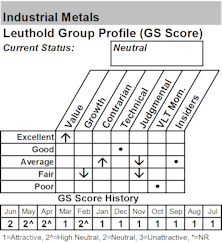

Industrial Metals

GS Scores: Industrial Metals Stocks Heating Up

While the Materials sector overall still isn’t looking stellar based on our work, we think with the Metals theme heating up, it’s a trend worth watching.

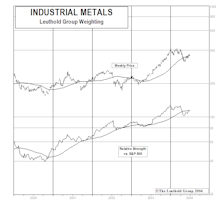

Industrial Metals Fall To "Neutral" After Six Year Run

Deactivating Industrial Metals after holding period of almost six years and a 400%+ gain.

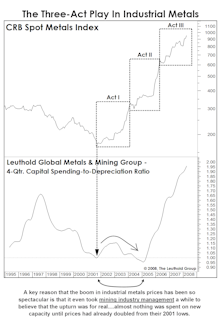

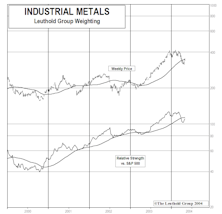

Industrial Metals: Now Over-Mined?

Waiting for the curtain to fall on Industrial Metals, we recap the “three acts” and throw in a time-tested contrarian indicator to boot.

View From The North Country

Steve presents his mid year outlook for “Alternative Investments”

View From The North Country

Even though it is entering its sixth year, the Industrial Metals play is not over. It seems to be entering its third and last act, an act that could run for at least another 18 months.

View From The North Country

Election should be a non-event for stock market. No matter which party gains control of House or Senate, we expect to see two more years of gridlock. Also, still bullish on Industrial Metals and the unusual behavior of U.S. Equity Fund Flows.

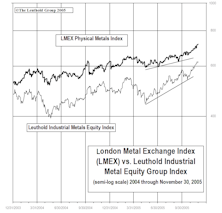

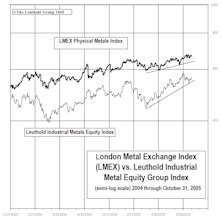

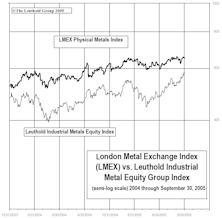

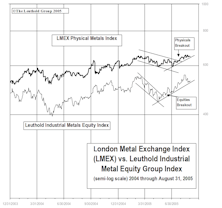

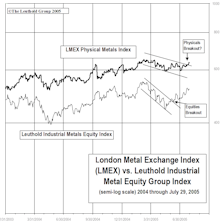

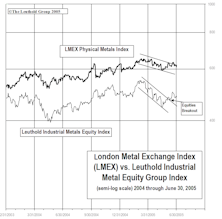

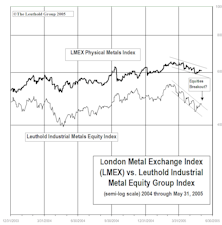

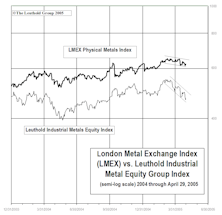

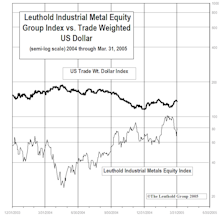

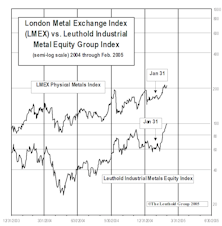

Price Divergence Between Metals Equities & Physical Metals – A Buying Opportunity?

Investors have soured on Industrial Metals equities, likely based on the belief that the prices of the underlying physical metals have stopped going up.

View From The North Country

This month Steve again lays out both the Bull and Bear cases.

View From The North Country

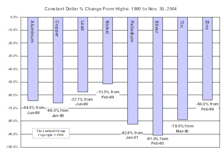

Metals stocks have already had a good strong run, and have been held in our portfolio for four years now. Despite the strong gains there is still significant upside when looking at inflation adjusted prices, and the strong demand/limited supply.

Did You Have The Right Mix In 2005?

2005 Performance Recap: Equities, Fixed Income, Large Vs. Small Caps, Weighted Vs. Unweighted S&P 500, Industrial Metals and AdvantHedge.

A Look In The Rearview Mirror...The Best And Worst Of Our Research In 2005

A look at the things we did well in the past year, the areas where we could improve, and those things that were downright wrong.

Industrial Metals Stocks…..Roar Back In November, Remain A Top-Rated Group

Industrial Metal equities far outpaced both the S&P 500 (up 3.5%) and our Leuthold Materials Sector Index (up 7.0%).

Industrial Metals Stocks: Metals Equities Give Back Some Performance, Still A Top-Rated Group

The weakness in metal equities this month was, in our opinion, mainly driven by a healthy dose of profit taking.

