GDP

Fiscal “Juice?”

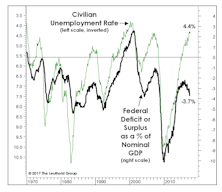

Not to pick a fight with Keynesians (or other economists), but we’re reluctant to label the explosion in the federal deficit as unequivocally “stimulative.” Some factors behind the increase probably do boost the economy, but others simply rob Peter to pay Paul.

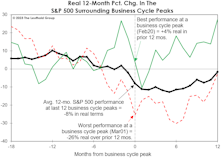

Has The Stock Market “Eased?”

The path of real stock prices in the current cycle looks very different from the typical pre-recessionary track. In fact, based only on the chart of performance in real terms since January 2022, we’d probably believe the economy has recently emerged from recession.

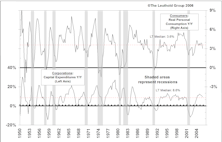

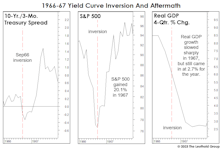

1966-67: When The Yield Curve “Failed”

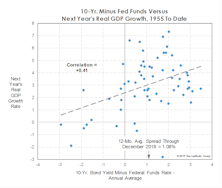

Given the tendency of economists and strategists to dismiss the message of an inverted yield curve, it’s surprising there’s been no scrutiny of the “dog that didn’t bark”—the inversion of 1966. That’s the last time an inverted curve did not lead to a recession.

Some Perspective For Dip Buyers

Losses in the Russell 2000 Growth Index and the NYFANG+ Index have topped 40%, and the only true equity rockstar, spawned by a 13-year secular bull market, has watched her fund’s value drop by more than three-quarters. Yet there’s still a televised debate as to whether this decline is even a bear! Could there be a more devious creature on the face of the planet?

Time To Start Thinking About “Thinking About…”

The COVID collapse showed the Fed could abandon its clunky forward guidance and make the appropriate “pivot” when the facts changed. Now that facts have changed for the better, the Fed is right back to the rigid and dogmatic approach that characterized Fed-speak for almost all of the last economic expansion.

The Case For “Five Percent”

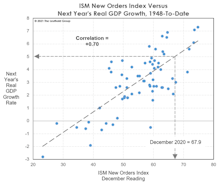

Forecasting GDP is hardly our forte, but 2021 should see a very big gain in real output. Our current guess is for real GDP to grow 5% this year. Statistically, though, that doesn’t imply that the stock market’s move will also be large (or even of the same “sign”).

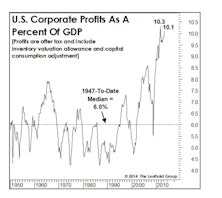

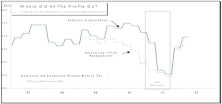

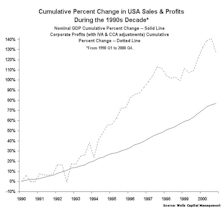

Margins Prove Capitalism Still Works

Corporate profits were outstanding last year, but even the benefit of a 40% cut in the top income-tax rate wasn’t enough to lift the net profit margin back to the all-time high of 10.6% established in early 2012. Still, the latest 10.0% figure is more than a percentage point above the 2007 cycle high and about two points better than any other cycle high.

Watch What They Do, Not What They Say

While the celebration over Jerome Powell’s “Christmas Capitulation” lingered throughout February, we’re still awaiting signs the capitulation consisted of anything more than words.

Yields Might Be Throwing A Curve

While the number of recession forecasts is on the rise, there’s a general reluctance among economists to project a downturn in the absence of a yield curve inversion.

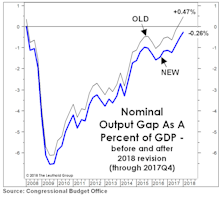

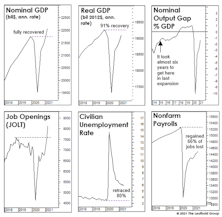

The Gap Is Back!

We celebrated the official closure of the GDP Output Gap in December, but that milestone was revised away in April by the statisticians at the CBO through a downward adjustment to the estimated rate of “full employment.”

Cashing In On The LEI?

The consensus view is that the stock market will be fine as long as there’s no recession in sight.The same LEI that has displayed a fine GDP forecasting record has shown essentially no relationship with S&P 500 forward twelve-month performance. In fact the regression line shows a slight negative slope!

Not A Tipping Point, But A “Toggle” Point?

Evidently, being a bull in a bull market is no longer good enough.

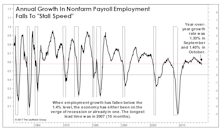

Below “Stall Speed”?

The last few months have served up some of the strongest readings observed during the U.S. economic expansion.

Don’t Look Now, But...

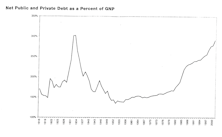

We recognize it’s uncultured to discuss federal debt and deficits during a multi-year bull market, but in economics and investing it frequently pays to worry when others don’t, and to stop worrying when others do.

Earnings: What Is Normal?

Corporate profits are notoriously cyclical, and for decades we’ve sought to temper their swings by using a five-year smoothing of S&P 500 EPS in our valuation work.

