Transports

Testing The Transports

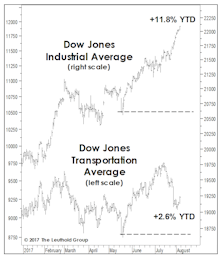

A new market high that is not confirmed by the stocks of companies that “move the goods” is a warning signal. We reviewed the Transports’ action in all years the S&P 500 accomplished a 12-month high during the month of July, like it did this year.

The “Transportation” Divergence

The Dow Jones Transportation Average has recently notched fresh all-time highs. Following a sizable relative performance dip earlier in the year, the Transports’ relative strength has recovered and moved to new 2020 highs (Chart 1). Still, compared to the broad market, the index’s YTD return appears fairly unremarkable, outpacing the S&P 500 by about 3%.

Revenge Of The Nerds?

Last month we detailed two technical shortcomings of the rally off the March 23rd market low. The stock market duly noted our critique and has issued its response.

Where Are The Leaders We Need?

Small Caps lagged during the bounce off the March lows before a late-April spurt briefly pulled them ahead of the S&P 500. Still, considering that Russell 2000 losses were so much steeper than the S&P 500’s (-43% versus -33%), we would have expected something better.

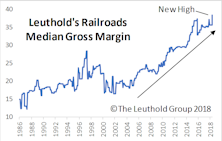

Transports Gain Momentum Amidst Struggling Industrials Sector; Railroads Purchased

Despite Industrials’ underperformance versus the broad equity market, the sector’s Transportation subset has been on the rise recently. In the latest round of our Group Selection (GS) Scores, four of the five Transportation groups rank Attractive, and the fifth one is rated High Neutral.

Troubling Transports?

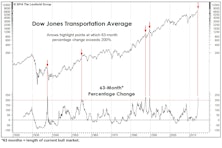

Does the last few weeks’ stumble in the Dow Jones Transportation Average foretell anything sinister? Not on the face of it.

Time For A Transportation Turnaround?

We examine the recent strength in the Dow Jones Transportation Index and its underlying industries: Airlines, Railroads, Air Freight & Logistics, and Trucking.

What Are The Transports Telling Us?

The MTI’s subset of Momentum measures entered September at a 6 1/2-year high reading of +1028, with only two of the category’s 40 inputs in bearish territory.

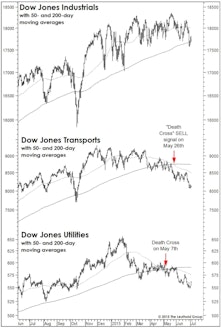

A BUY Signal That Says SELL?

Last month we discussed the negative market implications of May’s “Death Cross” signals in the Dow Transports and Dow Utilities.

“Overbought” Can Be Good Or Bad

The notion of “overbought” and “oversold” markets might be the costliest concepts ever developed by stock market technicians. The very words imply some sort of excessive condition that’s prone to naturally self-correct.

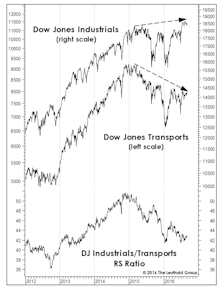

Transports Still Leading - Market Top Not Imminent

While stock market action YTD has not been quite as “uniform,” the hallmarks of an imminent bull market top are simply not present. The bullish portents apply to intermediate term results, however, they cannot rule out any short-term setbacks (which can appear with no tip-off from breadth or leadership measures).

Stock Market Observations

With our equity exposure high and our disciplines still tilting bullish, we’re naturally more concerned with what might go wrong than missing out on some kind of 2013 repeat.

.jpg?fit=fillmax&w=222&bg=FFFFFF)