Leuthold 3000

Broad Market Valuation Check

It was less than two months ago that broad market valuations--measured by the Leuthold 3000 median Normalized P/E--were still within the wide range we consider to represent fair value (between the 30th and 70th percentiles). Thanks to the rush of post-election euphoria, that's no longer the case, with median P/E shooting up three points in six weeks to 26.1x.

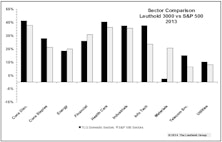

Sector Performance – Finding Discrepancies

Our Tech sector outpaced the S&P 500 Tech sector by 1400 bps and our Materials sector lagged the S&P 500 Materials by 2300 bps. Here’s why…

Why Use Leuthold's Groups?

Clients who use our equity group work are well aware of the successful history of picking groups through the quantitative Group Selection Scores (GS Scores).

Modifications To Leuthold Growth Versus Value Methodology

We have modified our Small Cap and Mid Cap Growth versus Value methodology, improving the algorithm for distinguishing between growth and value to make the components more reflective of these sectors.

Capitalization Tier Meausres

Continuing to evaluate Leuthold Index methodology.