Industrial Metals Stocks: Metals Equities Surge Higher In September, Now Top-Rated Group

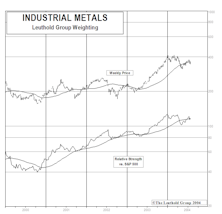

The Industrial Metals equity group was up a whopping 11.7% in September versus a 0.7% gain for the S&P 500 and a 4.0% gain for the Leuthold Materials Sector.

Industrial Metals Stocks: Metals Equities Continued To Outperform In August

The YTD performance of the Industrial Metals equity group is particularly impressive when you consider that the group was down 13.7% through mid-May.

Is Oil Overvalued Relative To Industrial Metals?

In comparison to crude oil, industrial metals are beginning to look like a real bargain.

Industrial Metals Stocks: Big Rally In Metal Equities

Metal equities broke out above their trendline near the end of May, and have continued to rally since.

Industrial Metals Stocks: Metal Equities Bounce In June, But Group Falls To ‘High Neutral’

We may be nearing a crossroads with our long-term holding in the Industrial Metals equities group.

Industrial Metals Stocks: May’s Rally Fails To Lift Metal Equities

The Industrial Metals equities group has been very disappointing over the past three months, especially given May’s rally in the broad equity market.

Industrial Metals Stocks: Metals Equities Continue To Suffer In April

The Industrial Metals equity group continued to sell off in April, dropping 10.5% on the heels of –6.1% return in March.

Industrial Metals Stocks: Metals Equities Give Back Some of February’s Big Gains

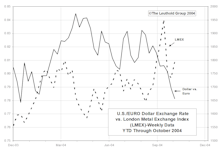

Profit taking certainly played a large part in the past month’s sell-off. Another key factor was that rising U.S. interest rates in March prompted a rebound in the U.S. dollar against major currencies.

Industrial Metals Stocks: Up Huge in February

We had speculated last month that both metal equities and physical metals were primed for a bounce, but we must admit we were surprised by the size of the bounce, particularly in the metal equities.

View From The North Country

Steve Leuthold’s commentary on how he would structure a defensive portfolio.

Metals Stocks Fall Again In January: A Buying Opportunity?

If this is indeed just another technical sell-off, now could be a great time to add to both metals shares and physical metals exposure.

Industrial Metals Stocks: Metals Stocks Slump In December, After Big November

Given the mostly positive performance in physical metals, profit taking was the likely culprit in pushing metal shares lower in December.

Industrial Metals Stocks: November Rewards The Patient And The Perceptive

Metals stocks quickly made back October’s losses, and more, during the November rally.

Industrial Metals Stocks: October Brings A Wild Ride For Metals Investors

Physical metals experienced a deep sell-off on Wednesday Oct. 13th. It was one of the largest single day drops ever in the base metals markets, prompting London metals traders to dub the day “Black Wednesday.”

View From The North Country

After all the outrage over Enron and other accounting scandals, Congress is now working to over rule the FASB recommendations and guidelines regarding the accounting for options. They have clearly caved to the Tech lobby and their campaign contributions.

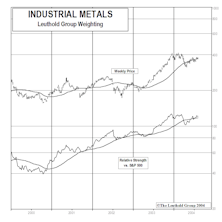

Industrial Metal Stocks: Share Prices Surge On Underlying Commodity Strength

Metals were a great place to be in the month of September, especially the latter part of the month.

Industrial Metal Stocks: The Rally Continues

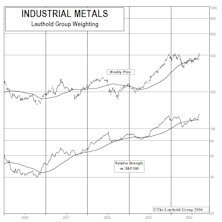

The strong relative performance in Industrial Metals shares over the past four months provides evidence that investors are beginning to buy into the sustainability of the current uptrend in metals prices.

View From The North Country

Terrorist threats, rising oil prices, the war in Iraq, and upcoming presidential election seem to have taken center stage against a backdrop of impressive corporate earnings momentum.

Industrial Metal Stocks: Down, But Definitely Not Out

The strong relative performance in Industrial Metals shares over the past three months leads us to believe that investors are beginning to buy into the sustainability of the current uptrend in metals prices.

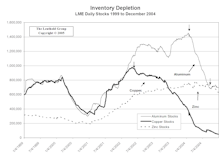

Industrial Metal Stocks: Rally Continues As Investors Revisit Bleak Supply Picture

The Industrial Metals group, our second largest Select Industries portfolio group holding, continued to rally in June.

Industrial Metal Stocks: Rally Continues With Bounce Off April’s Oversold Conditions

Industrial Metals group had nice rally after big decline in April. Early May increase in this portfolio group holding was very timely.

View From The North Country

There is a clear lack of attractive options in fixed income and we are increasingly skeptical about the REIT markets, as premiums and new offerings are at or near peak levels. Industrial Metals still offer outstanding opportunity.

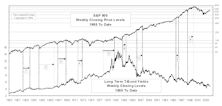

View From The North Country

Even with a clearly improving economy, the deficit estimate for fiscal 2004 as been revised upward to $480 billion. Also, the investment survival value of opinion versus discipline and investing in actual physical industrial metals.