Global

Ruminations On The Correction

If our market disciplines turn bullish in the weeks ahead, we’ll certainly follow that lead—covering remaining shorts, re-establishing a semi-aggressive market position, and wiping egg off our faces for having called a “cyclical bear market” that slammed the Russell 2000 (-26%), EAFE (-26%), and Emerging Markets (-37%)… but somehow not the one most followed, the S&P 500 (-14%).

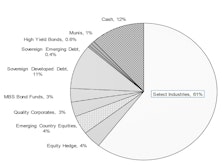

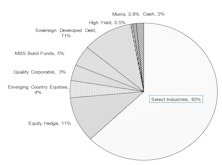

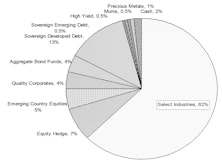

Core & Global Asset Allocation Portfolios

Major Trend Index strengthened in April; net equity exposure increased to 61%

A Quick Check On Global Fundamentals

The Street’s most clever invention is “12-month forward operating earnings” because the stock market invariably appears cheap on the basis of such inflated estimates.

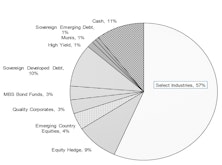

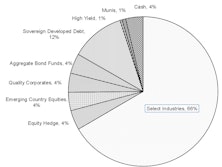

Core & Global Asset Allocation Portfolios

Major Trend Index Neutral: Equity Exposure Remains 52-53%

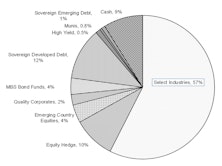

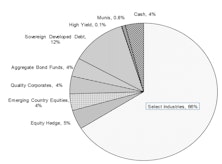

Core & Global Asset Allocation Portfolios

We increased equity exposure back above 50% in mid-November as a result of the MTI returning to Neutral.

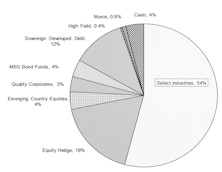

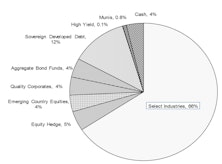

Core & Global Asset Allocation Portfolios

Major Trend Index turned negative and as of early October, we are now targeting 40% net equity exposure.

Core & Global Asset Allocation Portfolios Competitive With Benchmarks Despite Maintaining Reduced Equity Exposure

Net equity target is 55%; waiting for clearer signal from our Major Trend Index (currently rated Neutral).

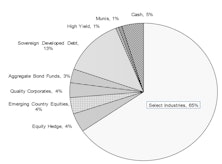

Core & Global Asset Allocation Portfolios’ Net Equity Exposure Unchanged At 65-66%

Both Portfolios lagged all-equity benchmarks in June; but still ahead YTD.

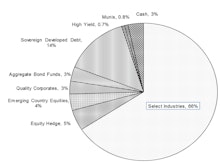

Core & Global Asset Allocation Portfolios’ Net Equity Exposure Unchanged At 65%

Both Portfolios matched their all-equity benchmarks in May, and are outperforming YTD.

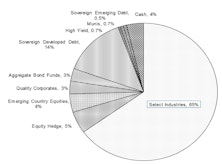

Core & Global Portfolios Net Equity Exposure Unchanged At 64-65%

Both Portfolios ahead of their all-equity benchmarks YTD.

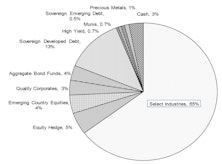

Core & Global Portfolios Equity Exposure Unchanged In April

The Major Trend Index remains positive, and our portfolios continue outpacing the market. Net exposure is 65% in both the Core and Global portfolios.

Core & Global Portfolios Equity Exposure Increased Slightly In February

The Major Trend Index remains positive, and net exposure is 65% in the Core and 64% in Global.

Core & Global Portfolios Equity Exposure Maintained In January

The Major Trend Index remains positive and net exposure is 63% in the Core and 62% in Global.

