Reward/Risk

Even “True Believers” Should Read This

Consider it a sign of the times: Here is the most bullishly slanted version of our “Estimating The Downside” exercise we’ve ever put in print (and likely ever will).

Back To The Brink

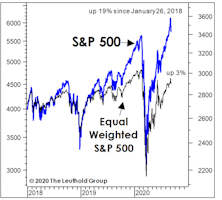

Despite equal-weighted measures’ long-time underperformance, all valuation ratios we monitor for the median S&P 500 stock have returned to their top historical deciles. Even worse, our new equally-weighted “Valuation Composite,” based on these measures, closed August at a 98th percentile reading.

Risks Still High In The “Median” Large Cap

The relative domination of Mega Caps might leave the impression that valuation of the “typical” (or median) Large Cap stock is reasonable. It’s not. The fall rally leaves all major valuation ratios for the median S&P 500 stock in the top decile of the 30-year history, and above the levels prevailing at the September 2018 market high.

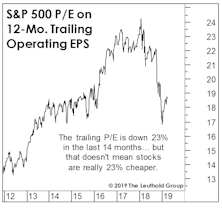

The P/E Decline Has Been Greatly Exaggerated

The S&P 500 has bounced back to levels seen at the January 2018 spike high, yet is valued more cheaply than it was 14 months ago.

Correction Creating Values?

While the consensus view remains that October’s stock market rout was “healthy” and “overdue,” we think it was more likely the first leg down of much larger decline. But it’s still worth reviewing the improvement in valuations that market losses and this year’s excellent fundamentals have combined to produce.

Estimating The Upside: Another Angle

A look at the potential upside for the median S&P 500 stock, based on the theory that each of four valuation ratios reaches its individual all-time high set during the last phase of the 1990s’ market mania.

.jpg?fit=fillmax&w=222&bg=FFFFFF)