Oil

2023—A Year Of Round Trips

The S&P 500 index painted a picture of a runaway market in 2023, but for a lot of non-equity markets, 2023 was a year of round trips.

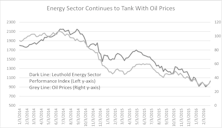

Energy: Kicking A Dog When It’s Down

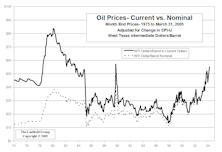

With crude trading at only about half the level seen in the first few years of this expansion, there might be a tendency to view its current price as depressed. But from an inflation-adjusted perspective, today’s price sits right on top of its modern-era (post-embargo) median.

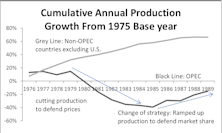

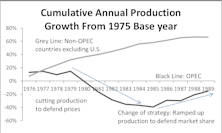

Recent Years’ Oil Price Experience Akin To 1980s’

We revisit commentary we published in 2015 regarding the late-2014 oil price crash and review why, at that time, we believed oil prices could stay at depressed levels for a longer period than most expected. Additionally, we advise avoiding two Energy sector segments: companies with high balance-sheet risk, and Energy Royalty Trusts.

Factor Performance Reverses

With the exception of Value, March was a bad month for quantitative factor performance. Every other factor category we follow underperformed, with Momentum posting its second consecutive –5% spread.

Big U.S. Banks: We Have A Motion, Is There A Second?

YTD the S&P 500 has fallen 2% while the S&P 500 Banking industry group is down over 12%—a shortfall that has the attention of value investors and contrarians seeking a chance to buy high-quality banking franchises at fire-sale prices.

Bottom-Fishing In Energy: Beware Of Bankruptcy Risks

New developments have lifted sentiment toward oil and Energy names, but we caution bottom-fishers to be mindful of risks. The fundamentals in the oil patch do not yet support strong oil prices going forward.

There’s Always A Hook...

Bear markets need a “hook”—some sort of misdirection that keeps the majority hoping. Our work suggests a primary bear market is underway, and we fear oil is this bear’s hook…but the problems run deeper than oil.

The Bullish Case: A Mental Exercise

We’ve been correctly positioned near our tactical portfolios’ equity minimums, yet we’re oddly compelled to use this month’s “Of Special Interest” section as a very public second-guessing of that move.

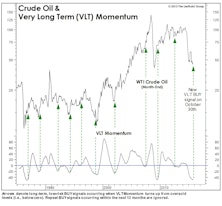

VLT Flashes A BUY On Oil

As expected, our VLT Momentum algorithm triggered a “low-risk” cyclical buy signal on crude oil in late October, only the 11th buy signal in the past 30 years. This algorithm was originally designed to identify low-risk entry points into the stock market, but we’ve found it useful with other assets as well.

Oil Price “Crashes” In Historical Perspective

In view of the last year’s steep decline in oil prices, Energy has been a frequent headline topic.

Declining Crude Prices Good For Emerging Markets?

The price of crude oil staged a dramatic change of fate in the past few months, and the bottom is still nowhere in sight.

A New Leg In The Commodity Decline?

For more than two years we’ve discussed the supply-side risks to commodity producers stemming from capacity built during the manic “Third Act” of last decade’s Three Act Play in commodities. Commodity-oriented equities have indeed underperformed since 2011, but to date, most pundits have laid blame squarely on the demand side.

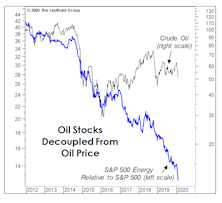

Buy Energy Stocks

Why is right now a great time to buy Energy stocks?

Like Oil & Water: The “Correlation” Between CleanTech And Petroleum

We examine the correlation between CleanTech and Petroleum and find that, contrary to what is commonly believed, the overall correlation between oil prices and Clean Technology shares is rather weak.

Will the Disaster in the Gulf Present an Opportunity for Alternative Energy Stocks?

In this month’s “Of Special Interest”, David Kurzman, manager of the “Leuthold Global Clean Technology” mutual fund provides his take on whether the Gulf oil spill will present any real opportunities for alternative energy stocks.

Point And Counterpoint: Big Oil

Client disputes Leuthold’s call for big oil to invest in alternative energy business. Read Steve’s in-depth rebuttal.

