Quantitative Strategies

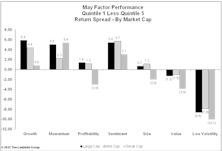

Growth Performance Roars Back

Growth quickly U-turned and led the market higher over the last two months, while low volatility stocks have been discarded. Momentum has weathered the volatility well so far—especially within small caps.

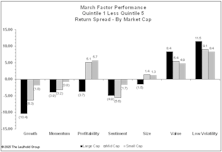

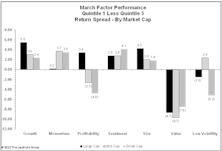

Growth Cracks Deepen: Worst Two-Month Stretch Since 2008

March marked the second consecutive month of historically poor growth performance, capping the worst back-to-back stretch since the global financial crisis. While low volatility and value surged, growth and momentum were hit hard—raising big questions about how much downside remains and whether safety now comes at too steep a price.

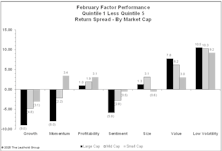

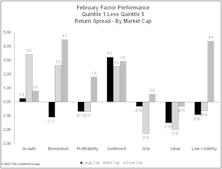

Flight From Growth

While the momentum factor often sees sizeable performance swings, in February, growth was the outlier with a -9% spread—the worst since September 2008. Growth has become very correlated with beta, making it more susceptible to underperformance during a flight to safety.

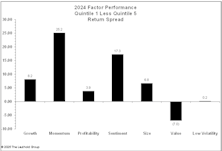

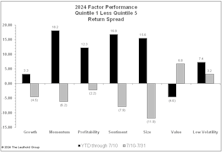

2024 Factor Performance

Momentum was the best performing factor for 2024 - and it wasn’t really close. Growth continued to perform better within large caps compared to small caps. Sentiment and growth were also positive while, no surprise, value was negative again.

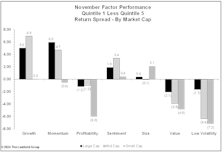

Post-Election Factor Performance

The election gave small caps and Financials a boost, but didn’t help value stocks as hoped. Momentum and growth were the main winners within large caps, while no factors worked well among small caps, where more speculative names benefited.

CPI Report Brings Massive Rotation

The mild CPI report on July 11th kicked off a violent rotation out of mega-cap stocks, with the Russell 2000/S&P 500 performance differential at +4.5% for the day. Other factors reversed as well, with all major styles posting inverse performance relative to their year-to-date numbers.

Low Correlations Haven’t Helped

With the Mag 7 driving S&P 500 returns on a daily basis, the other 593 stocks have become less correlated with the S&P 500’s day-to-day changes. Although dropping correlations are typically a good thing for active managers, we think this time is different.

Speculation Within Large Caps

Risk appetite continues to be stronger within large caps compared to small caps, with AI themes more prevalent among the biggest names. Less volatile, more profitable firms are winning within small caps.

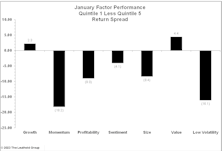

2024 Factor Performance

Factor performance was decidedly risk-on in February. Through month end, high-momentum names have outperformed the universe by 6.7%—we have to go back to the Tech Bubble to find a year when momentum had a stronger start.

2023 Factor Performance

Much like the overall market, factors reversed course in 2023 with most broad categories performing opposite of what they did in 2022. While two years ago, safety was a virtue, in 2023, the riskier the better.

Value Functioning Better Than Advertised

Value has worked much better within small caps compared to large caps for three of the last four years. This is nothing new, though, as value is historically a much better factor within the less efficient smaller-cap universe.

Factor Behavior Differs By Market Cap

Growth has performed much better among large caps than small caps, resulting in higher relative valuations for large caps. Based on factor valuations, we think value provides a more attractive large-cap entry point, while growth looks more attractive within small caps.

The Low-Quality Rally Of 2023

All the talk has been about mega-cap growth stocks, but equities with low-quality characteristics have fared even better. High beta, negative earnings, and those with high short interest have trounced the rest of our universe.

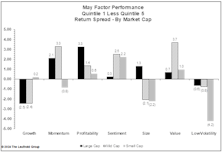

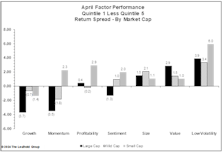

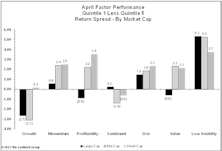

Low-Vol Back In Favor

The preference for defensive industries and sectors in April led to the outperformance of low volatility stocks, while growth lagged. YTD factor results have been poor, with negative spreads for momentum, profitability, value, and low-vol.

Growth Scare Hits Factors

Volatility returned, as two large bank failures had investors questioning growth expectations. Value was hit the hardest; growth was the main beneficiary.

The Calm After The Storm

Factor performance stabilized in February, recovering from a brutal start to the year. While those dynamics bled into the first two days of February, the trend quickly reversed as interest rates bounced off recent lows and stayed on an upward trajectory for the rest of the month.

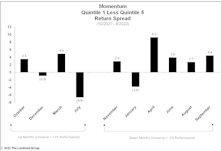

Losing Momentum

After working well in 2022, Momentum took a beating out of the gates in 2023. Investors rejected the winners from last year and returned to the lowest quality and most speculative winners from the previous low-rate playbook.

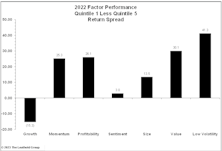

2022 Quantitative Factor Performance: Year In Review

The rotation into Value continued into 2022, with Momentum joining the party and Growth the only blemish on the factor scorecard.

Momentum Offering Downside Protection

In a volatile year, protection is coming from what many may deem an unlikely suspect—the momentum factor. Contrary to popular belief, momentum tends to work better in down months than up months.

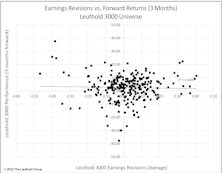

Earnings Revisions And Predictive Power

While the market moves back into sell-off mode, everyone seems to be waiting for the inevitable hammer to drop on earnings. If and when that happens, does it give us any insight about performance prospects? Or does it just make forward P/E ratios less attractive?