Fed Valuation Model

Sep

08

2023

A Flawed Model Proves Our Point

In early September, rising bond yields and a falling Forward Earnings Yield caused the Fed Model to rank the S&P 500 at its least-attractive level relative to Treasury bonds since mid-2002. We think this illustrates—better than any other measure—why market pundits have finally jilted their mistress of a dozen years: TINA.

Mar

07

2023

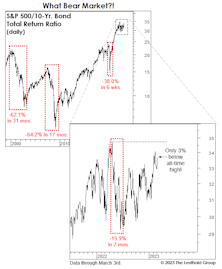

Meanwhile, In “Relative World”...

A large swath of the institutional asset-allocation world is engaged in the sometimes dangerous, binary game of “stocks versus bonds.” Although the 2022 bond debacle caused relatively mild damage to a massively overweight equity position, the bear markets of 2000-2002 and 2007-2009 produced losses for stocks versus bonds that exceeded 60%.