AANA

It’s Been Ugly Across The Board

Aside from a couple specialized approaches, 2022 is shaping up as the second-worst year for “multi-asset” investing since at least 1973. It seems money printing supported more than just the equity subset.

Asset Allocation: A Rising Tide Lifts Most Boats

Boy, we thought policymakers had thrown the kitchen sink at the economy in 2020. Evidently, the Fed’s Marriner Eccles building has two kitchens, because they were able to do it again in 2021: M2 grew 13%, the Fed’s balance sheet swelled19%, and the 2021 federal deficit will come in at 12% of GDP.

Time For A “Donut” Break?

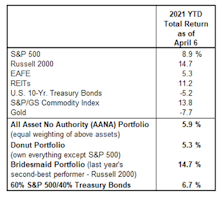

Despite a resurgence in Small Cap stocks and Commodities, it still feels like an “S&P 500 World” for asset allocators. The financial media remain obsessed with S&P 500 targets, S&P 500 earnings, and S&P 500 stocks. And why wouldn’t they be?

Liquidity Didn’t Lift Quite Everything In 2020

Last year should have been a perfect one for “diversification” to shine. Extremely high equity valuations entering 2020? Check. A recession-induced bear market? Check. Massive monetary and fiscal stimulus designed to lift all boats? Check and check.

A Good Year To “Own It All”

It’s no surprise that U.S. Large Caps were the #1 asset class performer in 2019. We were surprised that last year was the only one of the decade in which the S&P 500 won the annual performance derby. Here we review the annual performance of “Bridesmaid” asset class and sector, “Perfect Foresight,” and Lowest P/E sector.

Odds & Ends

Here are some brief follow-up notes on topics covered in recent months’ Green Books.

“De-Worsification” Ruled In 2018!

The market difficulties of 2018 were hardly limited to stocks. Commodities, in fact, were the worst performer among the seven major asset classes.

Market Observations

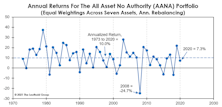

It’s been one of the worst years on record for diversification, with our hypothetical All Asset No Authority (AANA) portfolio down 7.2% YTD through yesterday. That’s the second-worst year for AANA since 1972, and there’s probably not enough time left for performance to undercut 2008 (-24.9%) for the bottom spot.

Thanksgiving Leftovers

Whatever one’s preferred leftovers from yesterday’s feast, the odds are good you’ll find them more appetizing than the slop served up by global asset markets this year. Stocks have obviously been turkeys, but all the surrounding trimmings that help diversify a portfolio have proven anything but complementary to the main course.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)