Growth Stocks

“PSsss”

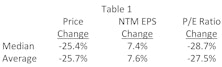

The most brutal bear markets occur when falling earnings are accompanied by shrinking valuations, producing a compound negative effect on stock prices. Investors in 2022 have (so far) avoided this double-whammy in that valuations have taken a hit, but EPS estimates are holding strong. We are intrigued by the notion that 2022’s bear market has, to date, been all about valuation compression rather than earnings weakness. Investors are coping with the problems of the day by letting the air out of bubbly valuations, and this report takes a closer look at the valuation squeeze underlying the current selloff.

Research Preview: P/E Multiple Compression In 2022

Stock market corrections are the result of falling valuations and/or falling earnings, and when both conditions appear together, investors are in for a rough ride. Thus far, the 2022 selloff has been confined to compressing P/E ratios, and we launched a research project to take a closer look at shrinking stock valuations in this market downdraft.

Carbuncles, Diamonds, and Tears

High growth rates, innovation, and disruption are defining traits of the companies that have powered the market to recent highs, and the ARK Innovators Fund (ARKK) is an example of today’s enthusiasm for visionary growth stocks. Recent returns and growth in AUM have been nothing short of spectacular, and ARKK has become symbolic of today’s style of new-era growth investing.

.jpg?fit=fillmax&w=222&bg=FFFFFF)