CPI

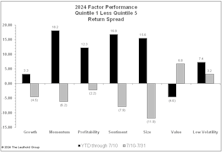

CPI Report Brings Massive Rotation

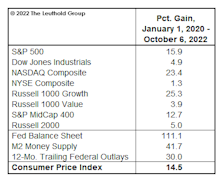

The mild CPI report on July 11th kicked off a violent rotation out of mega-cap stocks, with the Russell 2000/S&P 500 performance differential at +4.5% for the day. Other factors reversed as well, with all major styles posting inverse performance relative to their year-to-date numbers.

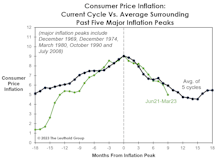

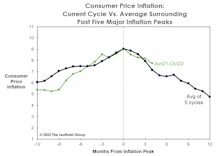

Inflation: Following The Script?

We know that historical analogs and averages can be overdone in market analysis, and our statistical approach (and maybe our longevity) makes us even more susceptible to looking for patterns that might not exist.

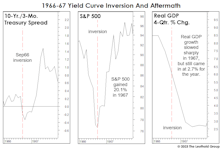

1966-67: When The Yield Curve “Failed”

Given the tendency of economists and strategists to dismiss the message of an inverted yield curve, it’s surprising there’s been no scrutiny of the “dog that didn’t bark”—the inversion of 1966. That’s the last time an inverted curve did not lead to a recession.

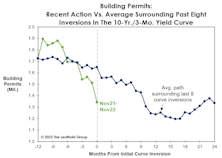

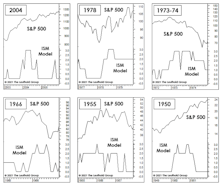

The Yield Curve And The Problem Of Timing

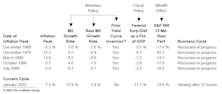

Frequently, there’s money to be made in the stock market in the months following the initial curve inversion. After the inversions of August 2006 and June 2019, the S&P 500 rallied another 23% and 19%, respectively, into its final bull market high. If this cycle plays out in textbook fashion, the business-cycle peak would arrive in September.

Goodbye Inflation, Hello Recession?

Unlike the five prior cycle peaks, this year’s inflation peak materialized during an ongoing economic expansion. That implies the “post-peak” monetary policy has never been tighter than today—making a soft landing even more improbable.

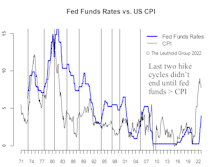

Fed Funds Rate Above The CPI—Inflection Point Likely

Stock market bulls hope for an end to the tightening cycle in the not so distant future. However, the last two rounds didn’t end until the fed funds rate was raised above the prevailing rate of CPI.

Roaring Good Times...

Boy, were the pundits ever right about the Roaring Twenties. Less than three years into the decade, the animal they fear most has already roared two times. Actually, the first one, in the first quarter of 2020, was more like a piercing “yap,” taking the S&P 500 down almost 34% in just 23 trading days. The second roar has been a deeper, more guttural one that’s lasted nine months and is probably not done.

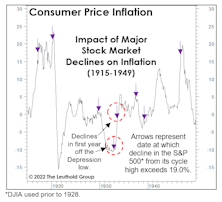

Stocks, Inflation, And Reverse Causality

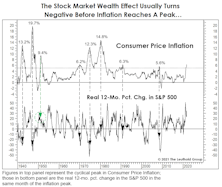

Forget interest-rate hikes and quantitative tightening. There exists a very important weapon in the fight against inflation that the Fed did not have at its disposal in the 1970s: an overvalued stock market.

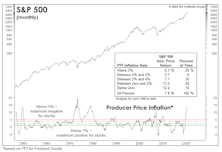

Market Gets A Speeding Ticket

PPI and CPI inflation reached levels that were “too hot to handle” last April and July, respectively, yet the blue chips kept going up through year-end. Large Cap investors who trimmed stocks in response to the violation of these long-time inflation speed limits, however, haven’t missed out on much, and Small Cap investors who did so are happy.

What “Causes” Inflation To Decline?

Last year’s consensus view that inflation would prove “transitory” missed the mark. There’s no reason for shame; inflation forecasting hadn’t been a required investment skill for the previous 30 years.