View From The North Country

Steve's commentary on the stock market's Wall of Worry, the oil patch and mining company squeeze, the abusurdity of corn to ethanol and the world's most valuable companies.

View From The North Country

Everybody sure hates the Homebuilders. However, contrarians should take note of this month’s analysis of earnings prospects, insider selling/buying, and the outlook for future housing starts. Now is not the time to be bottom fishing here. Nor is it time to be buying oil stocks.

Cautious On Oil Stocks In The Short Term

Surprised that crude oil did not soar above $70. Price of crude seems to have double topped at $70 and some correction is expected in coming months.

Is Oil Overvalued Relative To Industrial Metals?

In comparison to crude oil, industrial metals are beginning to look like a real bargain.

View From The North Country

In my opinion, the U.S. stock market is entering the terminal phase of the current cyclical bull market, based on our historical studies of typical cyclical bull market duration and magnitude. To a lesser degree the same can be said for the economic expansion.

View From The North Country

A recap of the year so far, and our outlook for the second half of 2005.

New Histogram: Oil Prices Vs. The S&P 500

This month, Eric Bjorgen presents a unique take on stock market valuations, by determining how many barrels of oil it takes to buy one unit of the S&P 500. Based on the historical relationship, the stock market is not overvalued versus oil.

Energy Prices In Perspective

With oil and gas prices continuing to make new highs, we thought it would be helpful to put some perspective on rising energy prices.

View From The North Country

Continue to conclude the cyclical bull market prevails but my level of conviction is down a few notches. Also, an oil message from the market and “Don’t Be Economic Girlie Men”.

Sector Spotlight...Energy

Based on oil futures prices, 2005 year-end consensus earnings forecasts for the Integrated Oil & Gas group appear too low! These too-low forecasts imply further upside for oil shares, and, at the very least, limited downside relative to the rest of the market.

View From The North Country

Steve's Half Time Report: A recap of the year so far, and our outlook for the second half of 2004.

View From The North Country

Leuthold believes the big depressant to stock market these days is not necessarily potential for rising interest rates or higher inflation, but instead is due to the gray cloud of the Iraq situation. Good news is that U.S. may be starting to extricate itself from the Iraq quagmire, and that could be a very bullish development in June.

Reprint Of Early April Conference Call

Special reprint of Steve Leuthold, Byron Wien and Charley Maxwell conference call from early April.

New Select Industries Group Holding: Oil Services...Lookin' Mighty Slick

This oversold group has already begun recovery from early-1999 lows, but is still down 44% from 1997 high.

View From The North Country

With margin debt soaring, it’s past time for the Fed to boost margin requirements. Charlie Maxwell offers unique insights on the oil patch. Rapidly deteriorating U.S./China relationship could have severe implications.

Energy…Global Giants: Oil Could Be a Slick Investment

New sector activated with a focus on the major oil companies from around the world.

The Oil Patch

Yes, we also should have bought these last month. The sector moved up another 5% in March.

Bond Market Summary

The recent improvement in the bond market is probably not the result of the politicians’ weak kneed program to deal with the deficit. Rather, it more likely stems from the lack of bad news from the Middle East and growing evidence that the economy is in a recession.

Bond Market Summary

As things heated up in the desert, the bond market swooned. Late in August, Middle East tensions eased somewhat, with the dollar and the bond market staging a rally, trimming the losses for the month. Nevertheless, bond market damage in August was still severe.

Oil Patch Cutback Begins

Our diversified index of oil related stocks is now up 110% from its lows of last summer, although still 22% below its 1980 peak. However, the relative strength line is now approaching its 1980 to date downtrend line.

Oil Patch Update

We continue to believe the Japanese Oil Patch invasion will develop and the sector continues to look oversold and cheap, with most institutions significantly underweighted. Larry Jeddeloh spent part of November on the west coast, combining a research trip with some client visits. Here are his observations.

View from the North Country

Update on the coming Japanese Oil Patch invasion: We are now even more convinced, it is only a matter of time.…ARFF (Angry Revengeful Frequent Flyers) – You too can be a member!

Japan and Oil

We would not be at all surprised to see the Japanese becoming quite active in acquiring foreign oil reserves and perhaps investing heavily in some major oil companies. In this section, nine major reasons are given to support this contention.

View from the North Country

Fiscal Responsibility Update...Who were the bad guys this year? How to make a killing in the Oil Patch and an update on Australian bond.