60/40

The 60/40’s Annus Horribilis

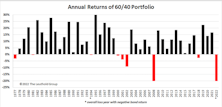

The balanced portfolio strategy of allocating 60% to equities and 40% to fixed income generated a highly satisfactory 7.9% annualized return over the last 30 years. Despite the excellent returns earned by investors following this strategic model, the past couple of years have seen a parade of articles with headlines such as “Is the 60/40 Portfolio Obsolete?” and “Is the 60/40 Dead?” Given the central importance of this moderate allocation strategy to investment industry practices, we felt a closer look at the 60/40 portfolio was in order.

Research Preview: The 60/40 Skeptics Were Right

The 60/40 strategy is having a terrible year, and its failure to protect investors in the bear market prompted us to take a look at the history and theory of the 60/40 guideline. We offer an early preview of the study, with a focus on 2022’s abysmal year-to-date returns.

An Unspoken Dilemma

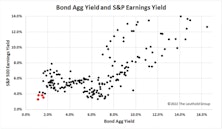

Need more proof that we really are contrarians? While others were celebrating new all-time highs in the S&P 500 during August, we were wringing our hands over a disturbing new all-time low.

Stock Values: Absolutely, Relatively

The severity of the market’s current overvaluation depends on one’s historical vantage point.