Yen

$Yen No Mountain High Enough?

One casualty of the U.S. market’s hawkish turn is the Japanese Yen. It certainly grabbed its share of headlines, yet, when viewing the selloff in historical perspective, this year’s uptick looks entirely inconsequential. Additionally, when considering the Yen through the lens of other Asian currencies, its outsized weakness versus the dollar essentially disappears. Dollar strength is the real driver and it has pummeled Asian currencies across the board.

The Dollar: Upside Limited In The Near Term

A closer look at the dollar’s two main counterparts, the euro and the yen, reveals a regime shift in both cases, but for different reasons.

The Weakening Yen — Too Far Too Fast

We are highly skeptical “Abenomics” can produce different results this time.

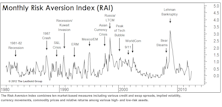

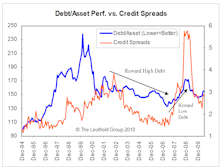

New Higher Risk Signal Generated But Optimistically Cautious

This new “Higher Risk” signal closed out the previous “Lower Risk” signal generated last December, and this measure is telling us it’s time to play a little defense.

Risk Aversion and “Episodic” Factor Returns: Investors Favoring Conservative Characteristics

We expect risk appetites to remain low and investors to continue to reward conservative stock characteristics over the next 3-6 months.

Different Pictures Of Gold Prices

Gauging how much impact the dollar’s decline has had on the rising gold price.

View From the North Country

The dithering dollar. Did we miss our golden opportunity? Some think there is current hope for Social Security reform. Is new NASDAQ rule an uptick or upchuck? The bears are howling.