEI’s 3.6% six-month annualized loss through September 2006 was the largest decline not followed almost immediately by a recession. This year, the LEI contracted by 3.7% over the six months through June—if a recession is avoided in the current experience, it would be the most misleading signal in the history of the LEI as currently constructed.

Fed Pivot Watch

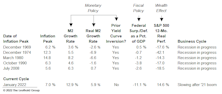

The late 2018 policy error and subsequent pivot of Chairman Powell’s rookie year is probably the best case-study for today’s pivot debate. Here we evaluate the current status of key pivot triggers and compare them to the readings of late 2018. Given the political environment and backward-looking nature of the Fed, we think the bar is higher for a pivot than the market hopes.

Your “Free Lunch” Comes With A Tab

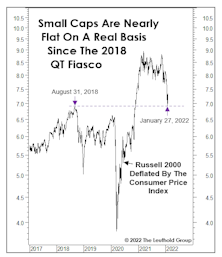

The market impact from money printing has been underwhelming when adjusted for the inflation it’s unleashed. Measured from the peaks associated with the first attempt at Quantitative Tightening, in inflation-adjusted terms, Small Caps, EAFE, and Emerging Markets all have losses.

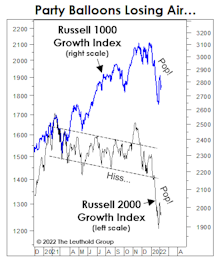

Past Pivots Put Powell In A Predicament

Market conditions leading up to the May rate hike were similar (if not worse) than those that triggered Powell’s late-2018 “pivot.” Free-market tightening of 2022 is apt to play into the path of policy. There’s likely a dovish “pivot” in store later this year—one that may be aggressively sold rather than bought.

Zigs And “Zags”

Like Gonzaga in the NCAA basketball tournament, stock market bulls are set for their first real test in a very long time.

What “Causes” Inflation To Decline?

Last year’s consensus view that inflation would prove “transitory” missed the mark. There’s no reason for shame; inflation forecasting hadn’t been a required investment skill for the previous 30 years.

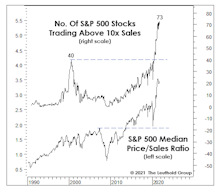

Speed Trap Ahead?

In San Francisco, thefts of less than $950 have been decriminalized, while in Minneapolis, police are so beleaguered that car thefts not involving injury are ignored. Is it any wonder that the economy felt free to violate its usual stock market “speed limits” throughout much of 2021?

Easy Money? Not In Small Caps

One might have predicted that big beneficiaries of war-time-style levels of federal spending, financed by money printing, would be Small Cap stocks. And from March 2020 until March 2021, they were. But the larger picture is sobering.

A Failure of "Free Money"

Senator Rand Paul’s annual “Festivus” report on wasteful spending makes for sobering reading to the dwindling few who care about federal finances. The “low light” for 2021 was a $465,000 grant to the National Institute of Health for a study of pigeons playing slot machines.

“Collared” By The Fed?

In late January, the S&P 500 was down so much (almost 10%!) that it revived talk of investors’ favorite “safe” security. No, not T-bills—and not even Amazon or Apple common stock—but the Fed “put.” Years ago, we called it the “hypothetical” Fed put. But by now, we’re believers.

Small Caps’ Three-Year Ride To Nowhere

Yesterday, the Russell 2000 closed down 20.9% from its November 8th high, and market bulls have conceded it was “due” for a pullback after a 146% gain off the March-2020 COVID lows.

The Russell’s decline is moderate by the historical high-beta standards of Small Caps. However, this drop—combined with other developments transpiring over the last few years—has produced a shocking result: The Russell 2000 is now unchanged on an inflation-adjusted basis since its “Quantitative-Tightening Top” of August 31, 2018. But what a three-year ride it’s been!

Is Powell A “Phillips Curve” Guy?

