Energy

Select Industries Moves Back Into Energy

Oil & Gas Equipment & Services was purchased for the Select Industries portfolio last month, re-establishing exposure to what was our largest overweight entering 2023. The sector leapt from #11 to #4 in the ranks on the back of improved sentiment and macro readings.

The 2022 “Tax Hike” Repealed!

In the last twelve months, spending on energy goods and services as a share of total consumer outlays dropped by 1.1%—that amounts to about $200 billion in savings (annualized).

Weight Watcher Update—Still Like Value Sectors

While the valuation gap between Growth and Value sectors was compelling just a couple of years ago, it has closed drastically the last twelve months. Our analysis shows that Value sectors (Energy, Industrials) are still more favorable than Growth sectors (IT, Health Care).

Rankings At The Top Offer Diversified Mix

Energy remains the top-rated sector, but Information Technology, Communication Services, and Financials follow closely behind. These offer a diverse mix of commodity, growth, and cyclical options.

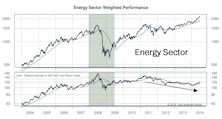

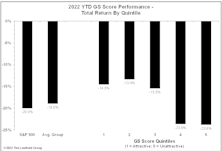

Energy Strength Is Intact; GS Scores Continue To Produce Positive Results

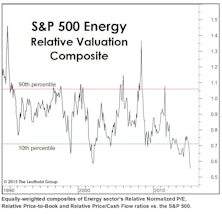

Energy has solidified its spot atop the GS Scores; it’s by far the highest-rated sector and counts three underlying groups among the top-ten industries out of all the sectors. Valuations have only improved amid steady outperformance, and renewed capital discipline looks to remain for the foreseeable future.

Energy Attains #1 Ranking For First Time Since 2009

The Energy sector has improved across a variety of factor subsets, with particularly large jumps in growth and macro/economic categories. For investors weighing investment ideas in the Energy space, we highlight the three Attractive groups for consideration.

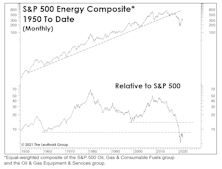

Energy Makes Its Move

After years of languishing in the rock bottom of Group Selection Scores and sector rankings, Energy exploded higher this month, jumping from 10th lowest (out of eleven broad sectors) to 3rd highest in our composite rankings.

Momentum: “New Junk” In The “Old Trunk”

March 23rd marked the one-year anniversary of the COVID-19 bear-market bottom. We are all eager to turn the page on the pandemic ordeal and move forward to brighter days ahead. Looks like some big help is coming our way.

Energy: A Curse And A Blessing

The Energy sector emerged as the top performer for January, a nice respite after a terrible 2020—but not exactly a good omen. Unlike in horse racing—where the concept of “early speed” has significant predictive power—the early leader in the sector-performance sweepstakes hasn’t reliably followed through in the last 30 years.

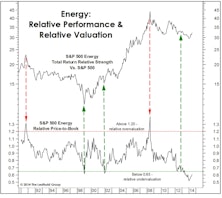

Energy: Still Too Early

Fundamentally, we don’t have much new to say on the disaster that Energy-sector equities have become. Mostly, we want to illustrate the danger of assuming that the stocks of commodity producers will necessarily follow the path of their underlying commodities.

Energy: Kicking A Dog When It’s Down

With crude trading at only about half the level seen in the first few years of this expansion, there might be a tendency to view its current price as depressed. But from an inflation-adjusted perspective, today’s price sits right on top of its modern-era (post-embargo) median.

Low P/E Track Record

The “robustness” of the “Cheapest Sector Strategy” concept is illustrated by strong results across all rebalancing frequencies.

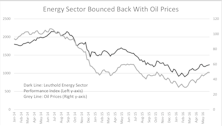

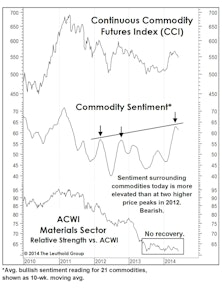

Commodity Stocks: More Of The Same

Someone forgot to tell commodity trades this is an era of diversity of inclusivity: This year’s leap in the S&P/Goldman Sachs Commodity Index has been entirely the result of its heavily-weighted energy inputs.

