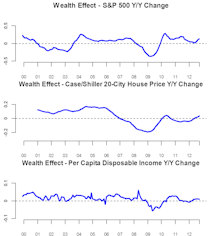

Wealth Effect

Bank Lending & Wealth Effect Support U.S. Economic Resilience

Improvement in bank lending trends should be a tailwind for economic activity, while steeper yield curves also imply a looser lending environment lies ahead. Another area supporting U.S. economic resilience is the wealth effect: The surging wealth effect is boosting consumer confidence which, in turn, leads to higher consumption.

Some Perspective For Dip Buyers

Losses in the Russell 2000 Growth Index and the NYFANG+ Index have topped 40%, and the only true equity rockstar, spawned by a 13-year secular bull market, has watched her fund’s value drop by more than three-quarters. Yet there’s still a televised debate as to whether this decline is even a bear! Could there be a more devious creature on the face of the planet?

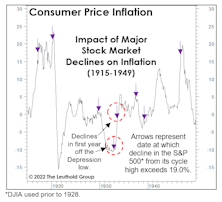

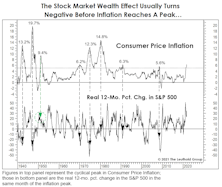

Stocks, Inflation, And Reverse Causality

Forget interest-rate hikes and quantitative tightening. There exists a very important weapon in the fight against inflation that the Fed did not have at its disposal in the 1970s: an overvalued stock market.

What “Causes” Inflation To Decline?

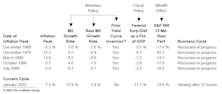

Last year’s consensus view that inflation would prove “transitory” missed the mark. There’s no reason for shame; inflation forecasting hadn’t been a required investment skill for the previous 30 years.

An Inflationary Wealth Effect

Causation between the economy and financial markets is never a clear thing. The optimistic group formerly known as “Team Transitory” believes a peak in the inflation rate is near, presumably clearing the way for even greater P/E multiple expansion than already seen in this cycle.

Powell’s Dovish Accomplice

Last week we argued that U.S. money growth remains way too high to reasonably expect a peak in consumer price inflation during the next few months. At the peaks of the last five bouts of inflation of 5% or more, real growth in the M2 money supply had turned negative in four cases and had slipped to less than 1% in the other one. Today, real M2 is growing at nearly a 7% rate.

Can The EM Problem Spread To DM? Yes, If It Gets Bad Enough

The current EM weakness is not yet a full-blown crisis but, if it does become one, it will drag down developed economies too.

10-Year: 185-245 Range Broken & Higher Volatility

We think 3% is the upper bound in the short term. However, we believe it will settle back closer to 250 bps by the end of the year.

Wealth Effects: Housing Likely To Be The Bright Spot

The stock market wealth effect has been direct and pronounced. But it’s been wearing off, with the subsequent rally after each Fed stimulus weaker than the previous one.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.zip.jpg?fit=fillmax&w=222&bg=FFFFFF)