Asset Allocation Strategies

Times Are Still Tough For “Timing”

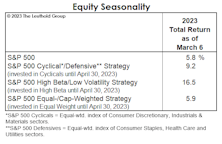

YTD, passive strategies are again ahead of most attempts at timing, though we still believe that asset allocation success over the next several years will require much more use of the latter.

Emerging Markets: Watching Closely

Foreign stocks have been leaders off last fall’s lows, but not by a big enough margin to flip our Emerging Market Allocation Model to a bullish stance. The model factored into our general avoidance of EM equities the last several years; now January’s action has us on alert that the outlook may soon shift.

2022 Asset Allocation Review

We’ve heard for eons that “Low bond yields justify high equity valuations.” Value-conscious investors might have described this conundrum another way: “Low future returns in one asset class justify low future returns in another.” (Mysteriously, only the first rendition became a CNBC catch-phrase.)

“The Streak” Is In Jeopardy…

With less than a month to go, our hypothetical All Asset, No Authority (AANA) Portfolio seems likely to beat the S&P 500 on an annual basis for the first time since 2011. However, it’s doubtful that many real-world, institutional multi-asset portfolios were as heavily exposed as AANA to the best-performing assets—commodities and gold.

Bonds: Not A Four-Letter Word

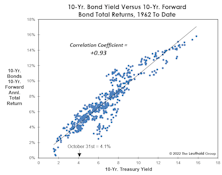

The bond market bubble has popped, and forward-looking Treasury returns are no longer a disaster. We aren’t suggesting one pile into them with yields near 4% and inflation around 8%, but we think they have suffered a much more substantial de-rating than large-cap stocks.

Cash, not Charles, is Finally King

Diversification has acquitted itself poorly in precisely the type of rough patch its proponents have been hoping for. So have some popular market-timing strategies, unless one has applied them across multiple asset classes.