LEI

Groupthink?

Question: While hopes for an economic soft landing have ticked up a bit, the consensus view among economists still seems to be for a recession in 2024. Does having so much company concern you?

Response: Of course!

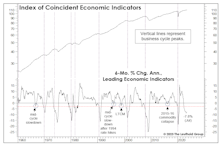

The LEI Clock Is Ticking

A contraction of 3% or more in the LEI’s six-month annualized rate-of-change has always been associated with a recession, with an average lead time of four months. Using that guideline, the most recent recession warning was triggered in June 2022, and the lead time is now approaching the longest ever recorded (16 months in 2006-07). If today’s lead time matches the 2006-07 experience, the business-cycle peak will occur in October.

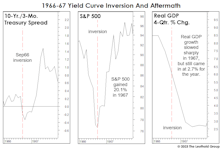

1966-67: When The Yield Curve “Failed”

Given the tendency of economists and strategists to dismiss the message of an inverted yield curve, it’s surprising there’s been no scrutiny of the “dog that didn’t bark”—the inversion of 1966. That’s the last time an inverted curve did not lead to a recession.

The Economy Rallied In January, Too

The narrative for January’s strong stock market bounce is that not all key economic releases looked to be forecasting a recession. However, one must consider that this was only true for coincident and lagging data series.

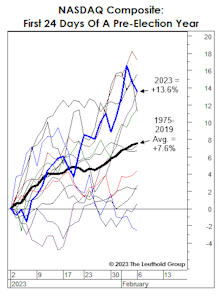

Irrationality Is Back, Right On Schedule

The hostile monetary backdrop makes recent stock market exuberance even more irrational than in early 2021. Yet, this is the middle of a seasonal window that historically boasts an elevated level of craziness: It is the year preceding a presidential election—a time when monetary and fiscal stimulus are ramped up.

A Trade Contrarians Will Love

Time cycles have been spot on in 2022, with the stock market declining through the mid-year months (May-October) of a mid-term election year. But November 1st saw the opening of the market’s most bullish window according to the same patterns.

LEI On The Precipice

The LEI’s 3.6% six-month annualized loss through September 2006 was the largest decline not followed almost immediately by a recession. This year, the LEI contracted by 3.7% over the six months through June—if a recession is avoided in the current experience, it would be the most misleading signal in the history of the LEI as currently constructed.