Debt

The Decades They Are A-Changin’

More than halfway through the decade, a lot of things have changed. We revisit several decade-defining charts from the 2010s and consider where these long-running trends stand today.

Company Leverage And The Impact Of Rising Interest Rates

Higher corporate leverage and rising short-term interest rates have not yet led to problems in the credit markets, but investors should be mindful of potential risks.

Trends In Corporate Debt And Coverage Ratios

Long-term debt (LTD) issued by S&P 500 companies has risen 75% since 2010, and the resulting deterioration in leverage ratios has been all too evident.

Emerging Market Currencies: January’s Panic Overdone

The emerging markets are in a much better financial position to weather any financial turmoil than they have been in the past.

Losing Confidence In Washington But Not U.S. Treasuries, At Least Not Yet

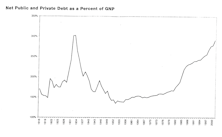

The inability of our politicians to recognize and resolve short and long term debt/deficit issues has caused many of us to lose even more confidence in Washington.

Putting Lipstick On The “PIIGS”

Global Industries equity portfolio has little to no exposure to the PIIGS (Portugal, Ireland, Italy, Greece, and Spain) as our Global Group Selection Scores have not led us to industries that have many component stocks domiciled in those countries. However, if this work leads us to groups with heavier exposure to the PIIGS, we’ll buy them without blinking.

The Demise Of The Consumer

“Of Special Interest” section examines the likely demise of consumer spending power. Taking a lead from the GS Scores and other economic data, we believe that a significant underweight in areas that are particularly sensitive to consumer spending is a prudent strategy for now.

The Consumer: Still Chugging Along

Consumer spending may have finally peaked in this cycle, but a consumer collapse is far from imminent. Consumers can be expected to remain supportive of economic growth.

Still Can't Count Out The Consumer

American consumer spending is still in an uptrend, helping to drive economic growth, although to a lesser extent. In the meantime, CapEx spending has been accelerating, which should serve to pick up any economic slack.

Don't Count Out The Consumer

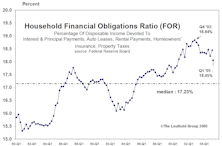

Consumer should not be underestimated. Combined mortgage debt and household debt only 14%, just barely above the 1980-to-date median.

Eye On The Consumer

Important pillars of economic bridge until Capex kicks in and business confidence improves. Interest only mortgages-the ticking time bomb debt. U.S. Consumer debt OK compared with other countries but, what happens when interest rates rise?

Corporate And Consumer Too Leveraged?

Increased reliance on debt to finance growth can cause problems down the road.

Debt Monetization and Inflation

Presented herein is an update of the debt monetization studies presented two months ago. Data has now been released for the first quarter of 1993, and there is virtually no change. Nevertheless, judging by client response, this will be of interest to our readers.

Debt Monetization: Is The Printing Press Working Overtime?

Debt monetization evaluated by three separate measures. All three measures suggest monetization is increasing, however the severity of this trend is debatable. Judge for yourself.