An Inflationary Wealth Effect

Causation between the economy and financial markets is never a clear thing. The optimistic group formerly known as “Team Transitory” believes a peak in the inflation rate is near, presumably clearing the way for even greater P/E multiple expansion than already seen in this cycle.

A 2023 Inflation Peak?

We don’t profess to be professional inflation forecasters, but are struck by a sort of “temporal” mismatch in the arguments used by those who believed the inflation pick up would be temporary. Specifically, the most commonly-cited bullish inflation arguments have been secular in nature, based on long-term trends in technological innovation, demographics, and free trade.

Is Powell A “Phillips Curve” Guy?

With consumer price inflation raging at 6.2% and few indications of an imminent rollover, Jay Powell has waved the white flag and retired the ill-begotten “transitory” descriptor. The timing of Powell’s concession is intriguing—perhaps he’s a fellow follower of a simple inflation model: the Output Gap.

Powell’s Dovish Accomplice

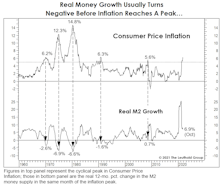

Last week we argued that U.S. money growth remains way too high to reasonably expect a peak in consumer price inflation during the next few months. At the peaks of the last five bouts of inflation of 5% or more, real growth in the M2 money supply had turned negative in four cases and had slipped to less than 1% in the other one. Today, real M2 is growing at nearly a 7% rate.

Timing Is Troubling For “Team Transitory”

From the start of the inflation upswing this spring, pundits cited well-known disinflationary factors they believe will soon halt the current inflationary upswing—like free trade, the speed of technological advance, and aging populations globally.

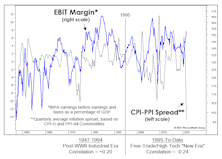

A Marginal Measure Of Margins?

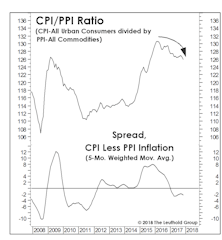

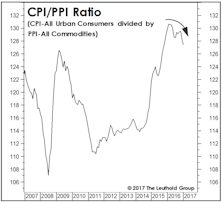

For those believers in a new economic- and stock-market era, there’s good news. The CPI-PPI spread has not been an effective proxy for profit margins during the 1995-to-date “New Era.” But, the failure of an inflation measure during a mostly non-inflationary era shouldn’t come as a surprise.

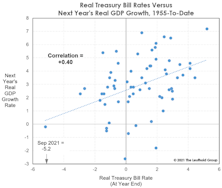

Rethinking Real Rates

Consumer Price Inflation has stabilized in the 5.2–5.4% range in the last two months, giving the Fed hope that it’s reached a near-term peak. Still, the presence of 5%-plus inflation in the face of ZIRP leaves the real short-term Treasury-bill rate about as deeply negative as it has ever been.

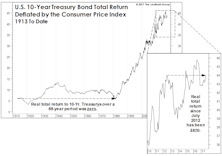

Golden Milestone

Fifty years ago this month, Richard Nixon formally suspended the convertibility of U.S. dollars into gold. Editorials commemorating this have tended to have a celebratory tone, and why not? Abandoning the gold standard greatly expanded the arsenals and imaginations of policymakers, both of which have been on historic display over the last 18 months.

The “Rule Of Twenty” Revisited

Pundits could reasonably argue the market has never been more expensive in light of the prevailing rate of inflation. That’s the conclusion of the “Rule of Twenty,” which proposes that the stock market’s P/E ratio and the trailing 12-month Consumer Price Inflation rate should sum up to 20.

Music For The “Mania”

At some point during the June/July streak of seven-consecutive S&P 500 daily-closing highs, an album from 1980 popped into our heads: Nothin’ Matters And What If It Did—released when John Mellencamp was still known as John Cougar. It brought to mind some “nothin’s” that seem not to matter.

Inflation Watch

April ISM readings, both for Manufacturing and Services, were hot across the board. That’s good news for a still-recovering Main Street, but it manifested in ways that have frequently caused problems for a famous Street located in Lower Manhattan.

Still Heating Up…

The Fed’s reflationary efforts are showing up everywhere except in the measure that’s engineered specifically to minimize them—the Consumer Price Index. It’s a virtuous circle, until it is not

A 40-Year Inflationary Echo

When measured by the gains in stocks, gold, and house prices, there has been just one other occasion in which asset inflation was as “broad” as today—late 1980. But the differences in underlying fundamentals between then and now couldn’t be more stark.

