Recession

Recession Dashboard Update—Low Recession Risk

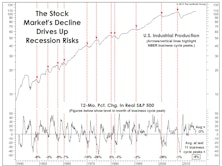

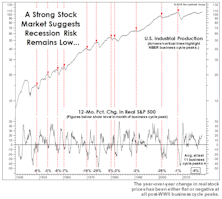

The stock rally and associated wealth effect make an imminent recession less likely (data that corroborates our Up/Down Earnings figures). Yet, things can change quickly when so much is riding on the market. Employment is still the biggest threat.

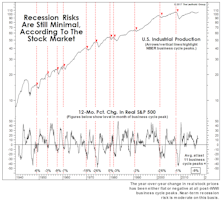

Slowdown Or Recession? Watch The S&P 500 Index!

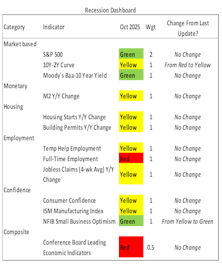

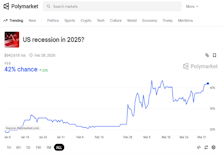

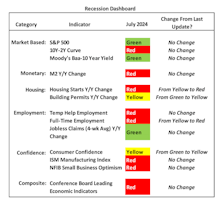

Uncertainty surrounding Trump’s second term and the risk of escalating tariffs have shifted market focus from inflation to growth, raising fresh concerns about a potential recession. Our updated Recession Dashboard shows a delicate balance, with risk now slightly above 50%—driven largely by weakness in equities and full-time employment. While some indicators have improved, the market remains the most important signal to watch. A sharp selloff could tip the economy from slowdown into recession territory.

Three Themes To Watch: Recession, Inflation, The Election

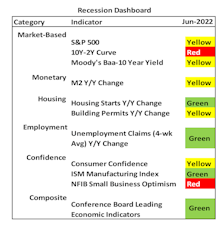

Is the market overreacting to recent economic data? Concerns about a growth slowdown are replacing the optimistic outlook of early 2024. Our Recession Dashboard shows increased risks, with notable declines in housing, employment, and consumer confidence. Despite this, equity and credit markets remain resilient. As we navigate these uncertain times, discover how upcoming elections and potential economic policies could shape the future.

A Delayed Day Of Reckoning?

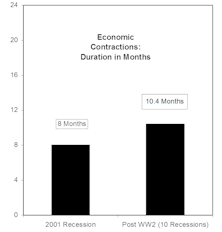

Today, the recession / no-recession call dominates daily market debate probably more than any time since the spring of 2008 (when the economy had been in recession for 4-5 months). We fully expect the U.S. economy to roll over in the next several months.

Soft Landing Or Recession? A Dashboard Update

The weight of evidence clearly leans more toward a recession, but the wild card is the recent dovish turn of global central banks, which can significantly boost confidence from investors, consumers, and businesses.

Goodbye Inflation, Hello Recession?

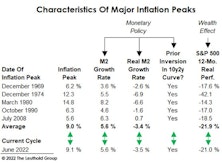

Unlike the five prior cycle peaks, this year’s inflation peak materialized during an ongoing economic expansion. That implies the “post-peak” monetary policy has never been tighter than today—making a soft landing even more improbable.

How This Year’s Inflation Peak Differs From Its Predecessors

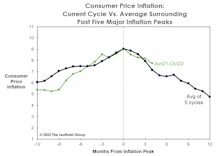

Our studies of economic and stock market history are meant to provide perspective, not an investment roadmap. But occasionally a current trend will resemble the past so closely it’s eerie.

Take the current inflation cycle. If (as we believe) June’s CPI inflation rate of 9.1% represents the peak for this business cycle, then many of its characteristics have lined up almost perfectly with the “average” of past inflationary episodes.

The World As Powell Sees It

When the economy falls into recession, labor market measures will be among the last to tell us. We can’t resist watching them anyway, for two reasons. First, we know that the Fed’s self-proclaimed data dependency is unduly reliant on lagging data points, like the monthly employment report. We want to see what the policymakers are seeing, even if that sometimes means using the same, fogged-up rearview mirror.

