Bloomberg US Aggregate Bond Index

The Return Of Returns

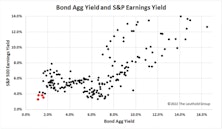

A distinguishing feature of fixed income securities is that the expected return on a bond over its remaining lifetime is known with considerable certainty at the time of purchase. This characteristic can be a blessing or a curse, the negative aspect coming into play during an asset price bubble. Equity investors can justify almost any price as they dream of boundless riches arising from the bubble’s driving theme, limited only by their imagination. However, a bond’s yield to maturity is known at the time of purchase and this is the return investors in aggregate will earn. Even during the euphoria of an asset bubble, the expected outcome - the return of par value at maturity - is also the best-case outcome, and that is where our story begins.

The 60/40’s Annus Horribilis

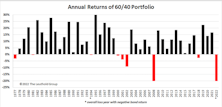

The balanced portfolio strategy of allocating 60% to equities and 40% to fixed income generated a highly satisfactory 7.9% annualized return over the last 30 years. Despite the excellent returns earned by investors following this strategic model, the past couple of years have seen a parade of articles with headlines such as “Is the 60/40 Portfolio Obsolete?” and “Is the 60/40 Dead?” Given the central importance of this moderate allocation strategy to investment industry practices, we felt a closer look at the 60/40 portfolio was in order.

Research Preview: The 60/40 Skeptics Were Right

The 60/40 strategy is having a terrible year, and its failure to protect investors in the bear market prompted us to take a look at the history and theory of the 60/40 guideline. We offer an early preview of the study, with a focus on 2022’s abysmal year-to-date returns.