Bear Market Rally

Feeble Bull Or Hibernating Bear?

At last October’s lows, we had yet to see any manner of economic, monetary, and valuation “reset” that would clear the path for a resilient cyclical bull. And, in the 51 weeks since that bottom, U.S. economic, monetary, and valuation conditions have only deteriorated further.

“Bear-Killing” Rally?

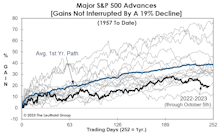

The S&P 500 came within 4% of its early-2022 high on July 31st, and some technicians insist that such a powerful recovery of bear-market losses has invariably been a bear killer. In both 1957 and 2000, however, bear rallies brought the SPX to within 1% of its prior high; and it’s worth noting, in 1957, the mid-July retest gave way to a recession in just six weeks.

Just A Typical Pre-Recessionary Rally?

Is the stock market disconnected from a souring economy? It might seem that way, and the topic dominated the discussion at the recent Market Technicians Association annual symposium.

Youthful Rally Already Looks Old

For more than a year, we’ve characterized the U.S. economy and policymakers’ decisions as increasingly late-cycle in nature, but that probably doesn’t do justice to the U-turn in the investment backdrop.

A Thrust Is Not Enough

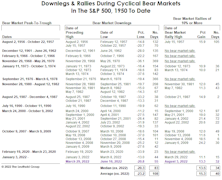

The S&P 500 rally off last October’s low reached +16.9% at its peak on February 2nd. That’s well below the largest post-WWII bear-market rally of +24.2%

What Does The Dow Have To Say About A “New Bull?”

Yesterday the NASDAQ 100 closed up more than 20% from its late-December low, prompting the media to enthuse that it had entered a “new bull market!” Sadly, though, the “NDX” has no company among the broad indexes: During this NASDAQ move, gains in the S&P 500 and Russell 2000 have been just 6.5% and 2.9%, respectively, while the DJIA is down 0.5%. (So much for January’s “breadth thrust!”)

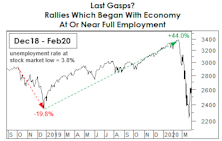

Rose-Colored Remembrances

Monetary conditions have worsened, recession evidence is piling up, and some of our Large Cap valuation measures have returned to their tenth historical deciles. However, with the economy near full employment we thought it worth revisiting the past to find examples where the market might have temporarily thrived under similar circumstances.

No Punch Bowl? No Problem!

Stocks are off to a strong start in 2023, and speculative juices are again flowing. In the final week of January, NASDAQ trading volumes were eight times those of the NYSE, a level seen only at the very peak of the meme-stock mania in early 2021. (Pre-COVID, the ratio oscillated between two and three. It’s a brave, new world.)

Fake-Out Or Break-Out?

“Don’t fight the Fed” was profitable advice dispensed almost daily by bulls in the 2nd half of 2020 and all of 2021. It’s been valuable advice in 2022, as well. However, when the Fed turned hostile earlier this year, the bulls deviated from their own sound advice and looked for new narratives.

No Rest For The Weary

If there’s a polar opposite to “Goldilocks,” this must be it. Not too hot and not too cold? What about both? Job growth and inflation are hot enough to force the Fed to follow through on its hawkish promises. But the leading indicators continue to warn us of oncoming cold. The odds that the porridge settles at the right temperature, without an intervening recession, look longer by the day.

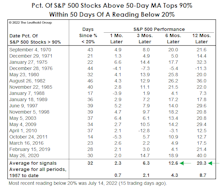

The Rally: Impressive, But Not Yet “Thrust-Worthy”

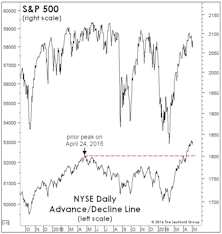

Many technicians contend that the rebound off June’s lows triggered a bear-market-killing “breadth thrust.” Several gauges we monitor to capture this phenomenon contradict that claim. None has reached a threshold that is extreme enough to qualify as a thrust.

Bear Market Rallies In Context

The 2022 bear market is the 13th cyclical bear since 1950, and it’s already joined the mightiest half of its predecessors based on the fact that it’s actually contained a bear-market rally. Six of the prior 12 bear markets weren’t interrupted by even one rally of at least 10%.

“Toro Nuevo” Or Mirage?

While our breadth measures do not consider this rally to be thrust-worthy, when based on nothing more than performance, it’s difficult to distinguish between the “first up-leg” in a new bull market and a bear-market rally. The vital signs at present appear to be more in-line with the latter (although making that conclusion based on price action, alone, is hardly better than a coin toss).

Overheated?

Living in Minneapolis, we’re bewildered by the absence of research considering global warming as potentially a good thing for certain organisms. That’s especially true for creatures where the science is almost nonexistent—like the stock market. Record heat wave? Bring it on!

Did The 20% Bounce Kill The Bear?

We rolled our eyes when Barron’s and others proclaimed a “new bull market” after a three-day, 21% surge off the March low. That incredible bounce is much more likely to be the first of at least a few bear market rallies.

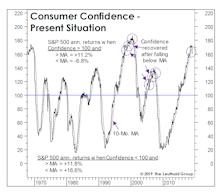

A Confidence Game

Several consumer confidence gauges plunged in the wake of the Q4 market decline (as expected), and then rebounded in a lagged response to the stock market recovery (again, as expected). But March saw the largest one-month drop in consumers’ assessment of their “Present Situation” since 2008.

Yet Another Anniversary?

We received two media calls in December hoping we would comment for upcoming special features about the tenth anniversary of the bull market. We rolled our eyes.

Sizing Up The Rally

There’s an old saying that bear market rallies look better than the real thing, yet the upswing off December lows looks even better than the typical bear market rally.

Sizing Up The Rally

While our MTI became bullish in mid-April, we can’t rule out that the rebound from February lows could be an impressive bear market rally. However, this rally sports impressive technical credentials.

Bear Market Rally Or New Upswing?

Richard Russell—who wrote Dow Theory Letters for almost 60 years before his death last year—observed that “bear market rallies look better than the real thing.”

Labeling The New Up-Leg

The short-term market surge certainly possesses the hallmarks of many previous bear-killers (or correction-killers)…but it also sports the look of many historical bear market rallies.

Bear Market Rally or Bull Market?

Major Trend Index improved to Neutral but not offering any guidance as to whether this is a bear market rally or a bull market.

New Bull? Second Leg?.....Or Bear Market Rally?

This move now appears to be a “second” leg, not an extraordinarily large bear market rally and not a new cyclical bull market.

So, What Happened?

Hopefully clients read the late July Interim memos. Truthfully, the move is a tad more than expected. What now? The last calculation of the Major Trend Index produced a still negative but improved reading. A new reading will be available August 7. Just a huge rally or a new bull market? I think it’s the latter, but want confirmation from our Major Trend Index.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)