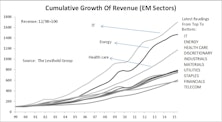

Searching For Growth In Emerging Markets

Even though the ten EM sectors are growing at a much stronger pace than corresponding U.S. sectors on the Top-Line, only a small margin exceed the U.S. in terms of EPS growth.

A Look At The Impact Of Lower Energy Prices On Countries

A big question for investors is: have oil prices bottomed? For the past four days, WTI jumped 19% from its low reached on January 28th, giving some the conviction that prices are reverting back to prior high levels.

Corporate Profits In 2014

Earnings growth over the next few years will—in the best case—be forced down to the rate of top-line growth (nominal GDP).

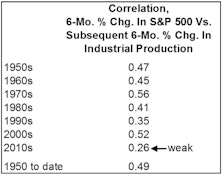

Stocks And The Dismal Science

Has recent Fed experimentation compromised the stock market’s “social function” as an economic forecasting tool?

It Doesn’t Get To Look Any Better

Ben Bernanke seems at peace with his looming retirement from the Fed. He’s certainly more relaxed and confident, and even looks more youthful. So much so, in fact, that Ben’s last appearance had me thinking of a young Tom Cruise - or more specifically, Cruise’s character Pete Mitchell (“Maverick”) in the 1986 film Top Gun. Remember when Maverick froze up during a dogfight with a Soviet MiG fighter, with his crosshairs trained perfectly on it?

Maverick: “Uh, it’s not good. It doesn’t look good.”

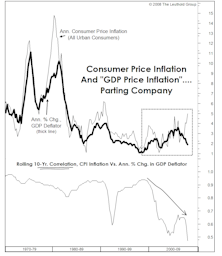

Market Interrelationships: “Unlearning” What We Thought We Knew

Doug Ramsey examines several once very reliable relationships between stocks, bonds, inflation, and commodities.

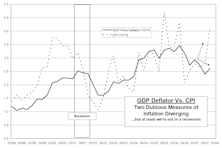

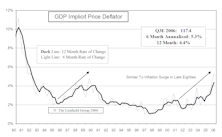

The GDP Report: “Exhuming McCarthy”

Significant disconnect between GDP Deflator and CPI. Recent GDP report implies a 1.1% inflation rate. It is ridiculous to assume the inflation rate is that low with the CPI at +5.5%.

The GDP Report You Didn’t Read

We’re back on form after last month’s praise of government economists... questioning the value of the GDP Deflator.

Economic Watch

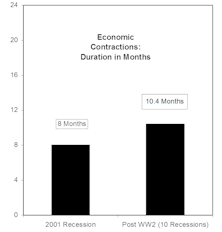

Even though government statistics do not yet indicate a declining quarter of real GDP growth, we believe we are, in fact, in the grip of a recession.

The Economy And The Stock Market

The stock market tends to peak out 6-12 months prior to recession but turns back up prior to the end of a recession.

U.S. Economy Skirts Recession In Q4, Or Does It?

It now appears that the downward bias in inflationary pressures suggested by the CPI data is tame compared to the GDP Deflator. And if this is true, investors may be operating under a false sense of security that economic growth remains positive (albeit ever so slight).

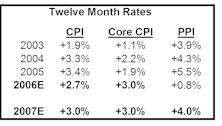

Inflation Is A Potential Threat

Inflation prospects are especially unclear. While many inflation gauges seem to be slowing, the threat of an inflation flare-up remains.

Today's Economic Recovery In Perspective

On a long term basis, we continue to be concerned about the sustainability of the current economic expansion, and we expect a significant slowdown by mid 2007.

Inflation Watch

CPI on a twelve month basis expected to decelerate further over the next month or two. Final two months of the year, however, could be another story, with CPI twelve month inflation reaccelerating.

Inflation Watch

CPI on a twelve month basis is expected to decelerate further over the next two months. The final 3 months of the year, however, could be another story.

Has The Yield Curve Lost Its Luster?

The traditional definition versus the new definition of an inversion...How real GDP has responded historically to past yield curve inversions….Effect of inversions on Financial stocks.

Update On The Economy….Q4 Just A Bump In The Road...Or Something More?

Real GDP in Q4 was not too robust, but the numbers will likely be revised upward.

Corporate And Consumer Too Leveraged?

Increased reliance on debt to finance growth can cause problems down the road.

Total U.S. Market Capitalization As A Percentage Of GDP: An Alternative Valuation Perspective

Total U.S. Market Capitalization As A Percentage Of GDP: Identifying “Fair Value.”

Are There Any "Good" Numbers These Days?

Revisions continue: How many revisions are possible?

Unreal Expectations, Unreal Money = Lingering Pain

By Kate Welling - Companies are still acting, by and large, as if they have an inalienable right to spin numbers in whatever direction produces the most pleasing results.

View From The North Country

What are the economists missing? Dismal performance by practitioners of a dismal science! Jim Bianco, Bianco Research L.L.C., helps shed some light on the subject: “GDP Reality vs. Perception”.

October: The Month Of Market Train Wrecks

Steve thinks too many people are looking for an Octber train wreck for it to happen, maybe in November. Market currently very short term oversold.

Profitless Prosperity

Earnings are declining, while stock prices are marching higher. GDP strong, but corporate profits have weakened considerably.

Bond Market Summary

Bond market looks attractive on 6-12 month basis. Economic expansion long in the tooth, but still surprisingly strong...Fed may tighten next time to slow down economy. Inflation cool, but wage pressures a worry.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)