Oil And The Dollar At New Highs: Is Something About To Give?

Crude oil and the U.S. Dollar Index accomplished a relatively rare feat by moving to simultaneous six-month highs earlier this week (Chart 1).

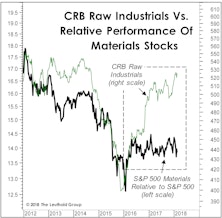

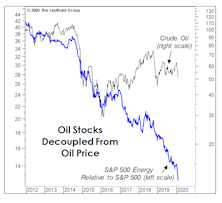

The Commodity Stock Disconnect

While watching a forecast go awry is painful, there’s an alternative that we consider to be even worse: the failure to be paid on an accurate forecast. The resulting feeling of helplessness must be similar to that of a corporate director who manages to lose money on inside information.

Areas To Avoid In The Energy Sector

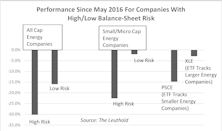

Anticipating prolonged weakness of energy prices, we advise avoiding two segments within the Energy sector: companies with high balance-sheet risk, and special Energy investment vehicles called Energy Royalty Trusts.

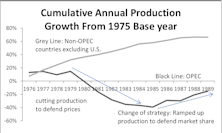

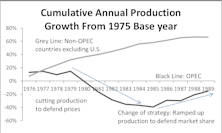

Recent Years’ Oil Price Experience Akin To 1980s’

We revisit commentary we published in 2015 regarding the late-2014 oil price crash and review why, at that time, we believed oil prices could stay at depressed levels for a longer period than most expected. Additionally, we advise avoiding two Energy sector segments: companies with high balance-sheet risk, and Energy Royalty Trusts.

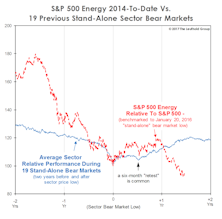

Energy Still Out Of Sync

We wrote a year ago that the Energy sector’s 2014-2016 decline of 47.3% was the worst-ever sector decline occurring outside of a cyclical bear market.

Energy: Too Early To Bottom Fish

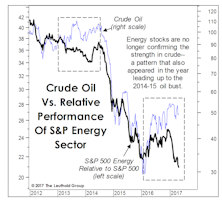

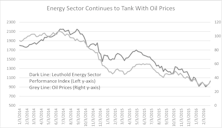

The gap between crude oil prices and Energy sector RS is now much wider than seen even at that historic 2014 juncture. The “divergent” weakness in Energy stocks suggests that crude will likely trade lower.

Another Leg Down In Crude?

Remember the special amplifiers used by the fictional rock group Spinal Tap that could be dialed up to eleven? S&P’s decision last year to designate Real Estate as a full-fledged sector means that our GS rankings can now be dialed down to eleven, and unfortunately the Energy sector has been a frequent occupant of that undesirable spot.

Using Energy Stocks To Forecast Oil

The latest Green Book highlighted the unusual divergence between crude oil and the relative performance of the S&P 500 Energy sector. Crude prices had—until this week—been trading near 18-month highs, while the relative strength of Energy stocks had slipped back towards January 2016 lows.

What’s Wrong With Energy Stocks?

One of our disappointments with the Group Selection (GS) Scores in 2016 was their failure to latch on to the rebound in Energy groups.

Energy: Waiting For The Green Light

Despite putting in lows in January, the Energy sector has been stuck at the bottom of the GS rankings, and the sector has given up more than half its relative gain over the last several weeks. Perhaps the GS Scores will highlight a better entry point in the months ahead.

Energy Sector: Too Much Risk Taking As Oil Price Bounced

Despite recent bounce among stocks in the Energy sector, the GS Scores still rate Energy groups poorly.

Time For Materials?

The Leuthold Materials sector jumped five spots to #3 in the June Group Selection (GS) rankings, its highest ranking in eight years and the first reading outside of the bottom four in almost four years.

