Factor Performance

Speculation Within Large Caps

Risk appetite continues to be stronger within large caps compared to small caps, with AI themes more prevalent among the biggest names. Less volatile, more profitable firms are winning within small caps.

2024 Factor Performance

Factor performance was decidedly risk-on in February. Through month end, high-momentum names have outperformed the universe by 6.7%—we have to go back to the Tech Bubble to find a year when momentum had a stronger start.

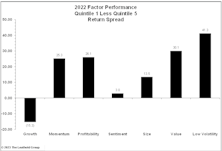

2022 Quantitative Factor Performance: Year In Review

The rotation into Value continued into 2022, with Momentum joining the party and Growth the only blemish on the factor scorecard.

#56 - Factor Returns And A Basket Of EGGs

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

Factor Performance: A Tale Of Two Halves

Through the first two-and-a-half months of 2022, factor performance maintained the trend established in 2021: Value outperformed everything else and Growth lagged. When the 10-2 year differential dropped near 20 bps on March 16th, Growth stocks outperformed from that day forward, while Profitability and Value suffered.

2021 Quantitative Factor Performance: Year In Review

After years of underperformance, Value was finally productive—it was the best factor we track. In general, overall factor performance was good, but worked much better within small- and mid-caps compared to large-caps. Value was especially superior outside of the large-cap universe.

Value Turns Discerning

The weakness in Value* over the last few months has gotten a lot of attention (Chart 1). While we are still on board with the “Value trade” in general, a subtle but distinct change within the theme has emerged. There is a clear bid for Quality, which had not happened in the massive post-Covid junk rally until recently.

Factors: Ain’t Misbehavin’

Investment styles and factors are generally interpreted as having an inherent preference for either bullish or bearish market environments. The theoretical tilt of each style is based on its design and its sensitivity to economic, profit, and valuation cycles. However, theory and practice do not always agree, and we must look to actual performance to confirm our impressions.

GS Scores Perform Well Amid 2020 Volatility

The GS Scores handled the chaotic, 2020 market well, turning in a +10.1% return spread. The lone black-eye was November, when the Pfizer vaccine news upended quant factors and produced the worst single-day performance in GS Score history.

Research Preview: Factor Standings For 2020

As we review factor and style returns for 2020, it occurs to us that the “whole” is much less interesting than the sum of its parts. Many factors are considered to be either bullish or bearish in temperament, and last year’s round-trip offers an opportunity to test the reliability of those characterizations.

Momentum’s Terrible, Horrible, No Good, Very Bad Day!

If Momentum and Growth investors thought they were escaping 2020 unscathed, they learned otherwise on Monday. Pfizer’s promising news about a COVID-19 vaccine was met with universal excitement and investors rearranging portfolios—taking gains in long-term winners and plowing into beaten-down cyclical stocks.

Election—Another Chance For Value

As we Chinese watch the elegant display of the western democratic process this election season, we can’t help but think there are indeed people less fortunate than us “commies.” Worse yet, some of these people are Value investors.

Valuation Dispersions Reach 2009 Levels

The recent market turmoil has only served to exacerbate equity style trends that have been in place for years, with Value, Small Caps, and High Beta all underperforming relative to Growth / Momentum, Large Cap, and Low Volatility, respectively.

“1” For The Record Books

Dark energy makes up 68% of the universe, yet astrophysicists are having a devil of a time explaining what it is, why it is, or how it works. Quant investors are facing their own dark-energy mystery in understanding style returns of 2019.

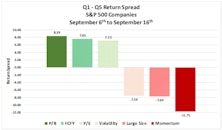

The Case Of The Flipping Factors

Equity market themes have been boringly consistent of late; growth beating value, large beating small, and domestic beating international. In the factor world, Momentum and Low Volatility have been investor favorites for most of 2019 while Value resided in last place – the same old, same old. Then, something remarkable occurred on September 9th.

A Most Peculiar Day

Something remarkable occurred on September 9th. Momentum crashed and Value soared on that Monday, in what one analyst described as a five standard deviation event. Do we have a clear understanding of what really happened? This research project takes a multi-faceted look at what transpired during one unusual week in September.

The Stock Market’s Clark Kent

Mild-mannered and humdrum on the surface but a superhero underneath—that’s Clark Kent and, in recent months, the Low Volatility factor. Low Vol stocks are unexciting by definition, and the factor’s current holdings focus on utilities, REITs, and insurance companies.

Acting Like A “New” Bull Market?

With DJIA and S&P 500 losses in the 2015-16 decline limited to less than –15%, there’s no way we’d argue the episode represented a completed cyclical bear market (and we said so at the time).

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)