Reversion-to-Mean

Reversion, But To Where?

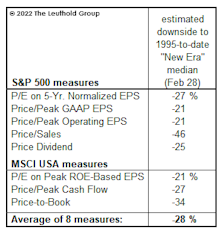

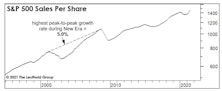

The concept of “mean reversion” used to help build massive fortunes. Of late, a better mantra has been “maximum attraction,” as valuations and bullish psychology have matched or surpassed excesses of the Y2K Tech bubble. Meanwhile, corporate profit margins, once dubbed “the most mean-reverting series in finance” by Jeremy Grantham, have now topped those seen near the Y2K top by more than 50%.

Long-Term Returns: You Wanted The Best, You Got The Best!

In a possible sign we’re not getting enough oxygen at current valuation altitudes, we decided to replace the usual mean-reversion technique with a much friendlier approach that we’ve dubbed “maximum attraction.”

Margins: Reversion Can Be Mean

In Q2, NIPA’s EBIT margin fell to a new four-year low, over one point below the early 2012 cycle peak.

Earnings: What Is Normal?

Corporate profits are notoriously cyclical, and for decades we’ve sought to temper their swings by using a five-year smoothing of S&P 500 EPS in our valuation work.