China

China’s “Whatever It Takes” Moment—“Believe Me, It Will Be Enough”

Market reaction to the latest flood of monetary and fiscal stimuli has been spectacular. While conviction about Beijing’s attempts to revive its flagging economy has been severely lacking, this time we should believe it. It’s certainly the right medicine China needs and the spark of confidence these actions will ignite should not be underestimated.

Three Themes To Watch—An Update

The Value/Growth dynamic seemed to indicate a return to the “lower rates are good for Growth stocks” regime. China reopening is still alive and well, despite a recent pause. The GSCI Industrial Metals/Gold ratio has broken below its recent range, which bodes ill for inflation expectations going forward.

Three Themes To Watch

The China-reopening theme is alive and well, which will likely support cyclical outperformance. The disinflation trade is at a crossroads. Value/Growth started to decouple from interest rates.

China—See The Policy Forest Through The Tree (Diagram)

There has been a torrent of new policies coming out of China recently. The goal of this report is to disentangle these seemingly random or even nonsensical policy moves and present a clearer roadmap of what China is thinking and doing.

Emerging Markets EPS: There's Many A Slip...

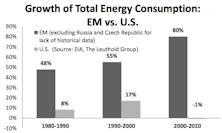

If there is one thing sure to make equity investors swoon, it is the prospect of buying into a credible, long-lived secular growth story at a relatively modest valuation. Over the past three decades, Emerging Markets (EM) have proffered just such an opportunity. EM’s economic growth rates have far surpassed those of developed nations, and the valuations attached to EM stocks have often been at a discount to other markets.

However, this combination of secular growth and attractive valuations has not always paid off for investors. The MSCI Index has underperformed the U.S., Europe, and even Japan over the last ten years in local currencies. Furthermore, EPS growth for the EM Index has come in far below its economic growth rate, creating an exasperating drag on Index performance as it tries to keep up with other regions.

That Money Tsunami Is Now Just A Flood

Compare the U.S. monetary response in early 2020 to China’s: The Fed quadrupled the M2 growth rate (from 6% to 24%) in three months, while China merely bumped M2 growth from 8% to 11%. This relative policy restraint leaves China in a better position to handle potential fallout than if it had gone “all in” like the U.S.

Research Preview: Emerging Markets’ Leaky Bucket

Investors view Emerging Markets (EM) as the best source of economic growth across global equity markets, and rightly so. Annualized EM GDP growth of 8.6% since 2001 is more than double that of the U.S. and Europe. However, investors have not captured this extraordinary advance because earnings per share for the MSCI EM Index have lagged far behind EM economic growth rates.

Coronavirus—An Accelerator, Not A Catalyst

Chinese and Hong Kong markets are currently following the same script as seen during the SARS outbreak, but we caution against using S&P 500 performance as a guide for what is likely to happen this time around.

恭喜发财- Red Envelopes From The Fed & PBoC

A significant policy move by China’s People’s Bank of China (PBoC) has gone largely unnoticed.

MSCI EM Reclassification: Achiever & Aspirers

EM segments on the “Aspirer” watch list for MSCI annual market reclassification: China A-shares and Argentina. The “Achiever,” Pakistan, just recently started trading as a new member of MSCI EM Index.

“Index Rebalance Effect” Once Again Proven

Validating results of a prior study, a look at the last four MSCI index rebalances shows that stocks soon to be added outperform from Announce Date to Effective Date, while deleted stocks underperform.

Update: U.S.-Listed Chinese Companies Going Private

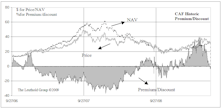

An update on a topic we’ve covered twice before—the wave of U.S.-listed Chinese companies that were mulling over going private. Because of relatively large discounts to offer prices, the taking-private targets represent a unique lower-risk investment opportunity.

MSCI To Include Foreign-Listed Chinese Stocks For First Time

MSCI will soon announce the results of its semi-annual index rebalance and, for the first time, overseas-listed Chinese companies will be included in the MSCI Emerging Market and China Country Indexes.

Chinese Economic Concerns Are Overdone

The traditional economic indicators are no longer as relevant as people think, and China’s condition may not be as bad as most fear.

Emerging Markets: A Half-Off Sale!

The Chinese government’s repeated stock market intervention attempts over the past several weeks have been remarkable, and obviously antithetical to the country’s move toward a more laissez faire corporate environment.

Chinese Equity Market: Valuation Gap And Going Private

The recent capitulation of the Chinese domestic equity market (or A-shares) makes headlines almost every day. Different theories, circulating in both China and overseas, pop up frequently to explain the daily movement of A-shares. It seems the investment community gets excited when the Chinese market is on the decline (but not so much when the market is on the upswing); many investors are quite reactive to any negative news coming out of China.