A Turn In Leadership?

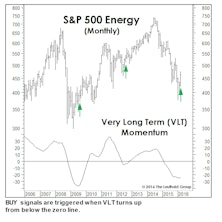

Last month we wrote that a big March gain would trigger a Very Long Term (VLT) Momentum BUY signal on the S&P 500 (Chart). The month’s 6.8% S&P 500 gain wasn’t quite enough to do the trick, but we’re intrigued that VLT did issue BUY signals for three of the market’s cyclical sectors, including Energy, Materials, and Industrials.

Muddle-Through Still Has The Benefit Of The Doubt

The market’s latest infatuation with bonds was driven by grave concerns that the weakness in energy and manufacturing sectors might be spreading to the U.S. economy as a whole.

Bottom-Fishing In Energy: Beware Of Bankruptcy Risks

New developments have lifted sentiment toward oil and Energy names, but we caution bottom-fishers to be mindful of risks. The fundamentals in the oil patch do not yet support strong oil prices going forward.

Oil Price “Crashes” In Historical Perspective

In view of the last year’s steep decline in oil prices, Energy has been a frequent headline topic.

The 30/30 Club!

The S&P 500 Energy sector’s latest plunge puts it down by almost a third in the last 14 months. It now belongs to an exclusive list of sectors which have declined 30% on both an absolute basis and relative to the S&P 500!

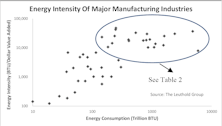

Cheap Energy—Which Industries Benefit The Most?

It’s more complicated than one would think. Besides input costs, one must consider the impact on revenues, and whether various pricing differentials come into play.

A Few Thoughts (And A Lot Of Charts) On The Oil Collapse

Has the recent collapse in crude oil prices presented us with a good opportunity for an outright commodity investment? No. Energy stocks aren’t on our radar screen either.

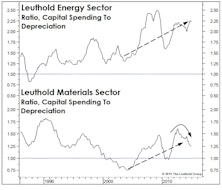

Capex, Capacity And The Dollar

We’ve been highlighting the overinvestment (or malinvestment) risks in commodity-oriented equity sectors for the past three years, but we certainly did not foresee those risks exploding the way they have in the oil market over the last seven months.

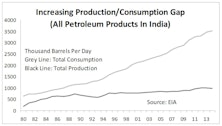

A Look At The Impact Of Lower Energy Prices On Countries

A big question for investors is: have oil prices bottomed? For the past four days, WTI jumped 19% from its low reached on January 28th, giving some the conviction that prices are reverting back to prior high levels.

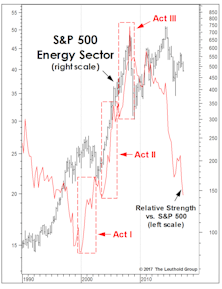

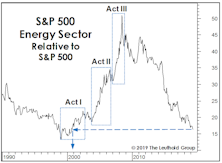

Thoughts On Energy

The recent Energy sector decline has accomplished the feat of wiping out all of the upside gains achieved during its “Third Act” played out in the 2006-2008 surge.

The Evolving State Of India’s Energy Sector Price Reform

In the August book we published an article about the Indian equity market and proposed that investing in India is now more of a macro bet. The honeymoon—during which time Indian stocks were bid up from high hopes that the new government would reinvigorate the economy—is over.

Energy Rates At 4-Yr High; Bought Integrated Oil

Strength in the Energy sector has been so compelling that our two recent Energy group allocations together now make up a 10% portfolio weight, after having no Energy exposure from June 2013—April.

Energy Sector Heating Up

We’ve been negative on commodities and most commodity-oriented equities for the last three years, believing that the magnitude of the ramp-up in commodity production capacity over the last decade remains generally underappreciated by investors.

Commodities: Not A New Bull

The year’s second biggest surprise (next to the relentless drop in bond yields) might be the YTD bounce in the major commodity indexes.

Refiners Group Looks Healthy Once Again

The only Energy group rated Attractive, its score has improved for seven consecutive months.

.png?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)