Overbought

Another Thrust, Right On Schedule

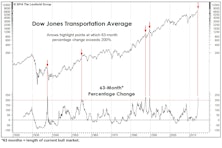

Among the latest bullish cues, we’d put the most weight on the MBI breadth-thrust signal because it’s the only one among a variety of measures we track that hasn’t falsely triggered during a bear market. Perhaps its first misfire is imminent.

Is This Year’s Strong Start “Signal Or Noise?”

This year is off to a much stronger start than suggested by the 3-4% gains in the blue-chip averages: Through January 12th, the Value Line Arithmetic Composite—an equally-weighted index of about 1,700 stocks, was up 7.0%.

When “Overbought” Is Bullish

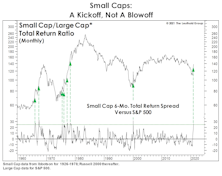

The recent months’ surge in Small Caps has been historic, and the Russell 2000 continues to register ridiculously “overbought” readings on many technical oscillators. In the short-term, that might be a cause for caution on the overall market. However (and perhaps counter-intuitively), this extreme strength cements our view that a long-term leadership cycle in Small Caps is underway.

“Not Quite” Super

The average “super-overbought” MBI reading occurred 54 days after a market low; June 4th marks the 51st trading day since the March 23rd low. Thus, any signal in the days ahead would arrive essentially “on time,” but the slippage (the S&P 500 gain already realized) would be enormous at around 40%!

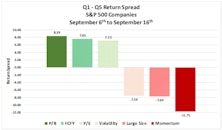

The Case Of The Flipping Factors

Equity market themes have been boringly consistent of late; growth beating value, large beating small, and domestic beating international. In the factor world, Momentum and Low Volatility have been investor favorites for most of 2019 while Value resided in last place – the same old, same old. Then, something remarkable occurred on September 9th.

“Overbought” Can Be Good Or Bad

The notion of “overbought” and “oversold” markets might be the costliest concepts ever developed by stock market technicians. The very words imply some sort of excessive condition that’s prone to naturally self-correct.

Stocks That Are “Over-Owned”

Start to worry when over 60% of a company’s shares are held by institutions. When a heavily owned stock disappoints its holders, watch out. In this section, 42 stocks are listed where 75 or more institutions cumulatively own more than two thirds of the shares outstanding.

.jpg?fit=fillmax&w=222&bg=FFFFFF)