Momentum

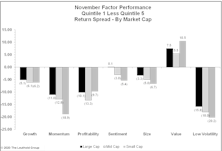

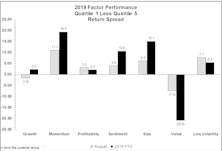

Extreme Factor Dispersion

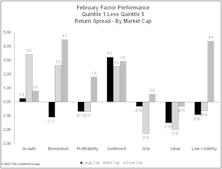

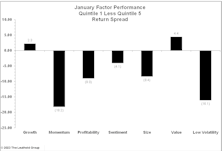

Dispersion remains elevated among factors, with growth selling off and momentum turning in extreme performance spreads. Low-volatility names finally did well after a long stretch of underperformance.

Research Preview: Show Me The Mo’

In a year when the Magnificent Seven has epitomized the concept of price momentum, investors who spotted that phenomenon and employed a momentum ETF to capitalize on the trend were not rewarded: Owning MTUM or SPMO not only forewent the tech titan rally, they both badly lagged the S&P 500.

The Calm After The Storm

Factor performance stabilized in February, recovering from a brutal start to the year. While those dynamics bled into the first two days of February, the trend quickly reversed as interest rates bounced off recent lows and stayed on an upward trajectory for the rest of the month.

Losing Momentum

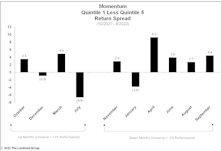

After working well in 2022, Momentum took a beating out of the gates in 2023. Investors rejected the winners from last year and returned to the lowest quality and most speculative winners from the previous low-rate playbook.

Momentum Offering Downside Protection

In a volatile year, protection is coming from what many may deem an unlikely suspect—the momentum factor. Contrary to popular belief, momentum tends to work better in down months than up months.

Factor Returns And A Basket Of EGGs

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

Additional Factors

The six-week rally that started mid-June featured advances from AAPL (+25%), AMZN (+30%), and TSLA (+39%), which accounted for one-fourth of the S&P 500’s gain. Despite the recent preference for Value, a spike in interest rates, and the bear market, the index’s concentration in the top-five firms is still near it’s all-time high set in August 2020.

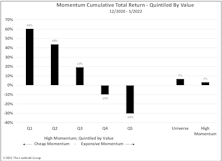

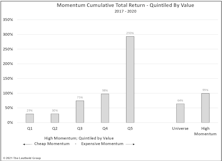

Reversal Of Fortune For ValMo Investors

From the end of 2020 through May, stocks in the top quintile of both value and momentum have returned 60% versus 7% for the overall universe. That compares to the brutal stretch from 2016-2020 when the only way momentum investing worked was to not only disregard valuations, but to actively buy the most expensive momentum stocks.

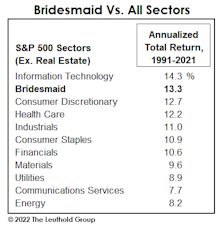

Bridesmaid Sector Track Record

As noted, the Bridesmaid sector strategy has underperformed what has become a more difficult benchmark in five of the last six years. Those poor results have cut the annualized excess return of this approach to just +2.1% since 1991.

Bridesmaid Strategy For Equity Managers

Once again, the idea is to dispense with macroeconomic trends, sector fundamentals, comparative valuations, and to base sector selection solely on the prior year’s total returns.

Momentum: Not Just For Stock Pickers

For those not blessed with clairvoyance, we’ve developed an asset selection strategy that’s done very well, historically, compared to the “naïve” AANA Portfolio and even against the almighty S&P 500. We’re not implying that investors dump their valuation models, economic forecasts, or their intuition. But they should recognize that price momentum tends to persist—not just among stocks and industry groups—but at the asset-class level as well.

These “Insiders” Have Exited; Should You?

