Apparel Retail

Examining The “Reopening Economy” Theme At The Group Level

We examine a variety of industry groups with noteworthy relative price action on both “reopening” and “closed economy” days. Our objective is to shed more light on the industry groups that are consistently moving together on these days.

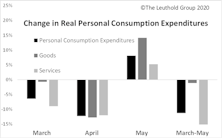

Retail’s Winners And Losers Of The Pandemic

Following the market bottom, the rebound across retail industries has been robust, but a divide has emerged. Consumers’ needs and behaviors have dramatically shifted as former lifestyles were uprooted. This swift change in economics has resulted in clearly-defined sets of winners and losers among retail industries.

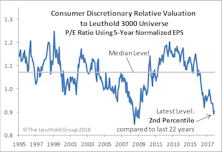

Consumer Discretionary Back On Top

Of the 110 industries in our framework, the top seven are all Consumer Discretionary.

Highlighted Attractive Groups

We examine the factor category strength behind Apparel Retail, Life Sciences Tools & Services, and Technology Hardware Storage & Peripherals.

Highlighted Attractive Groups

Airlines has spent only three months below “Attractive” since early 2012 and the group’s factor category scores continue to provide solid results. We also like the growth prospects for Drug Retail and Apparel Retail.

Selected Attractive Groups

Homefurnishing Retail, Apparel Retail, Systems Software

Retail Groups Rise In The Ranks

A new theme emerging within our GS Scores—Retail related industry groups are flocking to the upper rankings of the scores.

Upgraded Attractive Groups

Homefurnishing Retail, Apparel Retail, Apparel Accessories & Textiles