Core & Global Portfolios Equity Exposure Maintained In December

The Major Trend Index remains positive and net exposure in both portfolios is 64%. For all of 2013, our average net equity exposure was 60% in each portfolio.

Core & Global Portfolios Equity Exposure Raised Slightly As Hedge Reduced

The Major Trend Index remains positive and, as expected, our temporary ETF hedge was lifted. Our net exposure in both portfolios is now 64%-65%.

Core & Global Portfolios Equity Exposure Trimmed Slightly To 60%

The Major Trend Index remains positive, but we reduced our target exposure from 62% to 60% using a short ETF as we believe this position will be temporary in nature.

Industry Groups: No Need To Bottom-Fish

Buying global groups with strong price momentum has been a winning strategy. Will it continue?

Global Yield Curve Confirms “Muddle Through” View

The global yield curve is in a sideways range bound pattern, indicating anemic demand for credit. An examination of developed and emerging countries confirms our “muddle through” view.

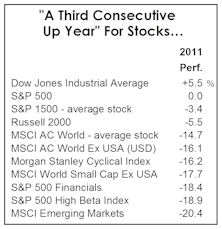

“Another” Year Of Gains?

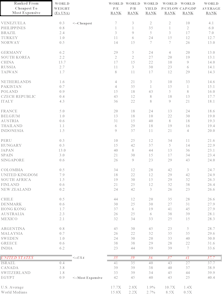

U.S. equity investors were disappointed in 2011, but we’d point out they fared better than investors in 45 of 48 other countries tracked by MSCI.

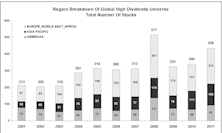

Global Dividend Screen

Methodology for the new screen and the Dividend Sustainability Rank are discussed in detail. Dividend strategies continue to gain popularity, as equity investors grapple for yield.

Going (More) Global

MSCI Index very undervalued, as the recovery off the March 2009 lows has left valuations still near prior bear market lows. Relative to foreign markets, the U.S. looks expensive. This is why we continue to maintain a healthy exposure to foreign stocks…especially emerging markets.

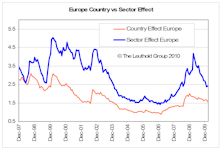

The Sector Effect vs. The Country Effect: A Region by Region Look

We examine the relative importance of country effect vs. sector effect within four regions: Europe, Eastern Europe/Middle East/Africa, Asia Pacific ex-Japan ex-China, and Americas ex-U.S.

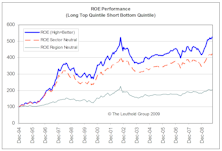

Decomposing ROE: A Global Perspective

Return On Equity (ROE) has been performing well as a quality factor on a global basis over the last six to twelve months.

Do You Believe In "Decoupling"

A popular buzz word in recent months is “decoupling”, often used in building a case for investing in fast growing foreign stock markets even though the U.S. economy is entering a phase of minimal economic growth or recession.

View From The North Country

Half time update. Leuthold looks back at December 2005 predictions. Additional comments on Inflation, Corporate Earnings, The Dollar, Oil Prices, Gold, and Federal Budget Deficit.

U.S. Market Remains Relatively Overvalued Compared To Rest Of World

U.S. market ranks as fifth most expensive market based on comparisons to 44 countries from around the world.

Offshoring The Next Bubble?

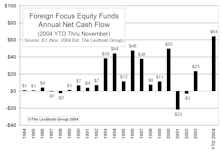

Main Street’s rush into international stock funds could be foreshadowing tougher times ahead for foreign markets.

Global Mania (U.S. Induced)

Savvy U.S. professional investors have been buying foreign stocks for a number of years now. Somewhat more recently, pension funds have been focusing on foreign diversification. Now, in 1993 mutual fund investors have become increasingly enamored with foreign stocks.

View from the North Country

Welcome Scott Archer.... More Bank Troubles and Write-Offs.... U.S. Banks Played Key Role in Oil Bath, Real Estate Debacle, Third World Loans and Busted LBO’s.... America As The “Center” Of the World Economic Universe.... Australia/New Zealand Update