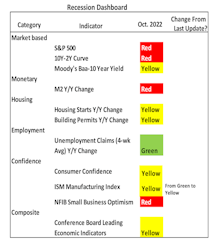

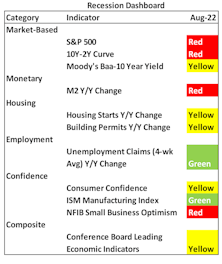

Recession Dashboard Update—More Deterioration

The latest ISM Manufacturing numbers resulted in a downgrade to that factor from “green” to “yellow.” Unemployment claims is the lone component with a green light on the dashboard. Overall, the various measures we track suggest the risk of a “real” recession is high—better than 50%.

#51 - Yield Curve Inversion

Our recession indicators have continued to deteriorate. Given the stagflation backdrop, the Fed’s tightening cycle is very likely to end in a recession.

Recession Dashboard Update—Real Recession More Likely Than Not

Our recession indicators have continued to deteriorate. Given the stagflation backdrop, the Fed’s tightening cycle is very likely to end in a recession.

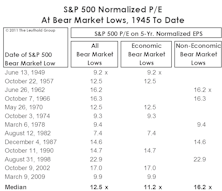

“Recessionary” Valuations?

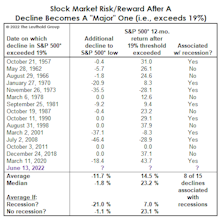

The bear was a mere cub back in March when we examined the historical record of buying S&P 500 dips in the -10% to -12% range. “Blindly” buying them turned out to have mediocre returns, but we illustrated that the positions of various business-cycle indicators could help one determine whether or not catching the proverbial “falling knife” was warranted.

Recession Dashboard Update—More Warning Signs

Overall, there are now more warning signs, but it still doesn’t suggest a recession is imminent.

Does An Economic Rebound “Inoculate” The Stock Market?

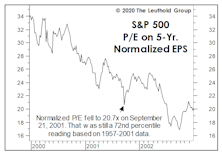

The 2020 decline exhibits a strong resemblance to the “incomplete” bear market of March 2000-September 2001—in that neither decline sufficiently deflated the extreme valuations of the preceding bull, and each was followed by an immediate rebound in reliable valuation measures to top decile levels.

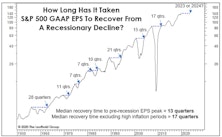

Mapping Out The Eventual Earnings Recovery

We view the coronavirus pandemic as the final straw that tipped an already vulnerable U.S. economy into recession, rather than the watershed event that will change the way we view growth, profitability, and even the nature of work itself. But even economic “optimists” like us need to recognize that the recovery back to last cycle’s earnings peak will be a long and grinding one. There’s a good chance that the four-quarter trailing S&P 500 GAAP Earnings Per Share cycle peak of $139.47 will not be exceeded until 2023 or 2024 (Chart 1).

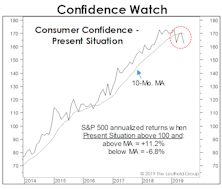

Back Breaker?

With the wavering state of consumer and business confidence, even a modest stock market correction of 8-10% might deliver the fatal blow to confidence—and therefore to the U.S. economic expansion.

Cross-Asset Cross Currents—All About The Recession Call

September was an emotionally exhausting month for investors as reversals in major themes produced wide-ranging repercussions. Movements in various markets have been increasingly tied to bonds—the market that is most sensitive to recession outlook.

Recession Evidence: How Much Is Enough?

Over a 12-month horizon, we now believe a U.S. recession is very likely, but aren’t confident enough to make the call when the forecast window is cut in half. Second-half stock returns could be decent if the business-cycle peak is still a year away. Then again, there’s peril in waiting for “too much” confirmation of recession.

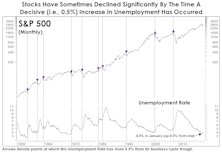

Unemployment And The Point Of No Return

We’ve done extensive work on the yield curve, but until now had entirely overlooked an employment-based recession indicator that’s lately come into focus.

The Rate Hike Carnage Is All Around Us

Taking a cue from the White House, today’s market pundits seem more prone to declarative, unsubstantiated statements than we can ever remember.

