10-Year Bond Yield

New Cycle High In U.S. 10-Year Yield

The 10-year yield made a new cycle high just before the Jackson Hole meeting. That is significant, as it not only broke the lower-high-lower-low pattern since last October, but also rejected the hypothesis, “we have seen the cycle high in interest rates,” which was the consensus at the start of 2023.

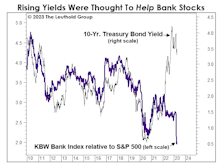

Banks: Happy Anniversary!

This year marks the 25th anniversary of a slew of major bank mergers: Wells Fargo/Norwest, Banc One/First Chicago, NationsBank/BankAmerica, Star Bank/Firstar, First Union/CoreStates Financial, and SunTrust/Crestar Financial. Who knew the KBW Bank Index would celebrate the occasion by returning to its price level of that same era?!

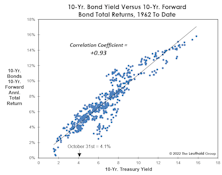

Bonds: Not A Four-Letter Word

The bond market bubble has popped, and forward-looking Treasury returns are no longer a disaster. We aren’t suggesting one pile into them with yields near 4% and inflation around 8%, but we think they have suffered a much more substantial de-rating than large-cap stocks.

Time To Retire The Fed Model?

We’ve heard no references lately to the famous “Fed Model” for stock market valuation. We think we know why: The model’s usual proponents probably don’t like its current verdict—which is that stocks are far more expensive than at the early January market peak.

.jpg?fit=fillmax&w=222&bg=FFFFFF)