Returns

Active/Passive Whiplash

The active/passive performance derby experienced a severe case of whiplash the last three months. Through the end of the first quarter, market conditions were advantageous for active managers, now the second quarter has revealed a massive shift in favor of passive styles.

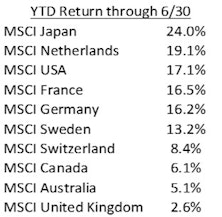

Land Of The Rising Stock

After years of wandering in the wilderness, Japanese stocks are leading the world’s developed markets higher in what has been a robust opening half of the year. The table shows Japan leading the world’s ten largest developed markets (as measured by the MSCI family of international indexes) with a 24% local currency return through June, easily outpacing the pack. Even as the MSCI USA index gained 17% by successfully “fighting the Fed” this year, Japan surged another 7% beyond that outstanding result. We were curious to understand the nature of Japan’s spectacular run in 2023, looking to identify the drivers of this strong and relatively quick jump higher.

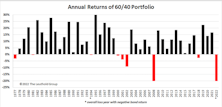

Research Preview: The 60/40 Skeptics Were Right

The 60/40 strategy is having a terrible year, and its failure to protect investors in the bear market prompted us to take a look at the history and theory of the 60/40 guideline. We offer an early preview of the study, with a focus on 2022’s abysmal year-to-date returns.

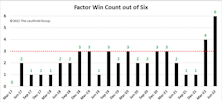

Factor Returns And A Basket Of EGGs

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

Research Preview: Factor Cyclicality

In Q2, all six major style factors outperformed the market. Those results are especially remarkable considering that factor excess returns the past few years have been underwhelming to the point that some investors began to wonder if they still work.

After The SPAC: De-SPAC Performance

The ultimate measure of a SPAC sponsor’s success is stock performance post merger: De-SPAC results. We analyze historical returns of De-SPACs that had initial market caps greater than $200 million.

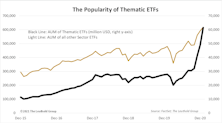

Newfound Popularity Of Thematic ETFs

We’ve noticed a small segment of equity ETFs, designated as “thematic,” that is increasingly gaining popularity. Thematic ETFs invest in baskets of stocks that share narrowly-defined business enterprises outside of the standardized GICS methodology.