What if the S&P 500’s September 2nd closing high were to miraculously stand as the cycle’s high-water mark? If it did, the peak was presaged—in retrospect—by two Federal Reserve Bank presidents who rode the liquidity wave all the way to its crest after assuring the floodgates would be left wide open. Both resigned in September.

A Lost Decade For Emerging Markets

Fading momentum in GDP growth, sizable dislocation of corporate EPS in the midst of an expansion, and U.S.-dollar weakness have all made EM equity investments inferior to U.S. stocks over the last decade.

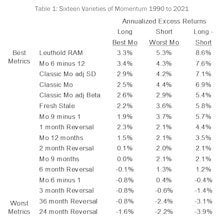

Can Mo Outrun A Bear?

Hiker #1: Can you run faster than that hungry bear looking at us?

Hiker #2: I don’t need to run faster than the bear, I just need to run faster than you.

The Momentum style of investing has a long history of generating excess returns, and ranks near the top of the list of essential smart beta factors. However, Momentum also has a dark side; it is prone to severe drawdowns whenever the market makes a significant reversal.

Val-Mo (Finally) Explodes Higher

After years of underperformance, investors who pay attention to both Momentum and Value are finally being rewarded. The turnaround has been substantial, but the relative valuation of expensive Momentum vs. cheap Momentum stocks is still extremely elevated by historical standards.

Momentum: “New Junk” In The “Old Trunk”

March 23rd marked the one-year anniversary of the COVID-19 bear-market bottom. We are all eager to turn the page on the pandemic ordeal and move forward to brighter days ahead. Looks like some big help is coming our way.

Momentum Across Asset Classes

In the extreme case where one possesses no other information beyond last year’s total returns, the best single-asset strategy has been to buy the second-best performer (the “Bridesmaid”) and hold it for the next twelve months in hopes that the prior year’s momentum will carry it through. That approach has beaten the S&P 500 by 3.7% annualized over the past 48 years.

Factor Chaos

The November 9th Pfizer vaccine news compressed an entire Momentum reversal into one historic day. Factor performance easily broke records looking back over our entire history of data. While great news for the general public, it was awful news for Momentum indicators.

Momentum’s Terrible, Horrible, No Good, Very Bad Day!

If Momentum and Growth investors thought they were escaping 2020 unscathed, they learned otherwise on Monday. Pfizer’s promising news about a COVID-19 vaccine was met with universal excitement and investors rearranging portfolios—taking gains in long-term winners and plowing into beaten-down cyclical stocks.

How Sharp Is This Falling Knife?

While it’s possible that Monday’s S&P 500 low of 2,386 will represent an important trading low, we believe it is too early to expect the market to form a major bear market low.

Factor Performance During Sell-Off: Momentum Dominates

Momentum made up for a lackluster 2019 by providing protection during the volatile market correction, while Value continued to be punished. Momentum remains expensive relative to its long-term history, while Value remains cheap, but neither is outside levels seen in recent years.

Enhancing Country Rotation With Sector Concentrations

A dramatic shift of country weights within EM indexes has become an inadvertent challenge for a country rotation strategy. Due to this, we tested the integration of a momentum-based sector rotation model to attain exposure to the top-rated sectors to represent the markets of the largest country components instead of seeking to obtain “whole market” exposure.

Interim Memo

The coronavirus epidemic/pandemic is getting the bulk of the blame for the sudden collapse in U.S. equities, and certainly qualifies as one of the few “black swans” seen in modern market history. We do not think the ultimate path of the coronavirus contagion can be analyzed at this point, and medical experts foresee possible outcomes ranging from a serious epidemic to a short burst of illness that fades with the summer weather.

Momentum Across Asset Classes

For those not blessed with clairvoyant asset selection ability, we’ve developed a simple single-asset portfolio strategy that’s handily beaten the AANA Portfolio and the S&P 500 over the long-term.

How Much Should We Pay For Market Momentum?

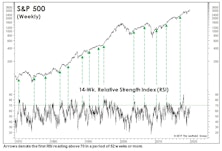

If the S&P 500 closes in the green today, an RSI "overbought" signal will be triggered.

