Small Caps

Small Caps: Unresponsive

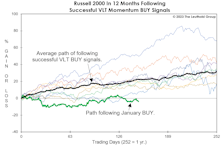

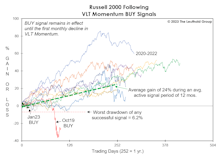

Based on successful Russell 2000 VLT BUY signals, 1982-forward, the index had gained an average of 23% eight months later—and none had a losing position. Since the VLT BUY on January 31st (eight months ago), the Russell 2000 has dropped 3.9%. Furthermore, Small Caps bottomed 15 months ago, and in a normal cyclical bull market, the Russell 2000 would be up 50-70% by this time.

A Small-Cap Conundrum

Data included in the accompanying tables are normally placed in the Green Book’s Appendix, but we added them here to make an important point: Deteriorating market breadth and Small-Cap underperformance are not necessarily the same thing.

Factor Tilt Update—June 2023

This Leuthold Refresh updates our Factor Tilt analysis, an ongoing process to evaluate the attractiveness of commonly accepted investment styles. Factors are investment characteristics that have historically produced excess risk-adjusted returns, but relative results fluctuate over time.

Small Caps Missed The Memo

For the first time since 1946-47, the super-bullish, six-month window beginning with the mid-term elections through the following April, failed to see a material upswing in Small Caps.

Small Caps Getting Cheaper By The Day

It was September 2020 when we suggested that a new multi-year phase of Small-Cap-stock leadership had begun. Almost immediately, the Russell 2000 reversed a big chunk of the prior decade’s underperformance. Unfortunately, that was the extent of the run.

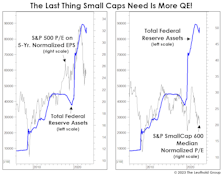

QE Fuels Inequality—Even Among Stocks

We don’t know enough about banking-system mechanics to conclude if the Fed’s balance-sheet increase associated with March’s bank bailout constitutes a new round of QE. But if it is, we’re skeptical equity investors should celebrate it. In fact, those running Small-Cap portfolios should probably fear it!

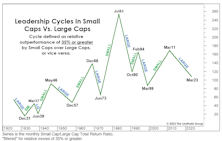

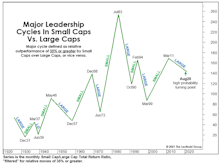

The Cycle That Never Was

At 144 months, this is now the longest Large-Cap cycle on record, but its dominance will have to prolong to eclipse the second-longest leadership phase (1946-1957), in which Large Caps achieved a 190% performance spread above Small Caps.

Small Caps: We’ve Seen This Setup B-Four

In mid-2020, we wrote that a new multi-year leadership cycle had probably begun. Technically, that belief hasn’t been disproven, but the extent of outperformance has been disappointing in the nearly three years since.

Small Cap Malaise

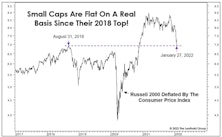

Imagine telling a Small Cap investor in mid-2018 that: (1) the U.S. economy would spend all but two months of the next 4-1/2 years in expansionary mode; and (2) M2 money supply would increase by 50% in that time, and yet the Russell 2000 would gain a grand total of just 9% over the same span.

VLT Update

The progression of bullish technical evidence since October’s S&P 500 low is compelling, though not overwhelming. With that low now almost four months behind us, the VLT Momentum oscillator for the S&P 500 probably “should” have already triggered a new BUY signal. Yet, both the S&P 500 and NASDAQ Composite are still holding out.

Growth vs. Value vs. Cyclicals

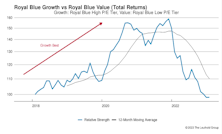

Both Growth and Value Small-Cap style boxes gained 10% in January’s rally. However, SC Growth remains well in the rearview mirror since its relative strength peak in September 2020: Small Cap Growth +8% versus Small Cap Value +60%.

Seasonal Nightmare Ending?

We’ve reminded dejected readers throughout 2022 that this year was statistically “cursed” from the onset. It’s a year ending in “2” and a Shmita year on the Jewish calendar, both of which have been associated with far below average stock market returns. More importantly, it’s a midterm election year, traditionally the weakest of the four-year cycle.

Supercharging VLT With Small Caps

Leuthold did not invent VLT. The credit goes to Sedge Coppock, a technical analyst who insisted on being called an “econometrician.” While the famed Coppock Curve was based on the Dow Jones Industrial Average, Leuthold found the algorithm useful at the industry group level—it is a component within our Group Selection (GS) Scoring system.

