Japan

$Yen No Mountain High Enough?

One casualty of the U.S. market’s hawkish turn is the Japanese Yen. It certainly grabbed its share of headlines, yet, when viewing the selloff in historical perspective, this year’s uptick looks entirely inconsequential. Additionally, when considering the Yen through the lens of other Asian currencies, its outsized weakness versus the dollar essentially disappears. Dollar strength is the real driver and it has pummeled Asian currencies across the board.

First BoJ Rate Hike In 17 Years—Not So Virtuous After All

To gauge how much faith we should have in this “virtuous” cycle, we examine the macro context in terms of the business cycle, the Yen, interest rates, and inflation. Ultimately, inflation holds the key to bond yields, as the main difference between pre- and post-1990 rate hikes boils down to inflation—which is also the key determinant of how far the BoJ can go in this tightening cycle.

New Cycle High In U.S. 10-Year Yield

The 10-year yield made a new cycle high just before the Jackson Hole meeting. That is significant, as it not only broke the lower-high-lower-low pattern since last October, but also rejected the hypothesis, “we have seen the cycle high in interest rates,” which was the consensus at the start of 2023.

Land Of The Rising Stock

After years of wandering in the wilderness, Japanese stocks are leading the world’s developed markets higher in what has been a robust opening half of the year. The table shows Japan leading the world’s ten largest developed markets (as measured by the MSCI family of international indexes) with a 24% local currency return through June, easily outpacing the pack. Even as the MSCI USA index gained 17% by successfully “fighting the Fed” this year, Japan surged another 7% beyond that outstanding result. We were curious to understand the nature of Japan’s spectacular run in 2023, looking to identify the drivers of this strong and relatively quick jump higher.

Research Preview: What’s Up? Japan!

After being ignored for a generation, Japanese stocks are roaring in 2023. The Nikkei puts the S&P 500’s 16.9% YTD gain to shame with its +28.7% return. With developed international equities (ex-Japan) up a paltry 9.5%, diversification from expensive U.S. stocks cannot fully explain Japan’s surge.

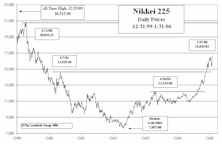

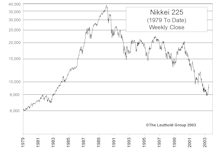

A Storied Bubble’s Pearl Anniversary

The decade of the teens has given way to the decade of the twenties and “year in review” retrospectives are in the books, but as the calendar’s last digit rolls from 9 to 0 we consider one more anniversary worth remembering.

Policies Trump Politics

We find ourselves in the twilight period where the impact of a rate hike might be waning, while the potential election-year impact might be gaining more influence.

Can The EM Problem Spread To DM? Yes, If It Gets Bad Enough

The current EM weakness is not yet a full-blown crisis but, if it does become one, it will drag down developed economies too.

Data Dependency—September Taper Still Likely

More upside surprises are still likely and, despite the disappointing jobs report, the overall economic picture still supports a September taper. The improving economic picture is not just happening within the U.S., but in other major countries. We still believe the upside for the U.S. 10-year is limited.

The Weakening Yen — Too Far Too Fast

We are highly skeptical “Abenomics” can produce different results this time.

QE3 Is Ill-timed And Should’ve Been Saved For A Greater Risk Event

What is the Fed going to do if another risk event hits and the S&P goes down 15-20%? Pray?

It’s The Economy, Stupid

U.S. likely averted worst-case scenario of default, but credit rating downgrade is still likely. Main impact of downgrade is not the increase in interest rates itself, but rather the liquidity risk in all markets that involve treasury securities as collateral.

The Impact Of Quantitative Easing On Style Factors

Chun Wang examines QE I & II in Japan, along with the initial QE in the U.S., to see how various quantitative factors have reacted in the past. While some factors may prove effective, the main difference between these past QE experience and the latest round is the macro conditions of the market.

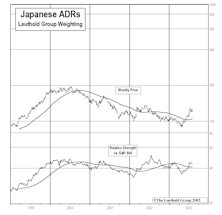

Update On Japan...Holding Our Positions, But Watching Closely

Recent market action appears to be indicating that cyclical forces have, for the time being, put Japan’s stock market recovery on hold.

View From The North Country

Even before Major Trend Index improved to Neutral, Leuthold was getting more bullish. Also, Is the Sun Rising or is it Setting on Japan?

Update On Japanese Stock Market...Has Our Bullish Outlook Changed?

Notwithstanding the market action in the most recent month, in the longer term we suspect that the Japanese stock market might be less vulnerable than other regions and countries of the world (including the U.S.).

Initiated A Position In Japanese Equities

Used market weakness in Tokyo to begin building position in Japanese equities.