The State Of Momentum

Going forward, high Momentum will depend on an unlikely combination of Information Technology and low Volatility, while low Momentum continues to have outsized exposure to Energy and Materials. Recent weakness only moderately tempered valuations, which could be a headwind.

The Case Of The Flipping Factors

Equity market themes have been boringly consistent of late; growth beating value, large beating small, and domestic beating international. In the factor world, Momentum and Low Volatility have been investor favorites for most of 2019 while Value resided in last place – the same old, same old. Then, something remarkable occurred on September 9th.

The Odd Couple

The Momentum style—in which investors buy what has been going up recently—represents an optimistic, hopeful, “I’ll take some of that” mentality. The Low Volatility factor entails a pessimistic, fearful outlook in which investors want (or need) to stay invested in stocks but desire downside protection in case the market performs badly.

Factor Performance: Momentum Saves The Day (Year); Value Is Awful

Momentum has made a furious comeback after a rough start to the year, posting an +11% spread in both May and August. Value continues to get crushed and there has been nowhere to hide: The pain is equally distributed between cheap and expensive, and it’s happening in every sector.

Assessing The Commodity Free-Fall

For at least two years, the unofficial title of “the scariest chart in the Leuthold database” belonged to the S&P 500 Price/Sales ratio. That chart still rattles us, with the July month-end ratio still in the vicinity of its old Y2K high.

Momentum Buyers: Beware

Momentum is a smart beta factor that gives investors excellent upside participation in rising markets. Most other smart beta factors are defensive plays, so Momentum is the place to be in strong upward moves. Momentum filled that role admirably in recent years, rising 56% from 2016 to the September top, compared to an average of +26% for the other major factors.

Incongruities In High Quality

Quality is one of the most popular and successful of the equity market’s quant factors. It is intuitively appealing and serves as a useful defensive strategy in falling markets. Low Volatility and Dividend Growth are also defensive factors, while Momentum and High Beta are viewed as aggressive or bullish factors. These offsetting behaviors would seem to make for excellent diversification opportunities in equity portfolios, and for the most part, that is true.

Characteristics Of Major Market Lows

We wrote in the January Green Book that the S&P 500 Christmas Eve low did not have the “right look,” in that: (1) there had been no sign of “smart money” accumulation beforehand; and, (2) downside momentum was also at a new low for the entire correction. Smart money buying is measured by the Smart Money Flow Index, which evaluates trends in first half-hour market action (considered to be more emotional and news-driven), and the last hour of trading (viewed to be more informed and institutional in nature).

Read This Before Taking The “Plunge”

After a bad market year like 2018, there’s a natural instinct for allocators to skew portfolios toward assets with poor recent performance. History suggests, though, that one shouldn’t make a habit of buying an asset on the basis of price weakness alone.

December’s Low Didn’t Have The “Right Look”

As the market sunk to a 3% loss on Christmas Eve, we sensed genuine investor panic—at least among the fraction of investors then paying attention.

Momentum Negative In Q4, But Positive For 2018

2018 was frustrating for most investors as Value continued to struggle and positive Momentum performance was difficult to capture. Small Caps, Mid Caps, and ADRs also underperformed.

VLT = Very Lousy Timing?

In the spirit of keeping an open mind, three months ago we observed that our S&P 500 VLT Momentum measure had triggered a “moderate-risk” BUY signal with its August reading.

What’s In Momentum Now?

Along with market volatility, the composition of Momentum has changed, becoming more defensive and less exposed to cyclicals and commodities.

October Factor Performance

Most factor categories reversed performance along with the market in October. During the month, Value had solid results while Growth gave up all of its 2018 gains. Profitability also had a nice bounce-back month.

Monitoring Mo’s Mojo

Momentum is one of the most successful investment styles over the long run, and does particularly well in the later stages of a bull market during the run-up to an eventual peak.

.png?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)