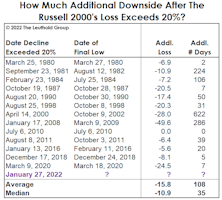

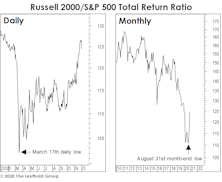

Two Ways To Spin The Russell 2000 “Bear Market”

At the market’s January 27th close, the headline blared, “Russell 2000 Enters Bear Market.” Well, not exactly. If one accepts that a 20% decline constitutes a bear market, then the bear actually began on November 9, 2021—the day after the Russell 2000 peak.

Easy Money? Not In Small Caps

One might have predicted that big beneficiaries of war-time-style levels of federal spending, financed by money printing, would be Small Cap stocks. And from March 2020 until March 2021, they were. But the larger picture is sobering.

Small Caps’ Three-Year Ride To Nowhere

Yesterday, the Russell 2000 closed down 20.9% from its November 8th high, and market bulls have conceded it was “due” for a pullback after a 146% gain off the March-2020 COVID lows.

The Russell’s decline is moderate by the historical high-beta standards of Small Caps. However, this drop—combined with other developments transpiring over the last few years—has produced a shocking result: The Russell 2000 is now unchanged on an inflation-adjusted basis since its “Quantitative-Tightening Top” of August 31, 2018. But what a three-year ride it’s been!

Speculating In “The Nebs”

One measure of a bubbly bull market is the degree of speculative fervor embedded in the prices of companies with nebulous, indeterminate, or even nonexistent intrinsic values. Since the bear market low in March 2020, speculative manias have evolved in a menagerie of asset classes including Innovators & Disruptors, SPACs, meme stocks, crypto currencies, and NFTs. Based on the breadth of valuation extremes across numerous and diverse assets, this bull market may rank second to none.

A Squandered Small-Cap Opportunity?

We know our view on this is controversial, but we like the relative prospects for Small Caps—even though we still believe the broad stock market is currently the most speculative one in U.S. history.

Research Preview: Style Swings In 2021

Despite elevated uncertainty over pandemic developments and expected policy tightening, and in the face of aggressive valuations, the S&P 500 still managed to gain a delightful +28.7% in 2021. Even more noteworthy, in our opinion, is that this advance came with nary a single correction of more than 10%.

Not Overthinking Small Caps

There are some positive cyclical influences for Small Caps, like higher inflation and deeply negative real interest rates. But in our minds, the valuation spread versus Large Caps is more important.

A Look At The Small-Cap Setback

The Russell 2000 has blown the 14% lead it had built against the S&P 500 earlier this year, and now trails the index by almost 5%. Has that type of intra-year reversal happened before, and, if so, did it portend a major change in leadership?

Digging Out Of The Red

An unprecedented number of companies are still deep in the red, even while the economy is shrugging off the impact of the pandemic. Small-cap growth companies are showing no sign of a quick recovery.

A Small-Cap Theory Of Relativity?

Small Cap median valuations are among the highest in our 40-year database, but they are bottom quintile versus the nose-bleed level of the median Large Cap. If this Small Cap leadership cycle only matches the shortest one on record, it will last another three years. Based on the valuation gap, that guess seems conservative.

Small Cap Synchronicity

Small cap stocks are often seen as a bullish, risk-on, pro-cyclical asset class. They benefit from economic growth, rising inflation, widening margins, and the willingness of investors to move out on the risk spectrum. The pandemic recovery has created these very conditions, and small caps responded right on cue by posting a blockbuster price gain of 130% since the COVID-19 bear market low of March 23, 2020. Because the pandemic was a global economic and health care catastrophe, we were curious to see if small caps behaved similarly in other regions.

Active Vs. Passive Return Drivers March 2021 Update

Our ongoing research into the relative performance of active vs. passive styles reveals that market conditions play a significant role in the active/passive return cycle. We identified a set of metrics that describe the market conditions we believe influence which management style is more likely to outperform. This note updates our data through March 2021.

Research Preview: Global Small Caps

U.S. small caps have posted blockbuster price gains coming off the pandemic bear-market low in March 2020. We were curious to see how international small caps have performed since then, and launched this project to learn how this asset class has recently behaved in other regions.

Equity Financing On The Rise In Some Market Segments

With the equity market at all-time highs and abundant liquidity in the economy, it is probably not surprising to see that CEOs are taking note: Equity issuance is on the rise, especially for small-cap companies.