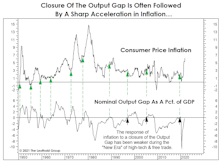

With consumer price inflation raging at 6.2% and few indications of an imminent rollover, Jay Powell has waved the white flag and retired the ill-begotten “transitory” descriptor. The timing of Powell’s concession is intriguing—perhaps he’s a fellow follower of a simple inflation model: the Output Gap.

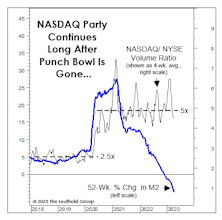

“Memes” Need Money Growth...

The extra months of QE “auto-pilot” failed to support some of the themes we’d have thought were the most likely to benefit from it—including IPOs, SPACs, Bitcoin, and the sky-high growers favored by the ARK Innovation ETF. Instead, the smart play with each of these assets was to ignore the ever-expanding Fed balance sheet and sell in February.

Fed Taper—Not A Policy Error

We believe concerns about central-bank policy error are mostly a foreign issue, because they have moved much more aggressively than the Fed. The market has shown no indication of a Fed-policy mistake and we are still on board with the reflation trade.

No Bark, No Bite?

If NBER is correct that a new economic expansion began in mid-2020, then this cycle is unfolding in “dog years.” After limiting between-meal snacks earlier this year, champion-breeder Jay Powell has informed his pack of canines that their portions will also be reduced as of later this month.

Aging Prematurely

Regardless of one’s view on the maturity of today’s economic and market cycles, it’s hard to deny that the continuation of extraordinarily-loose economic policies is now causing those cycles to age prematurely. And no doubt it’s contributing to the premature “graying” of many market participants.

A Good Thing To Have In Reserve

It seems investors care mostly that the authorities have fiercely defended the S&P 500’s status as the World’s Reserve IndexTM. A decade of QE should have taught us that when the Fed conducts a decade’s worth of QE in little more than a year, U.S. Large Cap stocks benefit the most.

Liquidity Letdown?

Stock market liquidity might seem plentiful, with the Fed still buying $120 billion in bonds per month under the all-too-predictable continuation of what was first billed as an emergency operation. However, the steadiness of QE masks a major second-quarter reversal in “excess liquidity.”

Sharing The Punch Bowl?

The gap between YOY growth rates in M2 and nominal GDP just flipped negative after four quarters of record-high readings. In other words, the recovering economy is now drinking from a punch bowl that the stock market once had all to itself. Similar drinking binges occurred in 2010 and 2018, both of which then experienced corrections north of 15%.

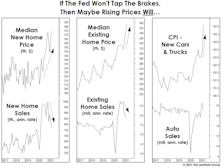

Are High Prices A Form Of “Tightening?”

It’s certain that today’s cyclical bout of inflation will prove “transitory,” if only because the word itself is practically meaningless. Our time on earth will also prove transitory, and so too will the current stock market mania—to the shock of most of the nearly 20 million “investors” on the Robinhood platform.

Ulterior Fed Motives?

In an echo of last decade, the Fed has come under fire for keeping crisis-based monetary policies in place well after a crisis has subsided. Predictably, the Fed rationalizes its uber-accommodation by citing the slowest-to-recover data series from a set of figures that already suffer from an inherent lag (labor market indicators).

We’re The Government And We’re Here To Help

Our trusted civil servants must have found a list of our old Economic/Interest Rates/Inflation components and began to “discontinue” those once invaluable to us and other Fed watchers. It’s a hindrance, but we still have the one that is most correlated to stock prices and it’s free: The ever-expanding balance sheet.

Time To Start Thinking About “Thinking About…”

The COVID collapse showed the Fed could abandon its clunky forward guidance and make the appropriate “pivot” when the facts changed. Now that facts have changed for the better, the Fed is right back to the rigid and dogmatic approach that characterized Fed-speak for almost all of the last economic expansion.

What Should Quants Count?

On May 25th, Fed Chair Jerome Powell promised to pull back emergency support “very gradually over time and with great transparency.”

“Very gradually?” No one doubts that. But “with great transparency?” Not a chance...

.jpg?fit=fillmax&w=222&bg=FFFFFF)