Cyclical Lows

Can The Rally Recover From Its 0-For-8 Start?

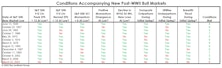

The current rally is either the first upleg of a new bull market, or the second-largest bear market rally in the last 125 years. The lone development that can settle the issue is for the S&P 500 to move above its February 19th closing high of 3,386.15.

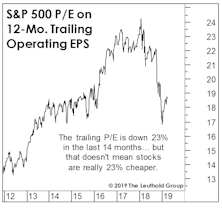

The P/E Decline Has Been Greatly Exaggerated

The S&P 500 has bounced back to levels seen at the January 2018 spike high, yet is valued more cheaply than it was 14 months ago.

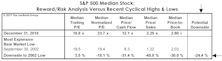

Guess-timating The Downside

While our market disciplines remain negative, we certainly aren’t oblivious to the haircut in equity valuations that’s already occurred.

Correction Creating Values?

While the consensus view remains that October’s stock market rout was “healthy” and “overdue,” we think it was more likely the first leg down of much larger decline. But it’s still worth reviewing the improvement in valuations that market losses and this year’s excellent fundamentals have combined to produce.

.jpg?fit=fillmax&w=222&bg=FFFFFF)