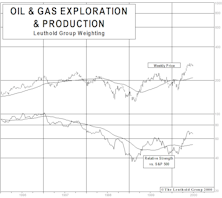

Oil & Gas Exploration & Production

Energy Makes Its Move

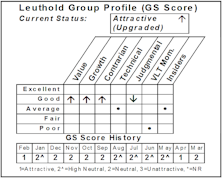

After years of languishing in the rock bottom of Group Selection Scores and sector rankings, Energy exploded higher this month, jumping from 10th lowest (out of eleven broad sectors) to 3rd highest in our composite rankings.

Oil & Gas Groups Lead This Week

Oil & Gas Exploration & Prod. and Oil & Gas Drilling are this week's best groups. Internet Software & Services and Drug Retail are this week's worst groups.

Diversified Metals & Mining Shine This Week

Oil & Gas Exploration & Production and Diversified Metals & Mining are this week's best groups. Movies & Entertain & Broadcast and Home Entertainment Software are this week's worst groups.

Humble Oil

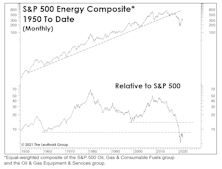

With Energy stocks underperforming the S&P 500 by 20% YTD, contrarian clients are wondering if the sector holds any promise. Here we look for valuation signals that offer encouragement for bargain-hunting investors willing to buy on weakness.

Oil & Gas Drilling Hits A Dry Hole

Application Software and Home Entertainment Software were this week's best groups. Oil & Gas Exploration & Production and Oil & Gas Drilling were this week's worst groups.

Casinos & Gaming Lead This Week

Tech Hw Stor & Periph and Casinos & Gaming were this week's best groups. Oil & Gas Exploration & Production and Oil & Gas Drilling were this week's worst groups.

Oil & Gas Exploration & Production Leads This Week

Oil & Gas Exploraiton & Production and Department Stores were this week's best groups. Homefurnishing Retail and Leisure Products were this week's worst groups.

Oil & Gas Flare This Week

Oil & Gas Exploration & Production and Oil & Gas Drilling were this week's best groups. Biotechnology and Precious Metals were this week's worst groups.

Coal & Consumable Fuels Choke Out The Competition

Oil & Gas Exploration & Production and Coal & Consumable Fuels were this week's best groups. Internet Retail and Airlines were this week's worst groups.

Diversified Metals & Mining Lead This Week

Oil & Gas Exploration & Production and Diversified Metals & Mining were this week's best groups. Packaged Food & Meats and Department Stores were this week's worst groups.

Oil & Gas Take The Lead Again

Oil & Gas Exploration & Production and Coal & Consumable Fuels are this week's best groups. Pharmaceuticals and Health Care Distributors are this week's worst groups.

Coal & Consumable Fuels Smoke The Other Groups

Oil & Gas Exploration & Production and Coal & Consumable Fuels were this week's best groups. Managed Health Care and Biotech...Small/Micro were this week's worst groups.

Oil & Coal Burn Into The Lead

After spending two weeks as the worst group, Oil & Gas Exploration & Production moves to one of the best groups this week, along with Coal & Consumable Fuels. Movies & Entertainment and Office Services & Supplies were this week's worst groups.

Oil & Gas Rise To The Top

Oil & Gas Exploration & Production and Oil & Gas Drilling were this week's best groups and Tobacco and Precious Metals were this week's worst groups.

Oil & Gas Groups Lead This Week

Oil & Gas Exploration & Production and Oil & Gas Drilling were this week's best groups and Managed Health Care and General Merchandise Stores were this week's worst groups.

Industry Groups To Avoid

Currently, the Unattractive range of our GS Scores is characterized by two themes, commodity-oriented groups and high dividend groups.

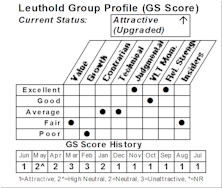

New Select Industries Group Holding: Oil & Gas Exploration

Upgraded to Attractive this month after three consecutive months of rising Group Selection scores.

New Select Industries Group Holding: Searching For Gains In New Oil & Gas Exploration Holding

Mid-East turmoil and Attractive rating for last five months.

New Select Industries Group Holding: Oil & Gas Exploration & Production

The oil play ain’t over yet. Look for this group to move as exploration heats up in second half of year.

New Select Industries Group Holding: Buying Natural Gas

Activating “Natural Gas Play” thematic group, which was upgraded to attractive this month. Charley Maxwell says it’s not too late.

Oil Patch Cutback Begins

Our diversified index of oil related stocks is now up 110% from its lows of last summer, although still 22% below its 1980 peak. However, the relative strength line is now approaching its 1980 to date downtrend line.