Risk/Reward

Bridesmaid Strategy Risk And Reward

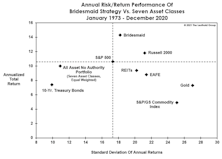

“Risk-adjusted returns” were all the rage after the Great Financial Crisis. Now that such returns are likely to become relevant again, naturally, there’s little scrutiny of them.

Bridesmaid Strategy Risk And Reward

We know that risk measurements have become passé, what with the S&P 500 having annualized at +13.6% in the last decade without a single drop of 20%. But the Bridesmaid strategy looks great relative to the available asset classes on a risk-adjusted basis.

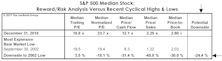

Guess-timating The Downside

While our market disciplines remain negative, we certainly aren’t oblivious to the haircut in equity valuations that’s already occurred.

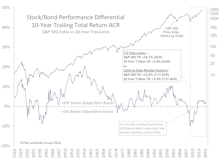

A Stock/Bond Relationship Revisited

Herein we further explore this month’s theme of “point-in-time relationships” and subsequent market returns. We review and update a study we initially conducted and published in June 2009.

Ruminations On The Correction

If our market disciplines turn bullish in the weeks ahead, we’ll certainly follow that lead—covering remaining shorts, re-establishing a semi-aggressive market position, and wiping egg off our faces for having called a “cyclical bear market” that slammed the Russell 2000 (-26%), EAFE (-26%), and Emerging Markets (-37%)… but somehow not the one most followed, the S&P 500 (-14%).