China A-Shares: Market Getting Too Hot?

Our long term view towards China is positive (especially relative to other large EM countries), but short term, we see signs of the A-shares segment overheating and caution against near term corrections.

Declining Crude Prices Good For Emerging Markets?

The price of crude oil staged a dramatic change of fate in the past few months, and the bottom is still nowhere in sight.

Chinese Stocks: Accounting Red Flag Screen

We examine several models or screens to detect accounting or governance risks.

Can The EM Problem Spread To DM? Yes, If It Gets Bad Enough

The current EM weakness is not yet a full-blown crisis but, if it does become one, it will drag down developed economies too.

Emerging Markets: Dismal 2013, Hopeful 2014

What worked, what didn’t; what you need to consider for investing in Emerging Markets this year.

Implications Of Increased Access To Chinese A-Shares

There are signs the domestic Chinese market may be more accessible to global investors sooner than most think. We explore the implications of these potential changes.

Supply/Demand Dynamics Drive Three Emerging Market Energy Themes

We find hidden opportunities in Equipment & Services Providers, Coal and Natural Gas. We consider these themes longer term holdings instead of short-term plays

A Comprehensive Look At The Emerging Markets: Diagnosis And Prognosis

We examine Emerging Markets from both the top-down and bottom-up perspectives as we try to identify where to move and what to expect. We check in on two successful EM thematic group ideas as well.

A New Leg In The Commodity Decline?

For more than two years we’ve discussed the supply-side risks to commodity producers stemming from capacity built during the manic “Third Act” of last decade’s Three Act Play in commodities. Commodity-oriented equities have indeed underperformed since 2011, but to date, most pundits have laid blame squarely on the demand side.

Commodities: Still Worried About Supply

Commodity producers seem to believe that last decade’s commodity boom is set to repeat. This belief itself probably ensures that it won’t.

Time To Bet On China?

Is it time to reverse the “long U.S. consumer/short China” trade?

China’s 12th ‘Five-Year Plan’ and the Healthy Tigers Index

Leuthold’s Jun Zhu provides an update on China’s latest Five-Year Plan and how it may affect the Pharmaceutical industry in China.

China Investing: Segment Valuation May Converge

Interesting development coming out of China recently that is getting little attention. The Chinese government is planning to allow ETFs with Hong Kong listed companies as underlying securities to be traded on the Shanghai and Shenzhen Exchanges.

Variable Interest Entity Structure In Chinese Companies

Jun Zhu examines Chinese companies with Variable Interest Entity (VIE) structures. Investors shouldn’t be completely turned off by concerns over these structures, but it would be wise to heed the risks.

It’s Been Better Than It’s “Felt”

The latest bull market has now essentially matched the returns for all bull market recoveries dating back to 1900. Remarkably, it has accomplished this in only half the normal time frame.

Everyone Should Be A Supply Sider!

Analysts typically focus on demand for products and rarely look at the supply side. Consumer Discretionary companies were rewarded for their pessimistic positioning with better pricing and higher margins.

Thoughts On China Investing: Domestic Consumption Versus Infrastructure Play

Jun Zhu makes a compelling case for focusing China equity exposure on consumer stocks. Increases in bank “Required Reserves” mandated by China government will have greater impact on Infrastructure stocks, while consumerism is still being supported and encouraged.

Rising Bank Lending In China: Good or Bad?

While U.S. banks are still seeing loan levels declining, China has seen a 24% increase in bank loans since the end of 2008. Assuming these loans are actually employed to build infrastructure, it would seem the recovery may be getting underway.

China Equity Market: Investment Vehicles For U.S. Investors

Looking at alternative ways to play China. See this month’s list of H-shares trading in U.S. markets.

Bulls In The China Shop… How and Why We Are Increasing Exposure To Asia

In mid May, 4% of assets were shifted from U.S. stocks to Emerging Market holdings, buying a package of individual Asian stocks. This same package is being used to boost exposure to 70% in early June.

China Equity Market: An Accelerating Supply of A Shares

A look at the perils with Chinese A Shares. Concern has been raised about China A Shares because they are seeing significant increases in their share float, due to government releasing restricted shares to the public.

Do You Have Appropriate China Exposure?

A brief description of the differences among these Chinese market segments and comparisons of major funds offering exposure to the Chinese stock market.

Do You Believe In "Decoupling"

A popular buzz word in recent months is “decoupling”, often used in building a case for investing in fast growing foreign stock markets even though the U.S. economy is entering a phase of minimal economic growth or recession.

View From The North Country

Steve's commentary on the stock market's Wall of Worry, the oil patch and mining company squeeze, the abusurdity of corn to ethanol and the world's most valuable companies.