Recessions & The Stock Market

In the last couple of months, we’ve come across a handful of economic “check lists” purporting to show the relative absence of recession harbingers as the expansion closes in on its ninth anniversary this summer.

Stocks And The Economy

The stock market is often maligned as a poor economic forecaster, and it’s true the market has predicted several more recessions than have actually occurred.

Boom/Bust Doesn't Point to Recession

The Boom/Bust Indicator, combines a market-based measure (commodity prices) with a weekly government report on the employment situation

Recession Watch

While we don’t see a U.S. recession on a one-year horizon, there are a handful of indicators that may force us to revisit that view—including the two relatively obscure data series shown below.

Recession? Too Early To Call

Among the various arguments put forward by those believing the recent decline is no more than a correction, the most difficult for us to address is the common claim that “there’s no recession on the horizon.”

Recession Or No Recession? That ISN’T The Question

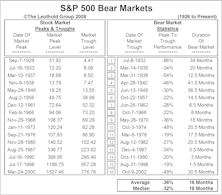

Doug Ramsey provides an analysis of non-recession related bear markets. Historically, non-recession related markets are shorter in duration than recession induced bear markets, but the decline is essentially the same magnitude.

Be A Buyer In An October Scare

Following a strong September, October may be a little weaker. However, readers should use any October scare to buy equities in anticipation of strong end to 2009.

Lehman Remembered

Market vacuum occurred during the 4 weeks following the collapse of Lehman Brothers, when the S&P 500 dove from 1250 to 900. This occurred during the recession, but it has been the Retailers that are among the few groups that have closed that gap.

November Market Action

Drama, if not direction, have become one of the stock market’s few certainties.

The Beginning Of The End.....Yes, We’re Talking About The Bear Market

September was a horrible month for the stock market, but now is not the time to be selling stocks. We believe a market bottom is close at hand, and this month’s “Inside The Stock Market” section presents several of our “big picture”, historical market studies to provide support for this belief.

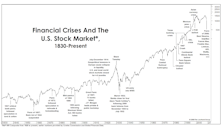

Financial Crises: A Historical Perspective

Doug Ramsey examines the history of bank failures and prior liquidity crises (back to 1830) to demonstrate that this current financial meltdown is not unprecedented. The names have changed, but the economic and emotional responses have been loosely patterned over the entire time frame.

Portraits Of Declining Inflation

Jim Floyd and Steve Leuthold believe that U.S. consumer price inflation has peaked and is headed for the +3% level by mid-2009. With current headline inflation running at +5.4%, that implies there is plenty of disinflation in the pipeline.

Economic Watch

Even though government statistics do not yet indicate a declining quarter of real GDP growth, we believe we are, in fact, in the grip of a recession.

Bear Market Bottom This Summer?

What follows is my attempt to accentuate the positive; why the current bear market may be maturing and bottoming out sooner than you might think.

Jobs/Consumer Data Flashing Recessionary Signals

Optimists have continuously cited low unemployment and the ever resilient U.S. consumer as two “pillars of strength” that will help keep the economy afloat. It has become considerably more difficult to make this case in recent months, as jobs and spending data have weakened to levels associated with recessions.

The Economy And The Stock Market

The stock market tends to peak out 6-12 months prior to recession but turns back up prior to the end of a recession.

Do You Believe In "Decoupling"

A popular buzz word in recent months is “decoupling”, often used in building a case for investing in fast growing foreign stock markets even though the U.S. economy is entering a phase of minimal economic growth or recession.

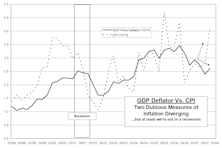

U.S. Economy Skirts Recession In Q4, Or Does It?

It now appears that the downward bias in inflationary pressures suggested by the CPI data is tame compared to the GDP Deflator. And if this is true, investors may be operating under a false sense of security that economic growth remains positive (albeit ever so slight).

View From The North Country

Steve's commentary on the stock market's Wall of Worry, the oil patch and mining company squeeze, the abusurdity of corn to ethanol and the world's most valuable companies.

.png?fit=fillmax&w=222&bg=FFFFFF)