Turning Japanese? A Look At The Rally In Japan Shares And How To Play The Turnaround

A look at the rally in Japan shares, and how to potentially play a turnaround.

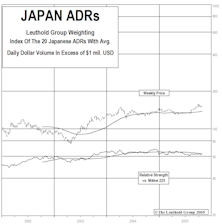

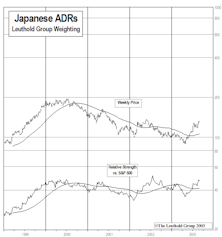

Japanese ADRs...Rising Suns

A brief recap of our reasons for a bullish outlook on Japan’s stock market.

Japanese ADRs...Update

A brief recap of our reasons for a bullish outlook on Japan’s stock market.

Saving Face...Is Japan Finally A Turnaround Play?

Japan appears to be getting its fiscal house in order. Opportunity may be developing here. We constructed a list of potential Japanese ADRs, and built an index to monitor the situation.

View From The North Country

Full Disclosure (Reg FD), Investment Banking conflicts (hardly a recent development) and the Nikkei and DJIA: Will they cross this year?

The Asian Grand Opportunity...Buy On Weakness

Small addition to Emerging Country Funds in both portfolios with purchase of Greater China Fund.

Worth Noting

Steve’s thoughts on 1998 Stock Market Leadership, Volatility, Japan, Gold and Inflation.

View from the North Country

Human behavior demonstrates that individuals as a group are risk averse…studies of investor behavior have yielded some interesting findings. Also, Japanese low interest rates in themselves have not yet converted caution and pessimism into confidence and optimism.

Worth Noting

Steve’s notes on revising the GDP calculation, market implications of discount rate cut, stock market capitalization as a percentage of the GDP and more.

What Might Change Today’s Bullish Psychology?

The basic question is, what might motivate the Teflon market to initially suffer a period of weakness?

Japanese Global Companies

A month ago, we noted that our long term momentum work indicated the Tokyo stock market might be in a bottoming process and if this work was correct, these Japanese Globals (all with U.S. ADRs) could be great buys.

Is It Time To Buy Japanese Stocks?

A pullback to 16000 or thereabouts could trigger some action on our part. One possible strategy we have discussed is an ADR package of major exporters.

View from the North Country

Please “bear” with us….Polling the Pros in April…Catch a Falling Knife (Investing in Japan)…Nuclear Power: Cheap & Clean?

Japan: Buy For A Rally (Maybe More)

One of the great bubbles of all time continues to deflate. The Japanese stock market, as measured by the Nikkei Index is now down 53% from its December 1989 peaks. The P/E for the Nikkei has fallen from its 1987 peak of 68 to its current level of 30 (trailing 12 month earnings), a decline of 56%.

View from the North Country

Playing The Game (Investment Management): Some Insights and Criticisms From Walter Cabot Of Standish Ayer & Wood...Tokyo Stock Market Update...Gasoline Prices Are Historically Cheap When Adjusted For Inflation...Country By Country Union Membership Statistics

Unconventional Asset Allocation Model Buys Nikkei Put Warrants

As readers know, we have been bears on Tokyo stocks for several years. But we were early in the past. Recent action leads us to believe the bubble may finally have burst, with the remarkable levitation act about over.

View from the North Country

"Gorby" Visits The Leuthold Group...Graying Of America And The Pension And Related Services Business...Client Feedback On Japan...California Real Estate Update

View from the North Country

What’s Up In Japan...Not High on Northwest Airlines...The Good Guys Are Leaving (Office)...Fat Is Where It’s At (Fearless Forecast)...Harley Davidson (Model Portfolio Stock) Introduces New Fat Boy Bike...Phony Evel Knutson Communique Surfaces!

View from the North Country

Update on Client and “Street” Reaction to Neil Dolinsky’s Sell Report on Tele-Communications...Japanese Stock Market Update...Health Care Industry: Why Are Costs Skyrocketing?

Japan Becomes Aggressive

Japan is clearly becoming more assertive and aggressive in its dealings with other countries. Economic muscle instills confidence. Larry Jeddeloh provides his observations and comments on the Japanese real estate invasion of Hawaii.

View from the North Country

U.S. Politics and Fiscal Responsibility…The Japanese Stock Market…Aussie Bond Update

View From The North Country

here is a lot to write about this issue, including a number of equity portfolio changes and shifting sector strategies. But this publication must also uphold a cherished February tradition.

View from the North Country

The Outlook - A Summary of Current Views…Faulty Recollection of 1929…A Crash Still Waiting To Happen…December Bottom Fishing Time…Aussie Bonds…The Leuthold Group Eats Some Garlic