Election

U.S. Election Study Update

Our assessment shows that “who” wins the White House does not seem to matter that much to most major asset classes. Nevertheless, we believe a strong dose of caution against political and/or geopolitical risk is prudent.

Three Themes To Watch: Recession, Inflation, The Election

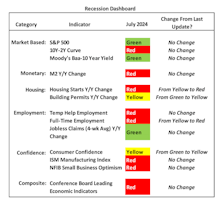

Is the market overreacting to recent economic data? Concerns about a growth slowdown are replacing the optimistic outlook of early 2024. Our Recession Dashboard shows increased risks, with notable declines in housing, employment, and consumer confidence. Despite this, equity and credit markets remain resilient. As we navigate these uncertain times, discover how upcoming elections and potential economic policies could shape the future.

How It Bodes For Biden

Early evidence suggests the Biden administration and the newly “purple” Senate will resist the pull of the far-left, at least from an economic perspective. Stock investors are cheering... though in light of their current euphoria, they might as well have celebrated a write-in victory for Ralph Nader alongside Green Party control of the Senate.

Inaugurations And The Stock Market

Presidents and the popular press have become obsessed with performance over the “first 100 days” in office. That prompted us to see if there have been any persistent stock market effects related to this 100-day window. There are many ways to slice the data, and the more we sliced it, the fewer the observations.

Don’t Overplay The Election

The lack of a “Blue Wave” doesn’t undermine our belief that a big stock market rotation is underway. The valuation gap between Large Cap Growth and other U.S. (and foreign) market segments is so large that it’s become unsustainable.

Markets & Election—Any Clear Result Will Do

We believe the worst outcome would be a drawn-out, contested presidential election that ends up in the Supreme Court. We review historical market patterns under several election-result scenarios.

Reflation And Election Year Patterns—Not Much To Lean On

· One bright spot in last month’s lackluster market action was that inflation sensitive assets saw impressive relative returns.

Do Health Care Stocks & Elections Mix?

A look at Health Care groups’ historical performance both pre-election and post-election; we identify past trends of leaders and laggards in each period.

Markets & Election—All Risk And No Reward

The upcoming election is likely to have wide-ranging impacts on both monetary and fiscal policies and we expect election risk to overshadow the Fed policy risk for the time being.

Questions Clients Are Asking

Since the Milwaukee poll taken in early October, it appears that optimism has continued to build. This opinion is supported by the kinds of questions we are now fielding from clients.

Bond Market Summary

For the month, the net loss for long T-bonds amounted to a half a point or less. All things considered, I thought it was an impressive performance, even though it took place in the dog days of August.