The Rotation Should Hardly Be A “Surprise”

Consumer Price Inflation of 1.2% for the twelve months through October remains way below the Fed’s long-time 2% objective, which is nothing new. But a first step in getting inflation to eventually run a little bit “hot” (the Fed’s new objective) is to break the long-term disinflationary psychology among consumers and investors, and that is clearly happening. In fact, based on the excellent “Inflation Surprise” Indexes published monthly by Citi, the U.S. is now the world’s inflationary hotspot!

Keep An Eye On What Your Stocks Will Buy

News that the Bureau of Labor Statistics may have undercounted the May unemployment rate by six percentage points should remind investors of the danger of taking government economic reports too seriously. Regardless of the figure, though, unemployment is no doubt near its peak for the downturn.

Stocks Just Delivered A Strong Deflationary Impulse

Investors have just suffered a negative wealth effect that will likely work to tamp down inflation over the next year.

Inflation—Another Small Miss

The latest CPI numbers missed market expectations. The problem is not with the actual CPI numbers, but merely the fact that market expectations are still a tad too high. More disconcerting is the cool trend in housing inflation.

Keep An Eye On “Relative” Inflation

While our Group Selection (GS) framework hasn’t yet warmed up to commodity-oriented industries, our macro work suggests perhaps it should.

Inflation-As Flat As The Yield Curve

The latest Core CPI number disappointed again. The divergence between inflation break-evens and the yield curve is puzzling. Given the lack of inflationary pressure and the Fed’s projected rate path, it would not surprise us to see a flatter curve without the help of fiscal stimulus in the next few months.

Inflation-Yield Curve Too Flat

The latest CPI numbers are in-line with expectations. The divergence between inflation break-evens and the yield curve is worth close monitoring. Given that the global recovery is still intact, we don’t think the current inflation picture justifies the flatness of the yield curve.

Inflation - Goldilocks Still Intact

The latest CPI numbers missed expectations but we consider it a passable reading.

Spoiler Alert! The Bond Bear Is Already Here...

Bond investors residing in the Lower For Longer© camp no doubt feel vindicated by the summer rally that’s taken yields on 10-year Treasury bonds to as low as 2.06% in early September.

CPI Weakness Is Broad-Based

The CPI numbers have disappointed five months in a row. The real bad news for inflation hawks is that the weakness in core CPI is broad-based. There is hope for inflation to stem its recent weakening trend soon as the Chinese CPI has already stabilized and started to turn up.

Inflation Slip Sliding Away

Temporary and transitory? The CPI numbers have come in below estimates four months in a row.

Inflation Disappoints Again

The CPI numbers have disappointed three months in a row. Weak commodity prices do not inspire higher inflation expectations. The global scope of inflation deceleration adds more weight to the recent soft readings. However, lower bond yields relative to nominal growth rate is inflationary and buffers the impact of weak inflation and rate hikes.

Inflation Subpar Again

The latest CPI numbers are slightly weaker than expected. We think expectations for higher inflation are still on the high side. The global scope of inflation deceleration adds more weight to the recent soft readings. Patience is the right approach for the reflation trade at this point.

Inflation-Weaker Sooner Than Expected

The latest CPI is weaker and the softness was sooner than we expected. More alarming is the recent broad-based deterioration in economic data. Lower inflation expectations have flattened the yield curve recently, which hurt Financial stocks. We believe inflation has likely peaked for the time being and patience is the right approach for the reflation trade at this point.

A Dovish Hike--Positive For Inflation

The dovish rate hike is a positive for inflation and credit. A hawkish message right now would have been quite detrimental and self-defeating in terms of realizing two more hikes later this year. We believe achieving sustained 2-3% inflation could be harder than most people expect going forward. Overall, we are encouraged by the dovish hike but we think the real test for inflation is when the base effect starts to wane.

Lo And Behold, Another RATIO!!

For managers who must remain fully invested in equities (or “paid to play,” as we’ve often called it), the level of inflation might prove a less important consideration than its character.

Inflation-All About That Base

CPI numbers were strong and better than expected. A big part of the recent upturn in inflation has to do with the much lower base from a year ago. We are seeing upside inflation surprises on a global basis but wage inflation is still disappointing. We are encouraged by the general uptrend in inflation data but we think the real test comes after the positive base effect subsides.

.zip.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)