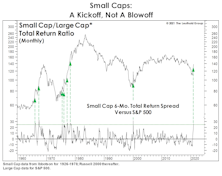

Small Caps: It’s Still Early

Technical analysts continue to be aghast at the relentlessly “overbought” readings generated by Small Cap stock indexes. However, last month we noted that such extremes had previously presented themselves only at the early or middle phases of a Small Cap leadership cycle—never at the end of such cycles.

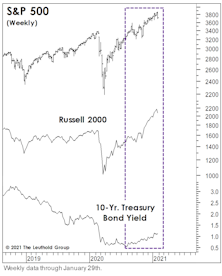

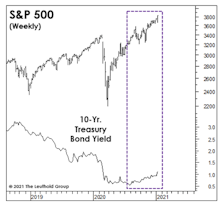

Stocks In The Face Of Rising Yields

With yields on the 10-Yr. Treasury finally breaking above 1.00% last month, the consensus has quickly evolved to the view that stocks and yields can continue to rise alongside one another for a while. Small Caps have shown a decisive performance edge during the recent episodes.

When “Overbought” Is Bullish

The recent months’ surge in Small Caps has been historic, and the Russell 2000 continues to register ridiculously “overbought” readings on many technical oscillators. In the short-term, that might be a cause for caution on the overall market. However (and perhaps counter-intuitively), this extreme strength cements our view that a long-term leadership cycle in Small Caps is underway.

Rising Rates And Rising Stock Prices?

Often, what market pundits like to pass off as bold, contrarian forecasts are merely rationalizations and extrapolations of trends that have already been in place for some time.

Momentum Across Asset Classes

In the extreme case where one possesses no other information beyond last year’s total returns, the best single-asset strategy has been to buy the second-best performer (the “Bridesmaid”) and hold it for the next twelve months in hopes that the prior year’s momentum will carry it through. That approach has beaten the S&P 500 by 3.7% annualized over the past 48 years.

Y2K 2.0?

Cap-weighted valuations for the S&P 500 and S&P Industrials are homing in on the all-time records seen in the first quarter of 2000. We’ll confess that after those valuations collapsed in the years that followed, we thought we’d never see them again in our lifetime—let alone a mere generation later.

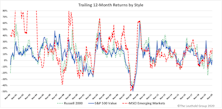

Style Rotation: Anything But Growth

Driven by massive government stimulus, an imminent vaccine rollout, and the expectation of record earnings in 2021, investors seem to be on the verge of embracing a move away from Large Cap Growth stocks in earnest. The leading candidates offered as broad-based alternatives to Large Growth (LG) include Value, Small Caps, and Emerging Markets.

Just A “Small” Beginning...

Knee-jerk contrarians are already claiming the stampede in Small Cap stocks is “too consensus” to continue in the near term. We couldn’t disagree more. In fact, we are very confident that a new multi-year Small Cap leadership cycle has kicked off.

Research Preview: Rotating Away From Growth

This study examines Value, Small Cap, and Emerging Markets to see if they do, in fact, behave in a correlated manner when viewed as alternatives to Large Growth. The goal is to determine whether this trio of rotational favorites can be considered as broadly-equivalent replacements for LG.

Podcast #23 - Investors Face Disparate Choices

Perusing current equity-investment possibilities highlights a diverse set of choices. Focusing on only two primary attributes—relative price and relative earnings—illustrates considerable diversity among the major investment styles.

VLT’s Struggles Are Telling Us Something

Our Very Long Term (VLT) Momentum algorithm has been a very good “confirmatory” market tool over the years, especially at the onset of a new cyclical bull market. But VLT has proven to be of little to no value in navigating this year’s gyrations. VLT’s latest flip-flops reinforce our view that the market leaderboard is set to be rearranged.

Small Cap Catch-Up?

The big jump in Small Caps over the last two weeks has entirely reversed the segment’s summer underperformance and has technicians feverish about another “breath thrust.” Technically, it’s impressive, but we are more intrigued by the fundamental potential for continued Small Cap (and Mid Cap) outperformance.

The Valuation Case For “SMIDs”

Mid and Small Cap stocks underperformed in 2018 and 2019. However, after the collapse of February and March, these “SMID” Caps have largely kept pace with the torrid rebound in the blue chips. Today’s valuations are priming the SMIDs for a similar “decoupling” in the years ahead, like that following Y2K.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)