Earnings Surprise

Excellent Back 9 For Q2 Reporting

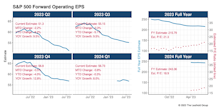

An outstanding second half for Q2-23 earnings pushed the S&P 500 bottom-up EPS estimate from $51.30 to $54.92. Amazon and Nvidia were the two largest contributors to the August surge. With the entire index nearly done reporting, our current EPS estimate will end 11% below its high watermark ($61.56).

Q2—The EPS Slide Resumes

Q2-23 reporting is about halfway complete for firms in the S&P 500. Bottom-up operating EPS estimates for Q2 are once again sliding lower as we wade farther into earnings season. This attrition is not uncommon but it is certainly a break from Q1 announcements, where EPS estimates rose 5% over the course of reporting. Q1’s action was a bullish talking point for many who touted the end of higher-than-normal erosion in forward EPS estimates over the past year. Since peaking in April 2022 at $61.56, Q2’s EPS estimate has shrunk nearly 17% (Chart 1).

“Surprise” Or “No Surprise?”

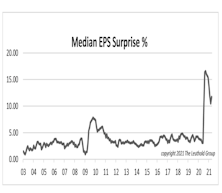

Navigating the investment landscape over the past year has been a journey full of surprises. No data other than “earnings surprises” can better demonstrate how unpredictable companies’ financial performance has become.