Banks

Crunched!

We have no special insights into the likely depth or duration of the banking crisis, but the impact on credit has already been severe. That might seal the fate of the economic expansion. It’s worth noting that in 2008, the recession seemed to have “caused” the credit crunch—not the other way around.

Banks: Happy Anniversary!

This year marks the 25th anniversary of a slew of major bank mergers: Wells Fargo/Norwest, Banc One/First Chicago, NationsBank/BankAmerica, Star Bank/Firstar, First Union/CoreStates Financial, and SunTrust/Crestar Financial. Who knew the KBW Bank Index would celebrate the occasion by returning to its price level of that same era?!

George Bailey Goes To Silicon Valley

One of the most vivid memories of the Great Depression is the sight of nervous depositors lined up outside a bank hoping to withdraw their meager savings before the bank failed. Like a rare tropical disease that was thought to be eradicated by modern medicine, the classic bank run reappeared this month in the form of Silicon Valley Bank. At the beginning of March, the market had no particular concerns about the potential for systemic bank failures, but SVB’s sudden demise has cast a pall over the entire industry.

A “Litmus Group” For The Bulls

As troubled sectors vary from downturn to downturn, commercial banks have shown an uncanny ability to leap in front of each cycle’s proverbial pie truck. This time, it’s hard to identify the precise epicenter—especially amidst all the bailouts.

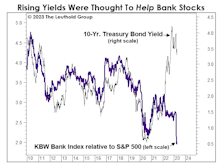

What Are Banks And Bonds Telling Us?

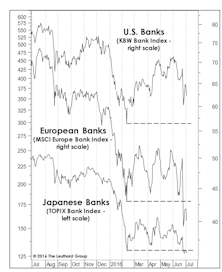

Last month we noted that European and Japanese banks were among the worst-looking industry indexes among the hundreds we monitor—and both groups obliged by dropping 15-20% in the last month.

Sizing Up The Rally

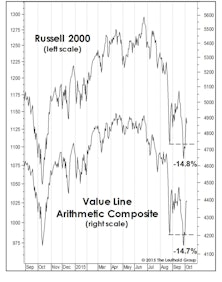

While our MTI became bullish in mid-April, we can’t rule out that the rebound from February lows could be an impressive bear market rally. However, this rally sports impressive technical credentials.

Big U.S. Banks: We Have A Motion, Is There A Second?

YTD the S&P 500 has fallen 2% while the S&P 500 Banking industry group is down over 12%—a shortfall that has the attention of value investors and contrarians seeking a chance to buy high-quality banking franchises at fire-sale prices.

Stock Market Observations

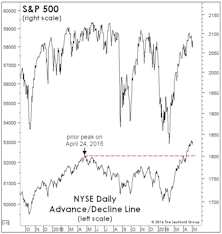

The August market break did not emerge from out of the blue. The foundation for the bear case was put in place many months before those four ugly days in late August.

Transports Still Leading - Market Top Not Imminent

While stock market action YTD has not been quite as “uniform,” the hallmarks of an imminent bull market top are simply not present. The bullish portents apply to intermediate term results, however, they cannot rule out any short-term setbacks (which can appear with no tip-off from breadth or leadership measures).

New Group Coverage…Banking On The Community

Initiated coverage of a new banking group subset in our Financial sector that focuses on small cap, community-focused banks.

View From The North Country

Full Disclosure (Reg FD), Investment Banking conflicts (hardly a recent development) and the Nikkei and DJIA: Will they cross this year?

View From the North Country

How Bush and the boys rescued the banks without busting the FDIC, fiscal responsibility in the 1993 Congress is examined and what the recent surge in commodity inflation means.

View from the North Country

Welcome Scott Archer.... More Bank Troubles and Write-Offs.... U.S. Banks Played Key Role in Oil Bath, Real Estate Debacle, Third World Loans and Busted LBO’s.... America As The “Center” Of the World Economic Universe.... Australia/New Zealand Update

The Bank Double Play

This strategy move was discussed last issue. Here are details, including 63 bank stocks that survived our screens. Also, our initial eight selections. This is damn difficult research, but more is coming soon.

View from the North Country

Financially sound regional banks that may, in coming years, be swept up in the now emerging consolidation trend may have significant performance potential. In addition, they should experience a profit surge when interest rates come down. We think potential downside risk with these stocks may also be less than the market.

View from the North Country

Buying the Worst-Managed Companies: An addendum to our feature of a few months ago. This time we look at Fortune magazine’s best-managed and worst-managed selections. Guess which have performed best in the market? Do You Know Your Banks?: Do you know all the new bank names? If you do you might win a prize in our new contest.

View from the North Country

“The Analyst Looks at Baseball” - Several analytical approaches are applied, combining team payrolls, runs scored, games won and attendance in an effort to determine who are the best and worst baseball teams.….”Don’t Always Underestimate the Banks” - Soon banks will be offering their own money market funds. Existing money market funds say they are not worried about the competition. They should be.